Dubai Car Insurance: A Comprehensive Checklist for Required Documents

Buying a new car? Congratulations. But wait, what about the car insurance? You can’t drive a car without having car insurance first in Dubai. If you are buying your car from a bank or a car dealer, chances are bank and car dealer will offer their services to find you a car insurance deal but is it wise to get their help? – Probably no because you can always find better and more tailored and customized deal if you look on your own.

Understanding the documents required for car insurance in Dubai is crucial before you start the application process. Having all your car insurance documents ready can help you complete your application quickly and get your car insurance policy online without delays.

Why Choose Your Own Car Insurance Provider in Dubai?

Do you know how many insurance companies are working in Dubai and UAE overall? More than 60. Yes, more than 60 options that can help you find an affordable and customized car insurance deal. So the recommended course of action is to shop on your own. Hire an insurance consultant or use online comparison websites, but make sure you are buying on your own instead of depending on your car dealer or bank.

Complete List of Car Insurance Documents You Need

To know beforehand about the required car insurance documents can save you a lot of time if you are buying car insurance on your own. Having the right car insurance paper ready means you won’t have to visit the office of the insurance company multiple times to bring all documents.

Even though the requirements for the necessary documents may vary from company to company, in most cases, the documents required for car insurance are the same as listed below.

Proof of Identity and Residency

- Proof of Name: For this, you need to submit the copy of Emirates ID if you are a national or copy of your passport and visa page if you are an expat working in Dubai.

- Date of Birth: For this, the above documents are sufficient.

Vehicle Registration Documents

- Vehicle Details: All companies require proof of vehicle details like year of manufacture, make and model. For this, you need a copy of the vehicle registration document. Make sure you have the copy of the vehicle registration card of both sides. Some companies may also need RTA Certificate of Transfer.

Driver’s License

- You also need a confirmation letter that proves your vehicle is GCC specified.

Claims History Documentation

- If you are renewing your car insurance, you also need to provide the details of the claims registered with your previous insurance companies. In case you have not registered any claims, you can submit the No Claim letter for the years you have not registered a claim. This can earn you a significant discount under the no-claim bonus offered by most of the insurance companies in Dubai.

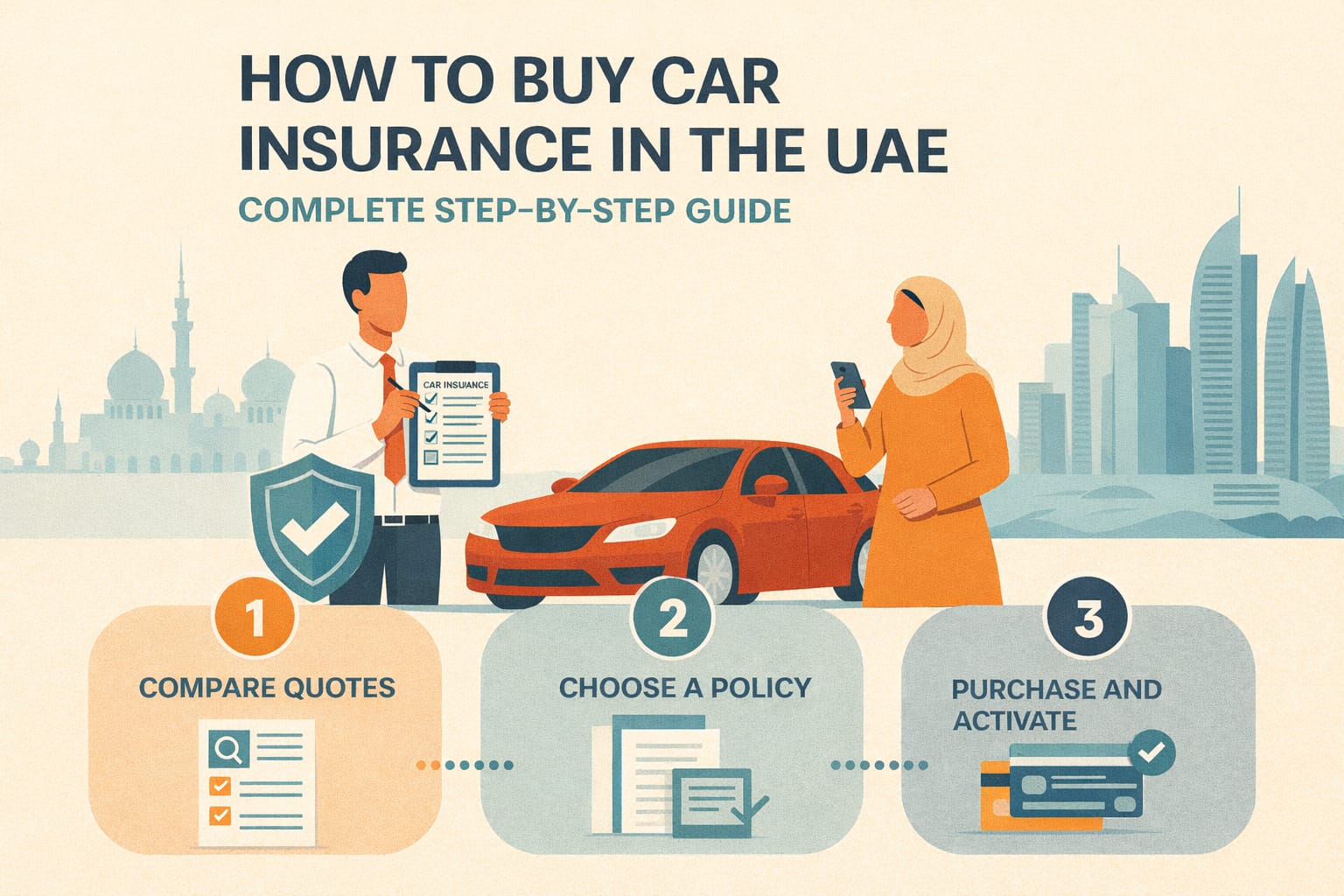

How to Submit Your Car Insurance Paper and Documents

The good news is, most insurance companies allow clients to upload electronic copies of the required car insurance documents, making it easier for insurance buyers. If you are busy and have the right documents required for car insurance in front of you, you can easily submit the documents from your home or office and get your car insurance policy online.

Where to Find Car Insurance Policy Information After Purchase

Once you’ve submitted all your car insurance paper and your application is approved, you might wonder where to find car insurance policy details. Most insurance companies in Dubai provide:

– Digital Policy Access: You can access your car insurance policy online through the insurer’s website or mobile app

– Email Confirmation: Your policy documents are typically emailed to you within 24-48 hours

– Policy Number Location: To find car insurance policy number, check your email confirmation, policy certificate, or log into your insurer’s online portal

Keep your policy number handy as you’ll need it for renewals, claims, and RTA registration.