Highest rated insurance platform

Simple and fast claims process

150,000+ policyholders

years of UAE Insurance experience

40 Insurance companies

access on the myAlfred platform

Why choose InsuranceMarket.ae?

At InsuranceMarket.ae we firmly believe we provide an unmatched customer experience and trust our members recognize that as well! Here are just 5 reasons why:

Top rated insurance platform

Over 21,000 Google reviews and 4.8 rating: customer satisfaction is our number one priority and we’ve got the feedback to prove we deliver!

Dedicated insurance advisors

To help answer your questions and help you with your car insurance purchase and guide you in the process

Reliable

Responsive, reliable and dedicated claims manager to offer advice, reassurance and assistance when you need it most

Best pricing

Competitive prices and comprehensive products providing the cover you need at a price you can afford from the insurers you can trust

Rewards

Great value-added services such as discount vouchers that are sent with your policy: you just keep on saving with Alfred!

Our insurance partners

Established in 1995, InsuranceMarket.ae stands as a beacon of trust and excellence in Dubai and the UAE insurance sector. Our deep-rooted relationships with premier insurers like AXA (now GIG Gulf), RSA, Oman (now Sukoon), QIC, and Tokio Marine, among others, are a testament to our unwavering dedication. With our esteemed partnerships and stellar reputation, we proudly present you with superior coverage options and exclusive benefits, guaranteeing optimal value in the market.

What our customers say about us

4.8/5

21,000+ Reviews

Find the best value on your car insurance in Dubai & the UAE with Alfred

Finding the right car insurance in Dubai, UAE for you at the right price has never been easier. This is made possible through our friendly and knowledgeable team of advisors who act as insurance advisors taking you through the covers available and explaining the cost involved so you can select a policy that gives you peace of mind and suits your circumstances. The moment you begin your journey with us you’ll start reaping the benefits. At InsuranceMarket.ae, we have great relationships with all the leading motor car insurance companies in Dubai and the UAE and our reputation and experience means we get great products at great prices. Not only that, our partnerships with a range of fantastic local businesses mean that when you buy your policy with Alfred you’ll get great money-saving discount vouchers sent to you too. From auto accessories to accident repairs, car valeting to personal grooming and auto-tuning to vocal tuning with music lessons and much more. You’ll enjoy benefits that can’t be bettered!

What is car insurance?

Car insurance is an agreement between you and an insurer or insurance company that provides financial protection against physical damage or bodily injury resulting from road accidents. You also get covered against other liabilities from road accidents, natural disasters, fire and theft. It’s mandatory in the UAE to have valid car insurance for your vehicle.

Third party liability

Put simply, Third Party Liability covers just that: your responsibility to pay other road users & their passengers and/or the general public for any property damage (including their vehicle) and/or personal injury sustained as a result of your negligence in driving. This is the minimum cover mandated under the law in the UAE.

Comprehensive cover

Comprehensive cover, as the name suggests, offers wider cover in that it protects your vehicle against own damage as well as Third Party Liability. Since most of us have a heavy reliance on our cars to run our busy lives and work hard to afford them, Comprehensive is the most popular motor insurance since it offers peace of mind knowing we are fully protected in the unfortunate event of an accident.

Both types of car insurance are widely available in the UAE and all leading motor insurers have reputable, reliable products. At InsuranceMarket.ae we have access to a wide range of policies and can therefore help you make the decision that is right for you.

What additional cover options and upgrades are available?

You might think that comprehensive policies are “comprehensive” in that they cover everything as standard but given everyone has different needs only the most common risks are included. That’s why many insurers offer a range of additional covers or “upgrades” for customers to choose from. These include benefits such as:

Agency repairs:

If your car is less than 5 years old, this is one option you can’t afford to miss out on. Agency repair allows you to have your vehicle fixed by a manufacturer’s approved repairer using only new/approved guaranteed parts: critical for complying with your manufacturer’s warranty and preserving your vehicle’s resale value.

Protected no claims:

Careful drivers should expect to be rewarded and claims free years can equal significant discount. Did you know that some Motor policies allow you to protect this so in the unfortunate event of a claim you don’t lose that hard-earned saving? Ask about Protected No Claims options.

Roadside assistance and breakdown recovery services:

Don’t leave things to chance. Even the newest vehicles can break down! Ask about Roadside Assistance cover when taking out your Motor policy. Because being on the road is better than stranded by the side of it!

Loss of keys:

If you lose your car keys this valuable cover gets your vehicle recovered and a new set of keys supplied to you so you can get back on the road again.

GCC cover:

We know many of you love a good road-trip to explore the beautiful region we live in! This upgrade extends your cover to include other countries outside of the UAE so wherever you are, you can feel protected like you were back “home”.

Personal accident benefit:

In some car accidents it’s not just the vehicle that suffers damage, the driver and passengers can sustain injury too. Personal Accident cover provides compensation in respect of bodily injury, disablement or death resulting from a road traffic accident: an invaluable benefit for peace of mind.

Hire car benefit:

If you rely on your vehicle to get to work and run your busy life, having it off the road following an accident can add to the headache. Take up the option of hire car cover in your policy and take the additional stress away!

How can I get low cost vehicle insurance?

There’s no magic formula for getting value for money Vehicle Insurance in the UAE but there are some steps you can follow and things you can do to get the best deal for your dirhams! We asked Alfred and here’s what he suggests:

Never buy vehicle insurance at the last minute. Give yourself plenty of time to consider the coverage you need against what’s available in the market. If time is running out then the budget can too if you blow it by taking the first deal that’s on offer……even worse, you might just end up paying a lot more money for a whole lot less cover!

Don’t be tempted to “go it alone” in your search for the best policy at the best price. Let the experts help! At InsuranceMarket.ae our Insurance Advisors are just waiting to do the hard work for you. It’s a simple but winning formula. No extra cost + no waste of your time = no brainer!

Don’t get too hung up on price alone. Being mindful of money is no bad thing but being bound by a budget can prove “false economy” if you don’t have the correct cover and lose out when it comes to a claim. At InsuranceMarket.ae we search the market and work with you to find the best cover for your budget.

How to compare car insurance quotes?

Let Alfred help you compare car insurance quotes with lightning fast service

Car insurance doesn’t need to be complicated but sticking to one option just isn’t enough and whilst two can be twice as nice, we believe in the power of three: that’s why we send you at least that many car insurance quotes to compare. Once you’ve got your selection, here are our top 3 tips for what to do next.

Check the cover provided under each quote and compare against each other. You can’t judge a square versus a circle so make sure your assessment is a fair one.

Check the cover provided against your current policy. Are you getting like-for-like, less or more? Also consider the “added value” items like optional extras, additional services as standard, add-ons etc.

Check the price last so you can see the benefits of the cover rather than being influenced by the premium first. You can then assess the value for money. And don’t forget those “extras” too: you may or may not be able to put a price on them but they do count!

Don’t auto-renew auto insurance

If you’ve bought motor insurance years ago, you may not have everything that you need and you’re probably paying too much.

Let insurance companies compete for your business.

Don’t auto-renew. Check with us before you renew your car insurance.

Review your coverage and benefits. Priorities change!

Get a no-claim discount with your previous record and save more

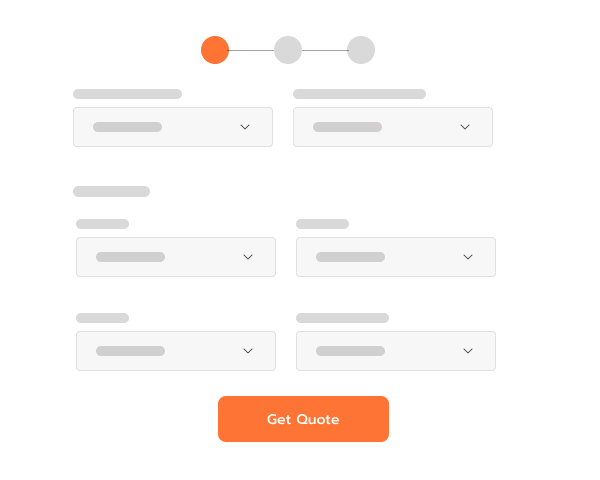

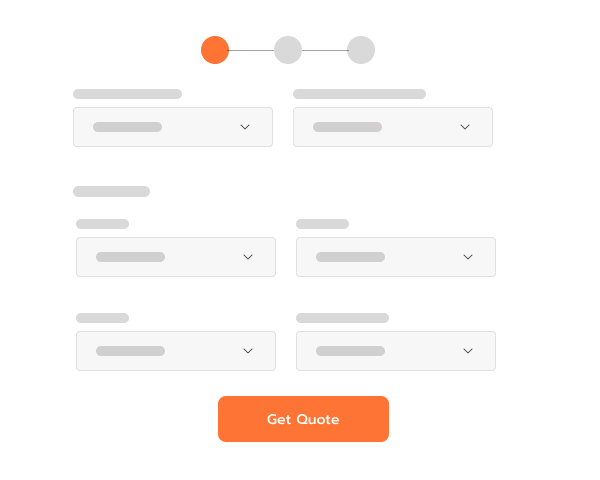

Get your insurance in 3 easy steps!

1

Start your journey

Begin by swiftly filling out our user-friendly form.

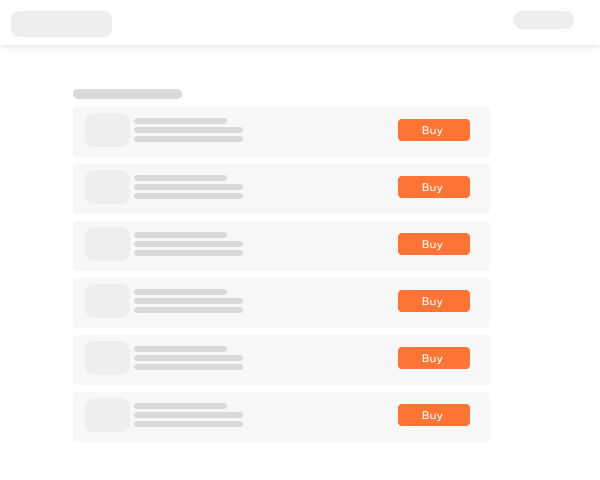

2

Check and compare options

Browse through a selection of handpicked options for the best fit, tailored to your needs

*

Get expert help

Reach out to your dedicated insurance advisor for assistance or queries.

3

Quick purchase

Secure your policy by purchasing and uploading the necessary documents.

Get exclusive premium membership access to myAlfred!

What does myAlfred offer?

As an InsuranceMarket.ae policyholder, you enjoy complimentary myAlfred premium membership. This unlocks deals from over 100+ well-known brands in the UAE. Dive into benefits and deals available from car care to personal grooming, from music lessons to shopping online or in store, from planning trips to experiencing adventures and excursions. myAlfred has got you covered every step of the way!

All you need to know about car insurance in Dubai, UAE

Companies

Coverage

Comparison

Savings

Payment options for car insurance in the UAE

Credit Card

Bank Transfer

Cash

Cheque

What does car insurance in UAE cover?

Depending on the type of policy you have, the cover will vary but if we consider a typical Comprehensive car insurance policy, the main risks covered are damage and/or injury caused by perils/causes such as: impact, storm, flood, fire, theft, accidental damage, lightning, explosion and vandalism/malicious damage. Whilst policy terms and conditions must be adhered to for a claim to be considered, it’s good to know that most circumstances you can think of are insured against!

What is not covered under your car insurance?

An insurance policy is designed to cover “relevant risks” and car insurance are no exception. Whilst auto insurance policies seek to protect you as much as possible, some risks are better covered under a different type of insurance or maybe excluded altogether. Typical examples include:

Any damage caused in the course of committing an illegal act: such as driving under the influence of alcohol or drugs.

Any damage caused whilst instructing a learner driver: all drivers with a “provisional/learning” licence should only drive under the tuition of and in a vehicle owned by a driving school.

Any damage caused to your own property whilst driving your vehicle: for example, impact damage to a perimeter wall or your villa itself while entering or exiting your home. The damage to your vehicle would be covered if you have a Comprehensive Motor policy but the damage to your buildings/structures would only be covered if you have a suitable Home Insurance policy.

Any damages caused to a vehicle while driving amid a flood might not be covered by an insurer, as some insurers would only cover flood- related damages if the car was parked during the flood.

Car insurance guides

Car insurance: Frequently asked questions

1. What is car insurance?

2. How can I calculate my car insurance premium?

3. What does 'No Claims Discount' mean?

4. How to claim insurance for a car accident in dubai?

5. How to check car insurance status online?

6. What is excess in car insurance?

7. How does car insurance work?

8. How to find my car insurance policy number?

9. What does 'own damage' mean in car insurance?

10. Can I customize my car insurance policy?

11. What are the types of car insurance in Dubai?

12. What Is the Penalty for Driving Without Car Insurance in the UAE?

13. Can I transfer my vehicle insurance plan to another car owner when transferring car ownership?

14. What documents do I need to purchase car insurance in the UAE?

15. Do you provide coverage for rental cars or loaner vehicles?

16. How do I choose between Third Party and Comprehensive insurance?