Health insurance is important today because it helps you feel secure and protects you from unexpected medical costs. ADNIC (Abu Dhabi National Insurance Company) is a top insurance provider in the UAE, well-known for its complete health insurance plans. This guide will explain everything you need about ADNIC health insurance, including its features, benefits, and how to make the most of your policy.

ADNIC health insurance overview:

ADNIC has been a trusted name in the UAE insurance industry since 1972. They provide a variety of insurance products, such as health, motor, property, and life insurance. ADNIC’s health insurance plans are designed to meet the different needs of individuals, families, and businesses, offering access to quality healthcare services in the UAE and worldwide.

Why choose ADNIC health insurance?

- Comprehensive Coverage: ADNIC provides many plans that cover many medical services, from regular check-ups to major surgeries.

- Extensive Network: You can access a large network of medical facilities, including hospitals, clinics, and pharmacies across the UAE and internationally.

- Flexible Plans: They offer customised plans to fit different needs and budgets.

- Reliable Customer Service: Their customer support is available 24/7 to help with claims and questions

Compare ADNIC Health Insurance Plans

There are four types of ADNIC health insurance categories at the moment:

- Bronze

- Silver

- Gold

- Platinum

Here is a breakdown of all the categories:

| Feature | Bronze Policy | Silver Policy | Gold Policy | Platinum Policy | |

| Annual Limit | AED 250,000 | AED 500,000 | AED 2,000,000 | AED 5,000,000 | |

| Geographical Limit | UAE only | Worldwide, excluding USA, Canada, and Europe | Worldwide, excluding USA and Canada | Worldwide | |

| Accommodation | Semi-private room | Private room | Private room | Standard suite | |

| Maternity Outside Network and Overseas | Not covered | AED 15,000 | AED 30,000 | AED 50,000 | |

| Medical Consultation Co-Insurance | AED 30 or AED 50 | AED 30 or AED 50 | AED 30 or AED 50 | Nil deductible | |

| Pharmaceutical Co-Insurance | Nil or 20% | Nil or 20% | Nil or 10% or 20% | Nil Co-insurance | |

| Outside Network Co-Insurance | Not covered | 20% | 20% | Nil Co-insurance | |

| Medical Appliances | Not covered | AED 5,000 | AED 25,000 | AED 50,000 | |

| Kidney Dialysis | Not covered | AED 15,000 | AED 50,000 | AED 100,000 | |

| Vaccination (Child) | Covered as per MOH schedule | Covered as per MOH schedule | At actual cost | At actual cost | |

| Second Medical Opinion | Not covered | Not covered | Available | Available | |

| Alternative Medicine | Not covered | AED 1,500 | AED 7,500 | AED 15,000 | |

| Routine Health Checkup Annual Screening | AED 750 | AED 750 | AED 1,000 | AED 2,500 | |

| Diabetic Consumables | Not covered | Not covered | AED 73,500 | AED 7,500 | |

| Psychiatry Treatments/Psychological Counselling | Not covered | AED 1,500 | AED 10,000 | AED 30,000 | |

| Cash Benefit | Not covered | AED 100 (10 nights) | AED 250 (15 nights) | AED 500 (15 nights) | |

| Overseas Direct Billing | Not covered | Available under “Shifa” medical product with MSH International Network | Available under “Shifa” medical product with MSH International Network | Available under “Shifa” medical product with MSH International Network | |

| Vision Care (Optional) | Not covered | Not covered | AED 750 | AED 1,000 | |

| Dental Care (Optional) – Routine | Not covered | AED 1,500 (20% co-payment) | AED 5,000 (20% co-payment) | AED 7,000 (20% co-payment) | |

| Dental Care (Optional) – Major | Not covered | Not covered | AED 5,000 (20% co-payment) | AED 7,000 (20% co-payment) | |

| Organ Transplant | Not covered | Not covered | Not covered | At actual cost | |

Best ADNIC health insurance plans in the UAE – 2024

If you are wondering, “How to apply for ADNIC health insurance in UAE?” You can get a quote by clicking on “Get Quote” below. Then, you can learn how to apply and other details about the insurance.

| Plan Name | Annual Limit (AED) | Know the Price |

| Bronze | 250,000 | Get Quote |

| Silver | 500,000 | Get Quote |

| Gold | 2,000,000 | Get Quote |

| Platinum | 5,000,000 | Get Quote |

Why choose ADNIC health insurance?

Here are the main reasons to choose ADNIC health insurance:

- Customised plans: ADNIC offers health insurance plans specially designed to fulfil the needs of each customer.

- Global coverage: ADNIC partners with MSH International, a top healthcare administrator, to provide worldwide coverage.

- Easy claims tracking: Users can easily keep track of their medical claims.

- Extensive network: ADNIC has agreements with over 3,000 medical providers in the UAE and other regions.

- Top healthcare centres: The company works with many healthcare centres and skilled medical professionals.

- Worldwide emergency coverage: Medical emergencies are covered globally when travelling.

ADNIC health insurance price:

The cost of ADNIC health insurance depends on several factors:

- Type of plan: The different plans have different coverage levels and prices.

- Coverage area: Plans that cover only the UAE are usually cheaper than those with worldwide coverage.

- Age of the insured: Older people may pay higher premiums because of increased health risks.

- Optional add-ons: Adding dental, vision, and other extra benefits will increase costs.

- Pre-existing conditions: People with pre-existing medical conditions may have higher premiums.

For an accurate quote, contacting ADNIC directly or using their online tools to get specific details about your insurance needs is best. Here is the link to get a quote from ADNIC.

ADNIC health insurance contact number:

You can contact ADNIC health insurance through the following ways:

- Customer service hotline: 8008040 or 97124080900

- Email: info@adnic.ae

- Website: ADNIC Contact Page

For more specific inquiries or assistance, visit their contact page or call their customer service hotline.

ADNIC health insurance hospitals & clinics network list

Mentioned below are some of the ADNIC health insurance network hospitals, but these aren’t just the ones, there are many hospitals in all the Emirates.

| Provider | Area | Phone | Direction |

| Dar Al-Shifa Hospital | 20th Street | 02-6900900 | See Direction |

| Dar Al-Shifa Hospital | 20th Street | 02-6900900 | See Direction |

| Dar Al-Shifa Hospital (Closed Temporarily) | 20th Street | 02-6900900 | See Direction |

| Cleveland Clinic Abu Dhabi LLC | Al Maqam Tower, Al Maryah Island | 02-6590200 | Get Direction |

| Golden Cure Pharmacy LLC | Mussafah | 02-6790622 | See Direction |

| Aster Pharmacies Group LLC – Branch of Abu Dhabi 6 | Shabiya #10, Near to Joy Alukas Jewelry, Mussafah | 02-5502429 | See Direction |

| Aster Pharmacies Group LLC – Branch of Abu Dhabi 8 | Canon Building, Electra Street, Next to CBI Bank Building | 02-6711831 | See Direction |

| Noor AlAhli Pharmacy – Branch 6 | Noor AlAhli Medical Center Building, Hamdan Street | 02-6210524 | See Direction |

| Point Care Pharmacy | Shop No. 6, P-8, Mr. Clean Car Wash Building, Near Al Falahiyah and Al Samha School, Al Samha East | 02-5641927 | See Direction |

| Select Pharmacy LLC | Mussafah M-10, Industrial Area, Ground Floor, Plot No. 48, Near Lal Market | 02-5467888 | See Direction |

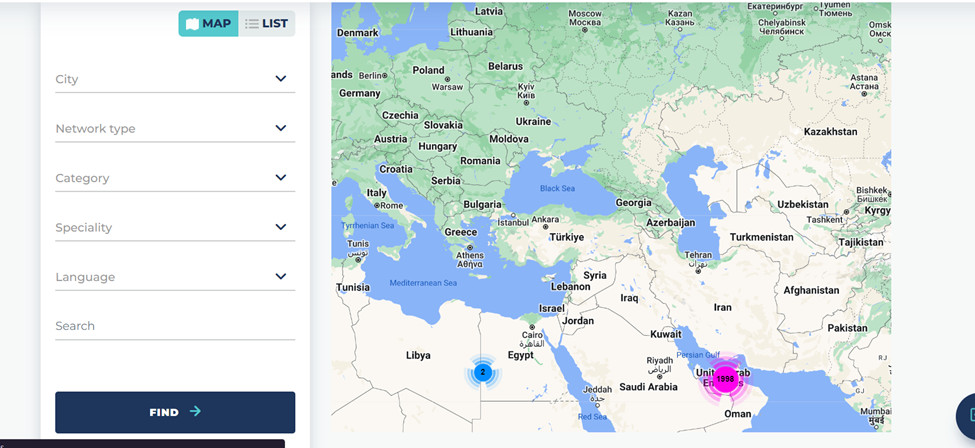

How to access ADNIC medical insurance hospital list?

To access the ADNIC Health Insurance hospital list, you can simply follow these steps:

- Visit the official website of ADNIC health insurance.

- Select the city, network type, category, speciality, and language.

- Click “Find”.

- They will give you an ADNIC health insurance hospital list according to your preferences.

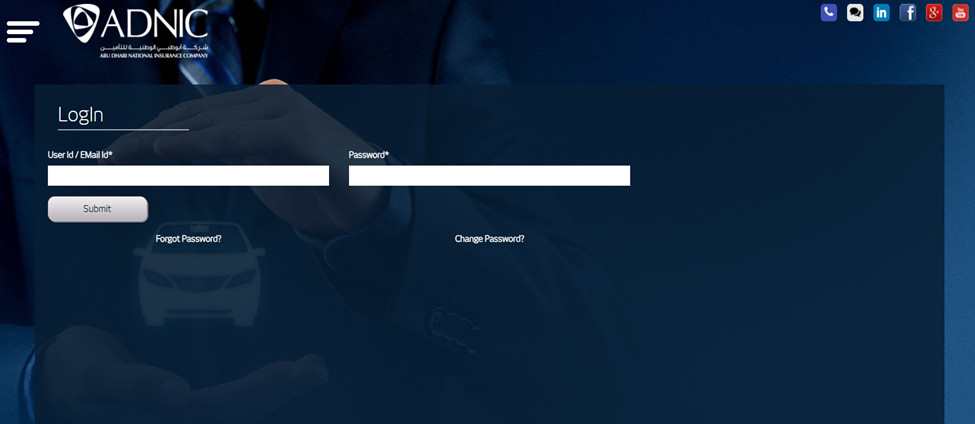

ADNIC health insurance login:

To log in to the ADNIC health insurance portal, you can do it via the app or the website. Let’s look at how to log in via the official website:

- Visit this link.

- Enter your user ID or email address.

- Enter your password and click “Submit”.

- You will be logged in successfully.

ADNIC health insurance app:

You can even download the ADBIC health insurance app for Android and iOS. The app allows you to get quotes, update information, download the ADNIC health insurance card, and do many other things.

Final takeaway:

ADNIC health insurance gives you complete coverage, access to many healthcare providers, and extra benefits to make sure you and your family get quality medical care. By knowing your needs and comparing different plans, you can pick the best health insurance in UAE that gives you peace of mind and financial protection.

For more detailed information, visit the official ADNIC website here.

Frequently Asked Questions (FAQs):

Q. Which insurance is best for health in the UAE?

There is a lot of good health insurance in the UAE, including Daman Health · ADNIC (Abu Dhabi National Insurance Company) · AXA (Gig), Gulf Insurance · Aetna, and many more. Click here to learn more about this health insurance.

Q. Who owns ADNIC?

The Abu Dhabi Investment Council owns ADNIC.

Q. How much is ADNIC health insurance?

Visit their official website for a quote on the different ADNIC health insurance categories.