Whether you’re a newbie in the home-buying game or a seasoned investor, getting your head around mortgage loans can feel like a wild roller coaster ride. And when it comes to the United Arab Emirates (UAE), where things are always buzzing, and cultures collide, understanding the ins and outs of mortgage loans is super important.

In this guide, we’re here to learn the whole mortgage loan scene in the UAE and give you the lowdown on everything you need to know. We’ll cover the basics, eligibility criteria, different types of mortgage loans up for grabs, and the key factors you should consider when picking the perfect loan for your needs.

Whether you’re dreaming of a cosy residential property, eyeing some real estate investments, or thinking about refinancing your existing mortgage, we’ve got you covered with some seriously valuable insights into the UAE’s mortgage market.

Let’s dive in! General Overview of Mortgage Loans in the UAE

A mortgage loan in the United Arab Emirates (UAE) is a financial product that enables individuals to purchase real estate by borrowing money from a financial institution. The UAE’s process and terms of mortgage loans generally follow international standards, but certain nuances are specific to the country.

Regulation and Legislation

The mortgage market in the UAE is regulated by the Central Bank of the UAE, which sets guidelines and rules for financial institutions offering mortgage loans. The legal framework ensures transparency, consumer protection, and stability in the real estate market.

Eligibility Criteria

Borrowers are required to meet specific eligibility criteria set by the lending institutions. These criteria often include a stable source of income, a certain debt-to-income ratio, and a minimum age requirement.

Loan-to-Value (LTV) Ratio

The maximum loan amount a borrower can obtain is determined by the Loan-to-Value ratio, which represents the percentage of the property’s value that can be financed. LTV ratios in the UAE typically range from 70% to 80%, meaning borrowers need to provide a down payment for the remaining percentage.

Interest Rates

Interest rates on mortgage loans in the UAE can be fixed or variable. Fixed-rate mortgages provide stability with a constant interest rate throughout the loan term, while variable-rate mortgages may fluctuate based on market conditions. The interest rates are influenced by factors such as the Central Bank’s policies, market trends, and the borrower’s creditworthiness.

Loan Tenure

Mortgage loans in the UAE usually have a maximum tenure of 25 to 30 years. The loan term is an important factor that affects the monthly installment amount and the total interest paid over the life of the loan.

Repayment Options

Borrowers can choose between conventional amortising loans, where both principal and interest are repaid over time, or Islamic financing options that comply with Sharia principles. Islamic mortgages involve profit-sharing arrangements rather than interest charges.

Many mortgage agreements allow borrowers to make prepayments or settle the loan early without penalties. However, the specific terms and conditions vary among lenders.

Finally, note that failure to meet mortgage payments can result in serious consequences, including foreclosure. Borrowers are advised to communicate with their lenders to explore potential solutions in case of financial difficulties.

What is a Mortgage Loan?

Now, you already have a brief overview of the mortgage loan landscape in the UAE, but let’s take a quick rewind to understand what really is mortgage loan in its simplest form.

A mortgage loan, simply put, is a type of loan specifically designed for purchasing a property, such as a house or an apartment. It is a financial agreement between a borrower (the individual or entity seeking to buy the property) and a lender (typically a bank or a financial institution).

When you take out a mortgage loan, the lender provides you with a substantial amount of money to cover the property’s purchase price. In return, you agree to repay the loan over a specified period, usually 10 to 30 years, through regular instalments that include both the principal amount borrowed and the interest charged by the lender.

The property you’re purchasing serves as collateral for the loan. If you fail to make your mortgage payments as agreed, the lender can foreclose on the property and sell it to recover the outstanding debt.

It’s worth noting that mortgage loans are a significant financial commitment and can have a long-term impact on your finances. However, they also provide an opportunity to become a homeowner or invest in real estate while spreading the cost over an extended period.

Mortgage Loan Offers in the UAE

RAK Home in One

RAK Home Loan offers a unique and flexible financing solution: the more you deposit, the lower your interest rate. By maintaining funds in your Home in One Current Account, you pay interest only on the outstanding loan amount, net of the credit balances. With interest rates starting from 4.24%, borrowers can have variable rates from day 1 or fixed rates for 3 to 5 years.

This home loan provides convenient access to funds anytime, allowing withdrawals like any other current account, and comes with standard current account features such as a debit card, chequebook, and online banking. RAK Home Loan stands out with its low-cost structure, including no In-Principle Approval (IPA) fees and attractive discounts on processing fees for various customer categories.

Additionally, RAK Home Loan’s competitive interest rates continue with variable rates based on 3 months EIBOR, providing borrowers with flexibility. The unique feature of linking the current account balances to the mortgage loan helps reduce the mortgage balance charged with interest, resulting in lower monthly payments. Low-yielding deposits in the Current Account yield the same rate as the mortgage loan, offering a balanced and cost-effective financing solution.

Low-cost mortgage:

- No In-Principle Approval (IPA) fees

- 0% processing fee for buyout loans.

- 0.50% loan processing fee for salaried and self-employed customers for fixed rates options of 3 years and 5 years.

- 0.25% loan processing fee for salaried and 0.50% for self-employed customers for variable rate from day 1 loans.

- Special discount on evaluation fees of AED 1,850.

Plus attractive discounts on life insurance at 0.0242% p.m. + VAT of the loan outstanding each month, as applicable!

Competitive interest rates:

- Variable rate from day 1 and fixed rate options available.

- Attractive option of 3 & 5 years fixed rates for salaried and self-employed customers starting from 4.24% p.a. to 5.54%, reducing rate p.a.

- Follow-on rates after expiring the fixed rate period starting from 3 months EIBOR + 1.74% to 3 months EIBOR + 2.24%.

- Variable rate from day 1 starting from 3 months EIBOR + 1.04% to 3 months EIBOR + 1.74% reducing rate p.a.

Eligibility

- Residency: UAE nationals and UAE residents

- Monthly Income Requirements: Available for salaried and self-employed individual customers for approved residential and commercial properties.

- Minimum income required for salaried individuals: AED 15,000 / month

- Minimum income required for single and joint ex-pats: One borrower’s salary has to be a minimum of AED 10,000 / month

- Maximum Loan Amount:

- For salaried individuals: Maximum loan amount of up to AED 13 million

- For self-employed customers: Maximum loan amount of up to AED 20 million

How to Apply?

- Step 1. Click on “Call Me Back – Home in On.“: Visit this link to initiate the application process.

- Step 2. Fill in Your Details: You will be directed to a form where you need to provide your details. Fill in the required fields, including your:

- Full Name

- Email Address

- Mobile Number

- Step 3. Choose Salary Range: Select your salary range from the drop-down menu provided. This helps the bank understand your financial profile.

- Step 4. Submit Your Information: Once you have filled in all the necessary details, click the “Submit” button to send your information to RAK Bank.

- Step 5. Await Contact: After submitting your details, RAK Bank’s representatives will review your information. They will contact you to discuss the next steps in the home loan application process. Alternatively, they may schedule a meeting to provide more information and guidance.

CBD Home Loan

CBD Mortgage Loans offer diverse solutions for individuals in the UAE seeking to achieve their real estate objectives. Whether the goal is to purchase a dream home, transfer an existing mortgage for reduced monthly payments, refinance a “Ready Property” for enhanced liquidity, or invest in “Under Construction” properties, CBD provides tailored options. For UAE Nationals, CBD supports investments and refinancing in plots, land, and farmhouses. Expatriates can also benefit from CBD’s offerings, allowing them to invest or refinance plots in Dubai in collaboration with select developers.

With loan amounts reaching up to AED 15 million for UAE Nationals and a maximum of AED 20 million or two times the annual income for the past seven years for Expatriates, flexible tenors of up to 300 months, and competitive loan-to-value ratios of up to 85%, CBD’s Mortgage Loans provide a comprehensive and accessible approach to real estate financing. Additionally, the option of both Variable and Fixed interest rates, along with reasonable debt burden ratios, adds to the flexibility and attractiveness of CBD’s offerings.

As part of its commitment to customer satisfaction, CBD ensures clarity in repayment terms specified in the offer letter, making the entire process transparent and accommodating for diverse financial needs.

Required Documents:

- For salaried individuals:

- Application form, consent letter, and authorisation letter for Bureau check.National ID or valid passport, residence visa, and Emirates ID.Original 3-month bank statement for new customers.

- For self-employed individuals:

- Application form, authorisation letter for lending, and consent letter for Bureau check.

- Copy of Trade License, Chamber of Commerce Registration, Memorandum and Articles of Association.

- Original 12 months company and personal bank statements for new customers.

Eligibility Criteria:

- For salaried individuals (UAE Nationals and Expatriates):

- Age between 21 and 65 years (at loan maturity).

- Minimum monthly income of AED 12,000.

- Minimum length of service of 6 months.

- For self-employed individuals (UAE Nationals and Expatriates):

- Age between 21 and 70 years (at loan maturity).

- Minimum monthly income of AED 20,000.

- Minimum length of 3 years in business

Note: Additional documents may be required based on underwriting terms and eligibility criteria.

How to Apply:

- Step 1. Click on “Get Pre-Approved Instantly.”: Visit this link to initiate the pre-approval process.

- Step 2. Provide Your Mobile Number: Enter your mobile number in the designated field. Ensure that you use a valid mobile number for communication purposes.

- Step 3. Agree to Terms: By signing up, you confirm your agreement to CBD’s Terms and Conditions. It’s important to review and understand the terms before proceeding.

- Step 4. Receive Verification Code: CBD will send a verification code to the mobile number you provided. Enter the code to verify your identity.

- Step 5. Complete Pre-Approval Process: Follow the on-screen instructions to complete the pre-approval process. This may involve providing additional information about your financial status.

- Step 6. Consult with CBD Representatives: Once pre-approved, CBD’s representatives may contact you to discuss your mortgage requirements, answer any questions, and guide you through the next steps.

HSBC Home Loan

HSBC Home Loans make the process of securing a home loan hassle-free and cost-effective. Until March 31, 2024, enjoy discounts on fees across all home loans, saving you money on your mortgage.

The Variable Rate Mortgage

The Variable Rate Mortgage linked to the Emirate Interbank Offered Rate (EIBOR), offers flexible interest rates that move with the 3-month AED EIBOR. Notably, there’s no early settlement charge if you repay the loan in full after 3 years, and you receive a 0.15% discount on your interest rate when buying Platinum or Gold LEED certified properties with the Green Home Loan.

Premier resident customers benefit from a competitive annual percentage rate, and an overpayment allowance of 25% of the outstanding balance is granted. HSBC provides essential support through mortgage advisor assistance and can arrange mandatory life and property insurance for your UAE property.

Additionally, for new build properties directly from developers, HSBC offers last payment finance, easing the financial burden upon completion. Whether or not you’re an HSBC customer, the bank handles all account setup arrangements for you.

HSBC Fixed-rate Home Loan

The HSBC Fixed-rate Home Loan provides homeowners with a dependable and stress-free financing solution, ensuring predictable monthly repayments for up to 5 years. During the chosen fixed-rate period, regardless of market fluctuations, borrowers benefit from consistent repayments, offering financial security.

Following this period, a seamless transition occurs to a 3-month EIBOR based variable rate for the remainder of the mortgage term. This home loan option offers flexibility, allowing borrowers to choose a fixed interest rate and steady monthly repayments for durations of 1, 2, 3, or 5 years. Additional perks include an overpayment allowance of 25% of the outstanding balance, a discount for sustainable LEED-certified properties, and accessibility for non-HSBC customers, with the bank managing the account setup process.

HSBC ensures transparency by calculating post-fixed period interest rates based on the 3-month EIBOR rate and the HSBC margin. With the flexibility to consider Loan to Value (LTV) ratios and a thorough breakdown of associated costs, the HSBC Fixed-rate Home Loan stands out as a reliable and customer-friendly option.

Eligibility:

If you meet the following criteria, you are eligible to apply for a Variable 3-month EIBOR Home Loan:

- Residing in the UAE

- Age between 21 and 65

- Minimum monthly income of AED 15,000

- Even if you reside outside of the UAE but are an HSBC Global Private Banking or Premier customer, you may still have the opportunity to apply for a home loan to purchase a property.

By taking out a home loan with HSBC, you may have the opportunity to apply for an HSBC Premier account. Becoming an HSBC Premier customer offers several benefits, including a more favorable interest rate on your home loan and exclusive perks.

To be eligible for an HSBC Premier account, you must meet one of the following criteria:

- Hold a mortgage with HSBC and have a drawdown of AED 3,000,000 or above for the initial 24 months. Afterward, you must fulfill one of our other eligibility criteria.

- Maintain a Total Relationship Balance (TRB) of AED 350,000 in deposits and/or investments with HSBC.

- Deposit a minimum monthly net income of AED 50,000 into your account.

- Already possess an HSBC Premier account and meet the qualification requirements in another country or region.

Requirements:

For your home loan application, you may need the following documents (if you’ve not already submitted them):

- Valid passport, visa and Emirates ID

- Personal bank statement dated within the last 6 months

- Salary certificate

- Property ownership documents

- Proof of funds for down-payment

How to Apply:

Applying for a mortgage with HSBC is a straightforward process that involves two essential steps. Here’s a step-by-step guide to help you through the process:

Step 1: Get an Approval in Principle

- Visit the HSBC Website: Access the HSBC official website to begin the mortgage application process.

- Complete the Form: Fill out the Approval in Principle form available on the website. This form will provide necessary details for your application.

- Submit the Form: Submit the completed form online. This step initiates the process of getting an Approval in Principle.

- Speak to a Mortgage Adviser: A mortgage adviser from HSBC will reach out to you after receiving your form. Alternatively, you can visit your local HSBC branch to discuss your mortgage needs.

- Prepare Required Documents: Gather essential documents as outlined above for verification.

- Approval in Principle: On average, within 60 minutes of submitting your documents, you will receive an Approval in Principle. This document outlines the potential loan amount you may be eligible for and is valid for up to 60 days.

The Approval in Principle not only provides an estimate of your borrowing capacity but also demonstrates your readiness to buy, giving you an advantage in the homebuying process.

Note: To get a detailed view of their loan rates, check here.

ADIB Home Finance ‘Buy a House’

ADIB’s Avail Home Finance provides a convenient and flexible solution for individuals looking to purchase their dream home or investment property. With easy documentation and attractive profit rates, this financing option allows borrowers to acquire a property directly from a developer or an existing owner.

Key benefits include financing of up to AED 10 million for both nationals and expatriates, competitive profit rates starting as low as 2.85% per annum, and exclusive rates for financing developer purchases or handover payments.

ADIB also covers property insurance throughout the loan tenure, with the added advantage of a grace period for the first payment, extending up to 6 months, and no early settlement fees when selling the property. The Home Finance Planner tool enables borrowers to calculate their eligibility and determine affordability instantly, making the process efficient and transparent. ADIB’s Avail Home Finance is designed to streamline the property buying process and cater to a diverse range of financing needs.

Documents Required:

Salaried:

- Valid Passport & Emirates ID copy

- Valid residence visa copy (Expats residents Only)

- Khulasat Al Qaid (Family book for UAE Nationals only)

- Salary Certificate

- 3-month bank statement

- Liability Letter (if applicable)

- Property ownership documents

Self- Employed (individuals):

- Valid Passport & Emirates ID copy

- Valid residence visa copy (Expats residents Only)

- Khulasat Al Qaid (Family book for UAE Nationals only)

- Company ownership documents

- 3-month bank statement

- Liability Letter (if applicable)

- Property ownership documents

Note: Further documents might be needed during the application process

Eligibility:

Salaried:

- Monthly salary of AED 10,000 for Salary Transfer and AED 15,000 for Non- Salary Transfer customers

- Min age 21 years at the time of application and max age 70 years for UAE National and 65 years for Expat at the time of financial maturity

- Properties located in all Emirates

Self-Employed:

- Annual turnover of AED 3,000,000

- Min age 30 years at the time of application and max age 70 years at the time of finance maturity

- Properties located in Abu Dhabi and Dubai only

How to Apply:

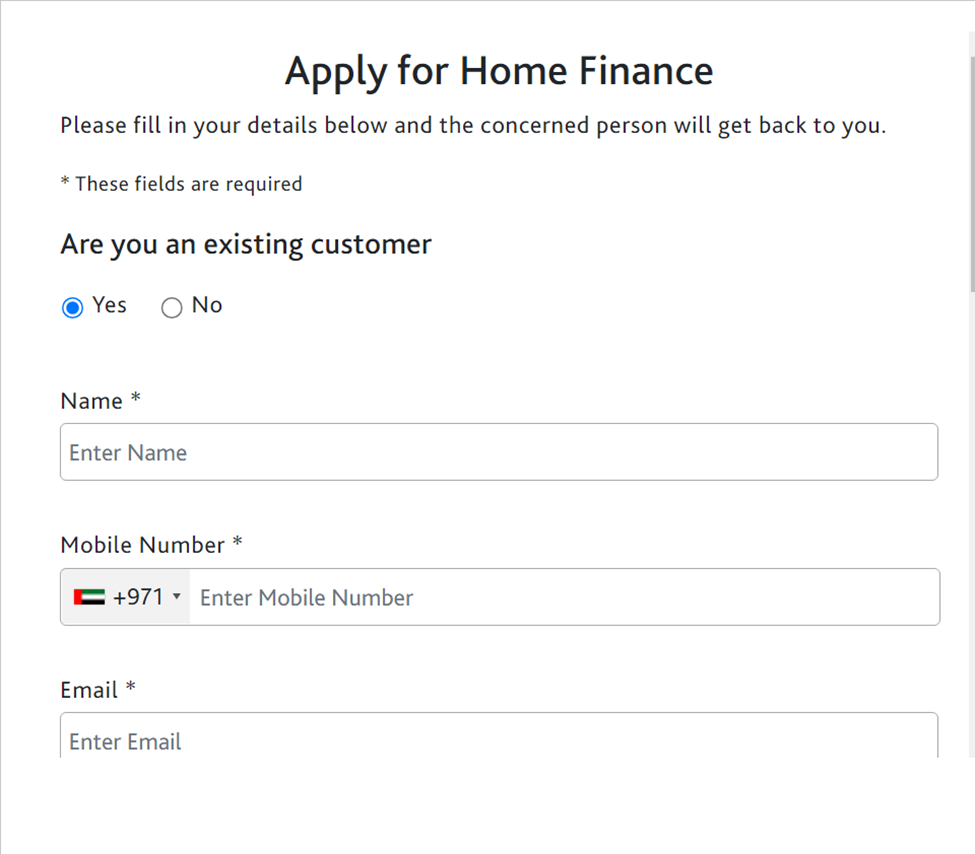

Step 1. Visit the ADIB Home Finance Application Page: Go to their official website’s dedicated ADIB Home Finance application page.

- Step 2. Complete the Application Form: Fill in the required details in the provided form. Include your name, mobile number (with country code), email address, and select your emirate of residence.

- Step 3. Existing Customer Status: Indicate whether you are an existing ADIB customer by selecting “Yes” or “No.”

- Step 4. Choose Financing Type: Select the type of financing you would like to apply for from the options provided.

- Step 5. Income Range: Choose your income range from the provided options.

- Step 6. Preferred Time To Call: Indicate your preferred time to receive a call from ADIB’s representative.

- Step 6. Confirmation and Consent: Confirm that the information provided is accurate to the best of your knowledge. Additionally, agree to ADIB processing your personal information in accordance with their privacy policy.

- Step 7 Submit Application: Click the submit button to send your application to ADIB.

- Step 8. Await Contact: A representative from ADIB will get back to you based on the preferred time you indicated.

RAKBANK Home Finance

Their Home Finance stands out as a flexible, affordable, and hassle-free solution for property purchases in Abu Dhabi, Dubai, and Ras Al Khaimah. With a dedicated team of Home Finance advisors providing personalised service, the entire process is guided seamlessly, aiming to minimise stress for prospective buyers.

The finance options boast competitive profit rates, including 3 & 5 years fixed rates ranging from 4.19% to 5.49%, complemented by follow-on rates after the fixed period and variable rates from day 1. Offering flexible payment periods of up to 25 years, it accommodates a wide range of budgets. The option for single or joint ownership enhances convenience and affordability, allowing shared costs with another borrower.

The streamlined application process ensures minimal formalities and fast approvals, promising a swift transition to homeownership without unnecessary delays.

Eligibility:

Salaried Individuals:

- Minimum monthly salary of AED 15,000

- UAE Nationals

- Proof of employment

- UAE Expatriate Residents

- Minimum of 6 months employment with the same employer

Non-Residents:

- Minimum of 12 months of employment with the same employer

Business Customers:

- Business ownership for a minimum of 2 years

- UAE residents and non-residents, UAE nationals and expatriates, GCC nationals

Fees:

- Due diligence, documentation and processing fees- 0.50%*

- Valuation fees- AED 1,850

- *for salaried customers and 0.75% for self-employed

How to Apply:

- Step 1. Click on “Call Me Back.“: Visit this link to initiate the application process.

- Step 2. Fill in Your Details: You will be directed to a form where you need to provide your details. Fill in the required fields, including your:

- Full Name

- Email Address

- Mobile Number

- Step 3. Choose Salary Range: Select your salary range from the drop-down menu provided. This helps the bank understand your financial profile.

- Step 4. Submit Your Information: Once you have filled in all the necessary details, click the “Submit” button to send your information to RAK Bank.

- Step 5. Await Contact: After submitting your details, RAK Bank’s representatives will review your information. They will contact you to discuss the next steps in the home loan application process. Alternatively, they may schedule a meeting to provide more information and guidance.

How to Calculate EMI of Your Mortgage Loan in UAE

An Equated Monthly Installment (EMI) is a fixed amount of money that a borrower needs to repay to a lender each month as part of a loan repayment plan. It is commonly used for loans such as home loans, car loans, personal loans, or any other type of instalment loan.

To calculate the Equated Monthly Installment (EMI) for a loan, you need the following information:

- Loan Amount (P): The total amount you are borrowing.

- Interest Rate (R): The annual interest rate for the loan.

- Loan Tenure (N): The number of months or years over which the loan will be repaid.

The formula to calculate the EMI is as follows:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Here’s a step-by-step guide on how to calculate the loan EMI:

- Step 1. Convert the annual interest rate to a monthly interest rate by dividing it by 12 (if the interest is compounded monthly).

- Step 3. Monthly Interest Rate (r) = (Annual Interest Rate / 12) / 100

- Step 3. Convert the loan tenure to the number of months.

- Step 4. Loan Tenure in Months (n) = Loan Tenure in Years x 12

- Step 5. Use the formula mentioned above to calculate the EMI.

Let’s take an example to illustrate the calculation:

- Loan Amount (P) = AED 100,000

- Annual Interest Rate (R) = 10%

- Loan Tenure (N) = 5 years

- Step 1: Convert the annual interest rate to a monthly interest rate.

- Monthly Interest Rate (r) = (10 / 12) / 100 = 0.00833

- Step 2: Convert the loan tenure to the number of months.

- Loan Tenure in Months (n) = 5 x 12 = 60

- Step 3: Calculate the EMI using the formula.

- EMI = [100,000 x 0.00833 x (1+0.00833)^60] / [(1+0.00833)^60 – 1]

Using the formula and performing the calculations, the estimated EMI for the given example is approximately AED 2,124.77.

Please note that this formula gives you an approximate value for the EMI and does not account for additional fees or charges that may apply to your loan. It’s always a good idea to consult with your lender or use their online EMI calculators to get precise information regarding your loan EMI.

FAQs

What is the minimum deposit for a mortgage in the UAE?

In the UAE, there are specific guidelines set by the Central Bank regarding mortgage deposits for both Emirati nationals and expatriates. For properties valued below AED 5 million, borrowers can obtain a loan of up to 85% of the property value, with a minimum deposit requirement of 15%. However, if the property exceeds AED 5 million, the loan-to-value ratio decreases to 75%, thus necessitating a higher deposit of 25%.

Is it possible for a foreigner to obtain a mortgage in the UAE?

Yes, the process is relatively straightforward for non-residents to secure a mortgage in the UAE. Suppose you are a non-resident seeking a mortgage in Dubai, Abu Dhabi, or any other Emirate. In that case, you must provide three months’ worth of bank statements to demonstrate affordability, along with a copy of your passport.

Can I obtain a mortgage in Dubai without residing there?

Yes, banks in the UAE offer mortgage loans to non-resident investors for purchasing properties in Dubai. Non-residents can enjoy advantages such as high loan amounts, low interest rates, and flexible home loan options.

How long does the mortgage process take in Dubai?

The mortgage process in Dubai generally follows a timeline of approximately three to four working days for pre-approval. Once the purchase has been finalised, it usually takes around one week to receive the mortgage offer letter from the bank. However, please note that the exact timing may vary depending on additional procedures or paperwork that may be required.