We are through the first phase of the pandemic, and the first half of 2020 is over.

I would first like to thank and congratulate the authorities here in Dubai and across the UAE for delivering a well-balanced and effective action plan to deal with the situation. And I would like to express heartfelt gratitude to the real superheroes in the healthcare community for their selfless contribution at this unprecedented time.

Life seems to come back to normal with ease of movement restrictions and business opening up again; however, this pandemic has hit the economies hard, leading businesses to devise retrenchment and right sizing strategies.

With the uncertainty looming over, organisations and people need to have an absolute focus on their spending, and this will have knock-on effects – it’s a bit of a vicious cycle.

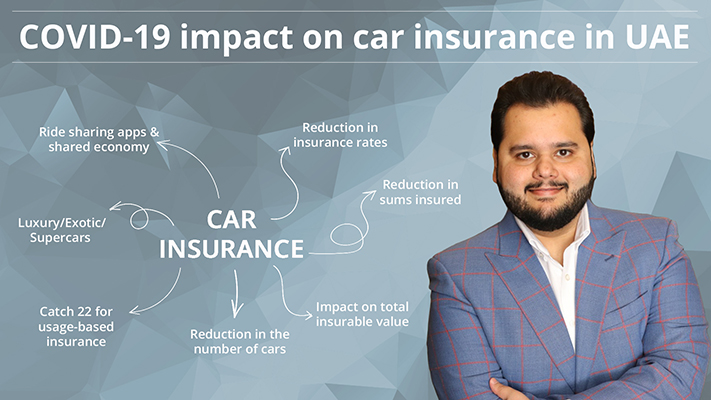

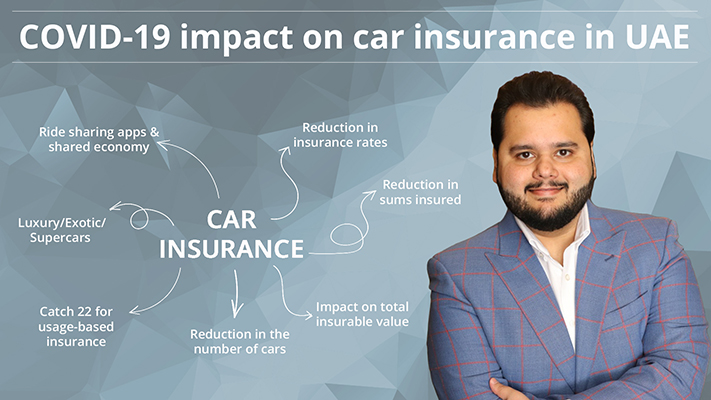

This is my opinion on how this pandemic will impact the car insurance industry in 2020:

- Reduction in insurance rates: There will be tremendous downward pricing pressure on insurers as the frequency of accidents reduces given that people will drive less. Voluntary social distancing in some form may well continue until the end of the year or until the vaccination is developed and propagated at a mass scale.

- Reduction in sums insured: We might see a decrease in car valuations as rent-a-car companies and private individuals will need to resort to distress/undervalued sale of assets, coupled with weaker demand. This will proportionately exercise a downward pressure on insurance premiums.

- Impact on total insurable value: There will be a reduction in total insurable value as people will hold on to their cars longer and avoid upgrading, due to reduced consumer confidence and lower utilisation of vehicles.

- Reduction in the number of cars: There might be a drop in the number of cars on the road in UAE because of a decline in the employed population, obviously resulting in an overall decline in the number of motor insurance transactions.

- Catch 22 for usage-based insurance: There will be a stronger case for usage-based insurance; however, the overall margins for insurers have always been too thin due to competitive pressures, and this will continue as conventional insurers will adjust rates to match the reduction in driving, thus making it difficult for pay-per-km insurance to succeed.

- Luxury/Exotic/Super cars: will continue to do well as the High Net Worth insurance segments will have little or no impact on their liquidity/disposable income.

- Decline in ride-sharing and the sharing economy: Ridesharing will see a decline in the foreseeable future as gig economy workers might look to explore other avenues to survive during extended lockdown/social distancing periods. App-based car service and rent-a-car users may abstain from using Uber-like services to reduce their exposure to the virus and might consider buying their own cars for the sake of hygiene. This will cause an upward impact on the demand for personal car insurance.

These are my views based on developments of the past couple of months.

Avinash Babur

Avinash Babur