Navigating the bustling city of Dubai requires a smart, efficient, and cost-effective approach, especially when commuting and managing daily expenses. The Emirates Islamic RTA card provides convenience and savings for residents and frequent visitors. This comprehensive guide dives into the numerous benefits, eligibility criteria, necessary documentation, and the application process for this innovative financial tool.

Benefits and Features of the Emirates Islamic RTA Card

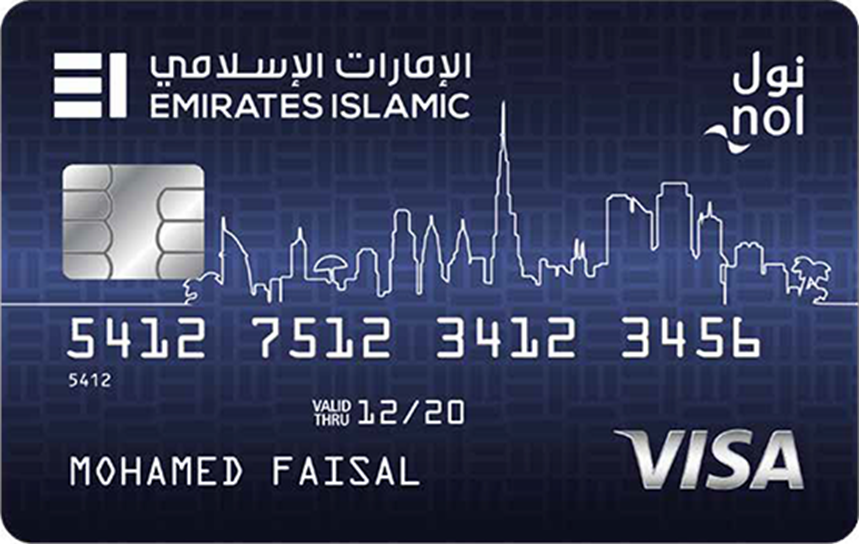

The Emirates Islamic RTA card is a special kind different from the usual credit cards. It works in two ways: like a normal credit card and like an RTA NOL Card. What does this mean? It means you can use it for shopping and paying for things as you would with any credit card. But there’s more! It also lets you easily use and pay for transportation in Dubai. This card covers you whether you’re taking a bus or metro. It’s super handy for anyone who travels around Dubai a lot. Think of it as your go-to card for shopping and commuting, making your daily travels much smoother.

Key Benefits Include:

- Fuel spends: Enjoy 10% cashback on fuel expenses, easing the burden of car ownership in the city.

- RTA transport payments: Receive 10% cashback on RTA transport payments, including metro, buses, and taxis.

- Cashback on other spends: Earn up to 2.25% cashback per AED 1 spent on different categories, maximising your savings on every transaction.

- Built-in Nol card: The integrated Nol chip facilitates easy payments across the RTA network, streamlining your commute.

Please click on this link for more information about the advantages of using the Emirates Islamic RTA card. Here, you will find a comprehensive list of all the benefits, including rewards, discounts, and special offers, that cardholders can enjoy.

Offers and Rewards on Emirates Islamic RTA card

Get rewarded for your spending and earn cash back on various purchases.

- Transport and fuel: 10% cash back on RTA transport and fuel station expenses, up to AED 100 monthly. This will decrease to AED 75 starting March 16, 2024.

- Shop globally: Enjoy up to 2.25% cash back on international purchases, with no upper limit.

- Everyday purchases: Earn up to 1.25% cash back on all other local spending without any cap.

- Groceries just got better: Receive 1% cash back at domestic grocery stores and supermarkets, unlimited.

- Cars and insurance deals: Get 0.19% cash back on automobile and insurance payments, with no limit.

- Boost your knowledge and comfort: Spend on education, telecommunications, and real estate for unlimited 0.13% cash back.

- Dining out: Earn unlimited 0.31% cash back at quick service or fast food restaurants.

- European adventures: Spending in European Economic Area (EEA) countries, including the UK, gets you 0.56% cash back with no cap.

Advice: Always check where you can earn cashback. Plan your spending to maximize rewards. Keep an eye on changes, like the RTA transport payments and fuel stations, on March 16, 2024.

Cashback Perks:

- Enjoy cashback: Earn cashback on domestic and international spending, except for government-related transactions.

- Minimum points: You need at least 300 Cashback Points to start redeeming.

- Monthly rewards: Your cashback is calculated monthly based on how much you spend.

- Validity: Your earned points are valid for two years.

- Credit limit: You can earn points up to your credit card’s limit. Spending beyond this will not earn you points in that month.

- Merchant categories: Sometimes, transactions might fall under a different category. Unfortunately, Emirates Islamic can’t fix this for you.

How to Redeem Cashback Points?

Please follow these simple steps to turn your cashback points into real rewards:

- Log in: First, log into your Emirates Islamic account. You can do this through our Online Banking or Mobile Banking app.

- Navigate to cards: Head to the ‘Cards’ section once logged in.

- Find rewards: In the ‘Cards’ section, look for the ‘Rewards’ option and give it a click.

- Redeem your cashback: Now, select ‘Redemption’ to reveal your options. Choose the one that best suits your needs and submit your request.

Eligibility for Emirates Islamic RTA card in the UAE

Applying for an RTA Emirates Islamic Credit Card is easy, but you need to know a few important things. First off, you must be at least 21 years old. Here’s a simple guide to understand if you’re eligible:

- If you have a job: Your salary needs to meet a certain amount, depending on your desired credit card. Here’s a link to check the minimum salary criteria.

- If you run your own business or self employed: Your income should also meet the minimum required for the card.

- If you don’t have a job or your income isn’t enough: Don’t worry, you still have a chance! You can open a Fixed Deposit Account with Emirates Islamic. The deposit amount must match the minimum required for the card you’re eyeing.

If your credit score is lower or you already have a lot of debt, getting approved might take longer.

Remember, it’s all about making sure you fit the criteria. If you do, getting a credit card could be a smooth process. Keep these points in mind, and you’ll be on your way to applying for your RTA Emirates Islamic Credit Card.

Documents Needed for Emirates Islamic RTA card

Applying for the Emirates Islamic RTA card requires submitting specific documents to verify your identity, income, and residency status. These typically include:

- Valid Emirates ID

- Passport copy (for non-UAE nationals)

- Salary certificate or proof of income for employed

- Trade licence for self-employed

- Bank statements (within the last 3 months)

- If applicable, a security cheque

Application Process for Emirates Islamic RTA card

The Emirates Islamic RTA card application process is straightforward and user-friendly. Prospective cardholders can apply online through the Emirates Islamic website, visit a branch, or contact customer service for assistance. The process involves:

- Fill out an application form.

- Submitting the required documents.

- Waiting for approval from the bank.

To Apply via Website:

- Visit the Emirates Islamic RTA card application page.

- Hit the “Apply Now” button.

- Fill in a brief form with your name, contact information, and details about your income to express your interest.

- Once you’ve completed it, click “Submit” to send off your application. A customer service representative will contact you within two business days.

To Apply via Online Banking:

- Log in to your online banking account.

- Look for and click on the option that says Apply for a Product, then choose Card Products from the menu.

- From the list, pick the credit card that you’d like to apply for.

- Fill in the necessary information about yourself and click on the Next button to proceed.

- Please wait for a call or email from our customer service team. They will contact you within two business days to help you complete your application.

To Apply via Mobile Banking:

- Open the Mobile Banking App on your phone.

- Look for the Main Menu, usually found at the top left corner of the screen, and tap on it.

- In the menu that appears, tap on “Credit Cards,” then “Apply for a Card,” and finally “Apply for a New Credit Card.”

- Browse the available credit cards, choose the one you like, and tap “Apply Now.”

- After you apply, a customer service representative will contact you within two working days to assist you further.

FAQs

What are the payment options available with this card?

Your Emirates Islamic RTA card offers multiple payment options for your convenience. You can pay your credit card bills online through Emirates Islamic Internet Banking, ATMs, Cash Deposit Machines (CDMs), or exchange houses. This variety ensures you can choose the method that best suits your lifestyle.

Can I get supplementary cards with this credit card?

Absolutely! You can avail of supplementary cards for your family members. This way, they can also enjoy the benefits and convenience of the Emirates Islamic RTA card, making it a great option for managing family expenses.

What is the value of a point on this card?

The value of a point varies depending on the type of transaction and the redemption options available. Points can be redeemed for cashback, and the redemption rate may change. It’s always a good idea to check the latest redemption options and rates through Emirates Islamic Online Banking or by contacting customer service.

Do RTA card cashback points expire?

Yes, the cashback points on your Emirates Islamic RTA card have a validity period of two years. To maximise your rewards, redeeming your points within this timeframe is important.

Will my cashback be cancelled if I cancel my card?

If you decide to cancel your card, it’s wise to redeem any accumulated cashback points before doing so. Once the card is cancelled, you might be unable to redeem or access your unredeemed points.

What happens to the cashback points I have earned in case of a transaction reversal?

In the event of a transaction reversal, the cashback earned on that transaction will also be reversed. This means that cashback is awarded only for actual purchase transactions that are not reversed or refunded.

Are there transactions that do not qualify for cashback?

Yes, certain transactions may not qualify for cashback. These typically include government-related payments and specific categories outlined in your cardholder agreement. It’s important to review which transactions are eligible for cashback to maximise your benefits.

Can I convert cash back points from one card to another?

Typically, cashback points are specific to the card with which they were earned and cannot be transferred between cards. This ensures that your rewards are directly related to your spending on that particular card.

Conclusion

In conclusion, the Emirates Islamic RTA card stands out as a versatile financial tool that simplifies your daily commute and rewards you for your spending. Its benefits, rewards, and convenient features make it an excellent choice for anyone looking to maximise their savings and enjoy a hassle-free lifestyle in Dubai.