This guide from InsuranceMarket.ae covers what you need to know. It includes Term Insurance types, benefits, key points, and common mistakes. This way, you can make a smart choice to protect your family’s future.

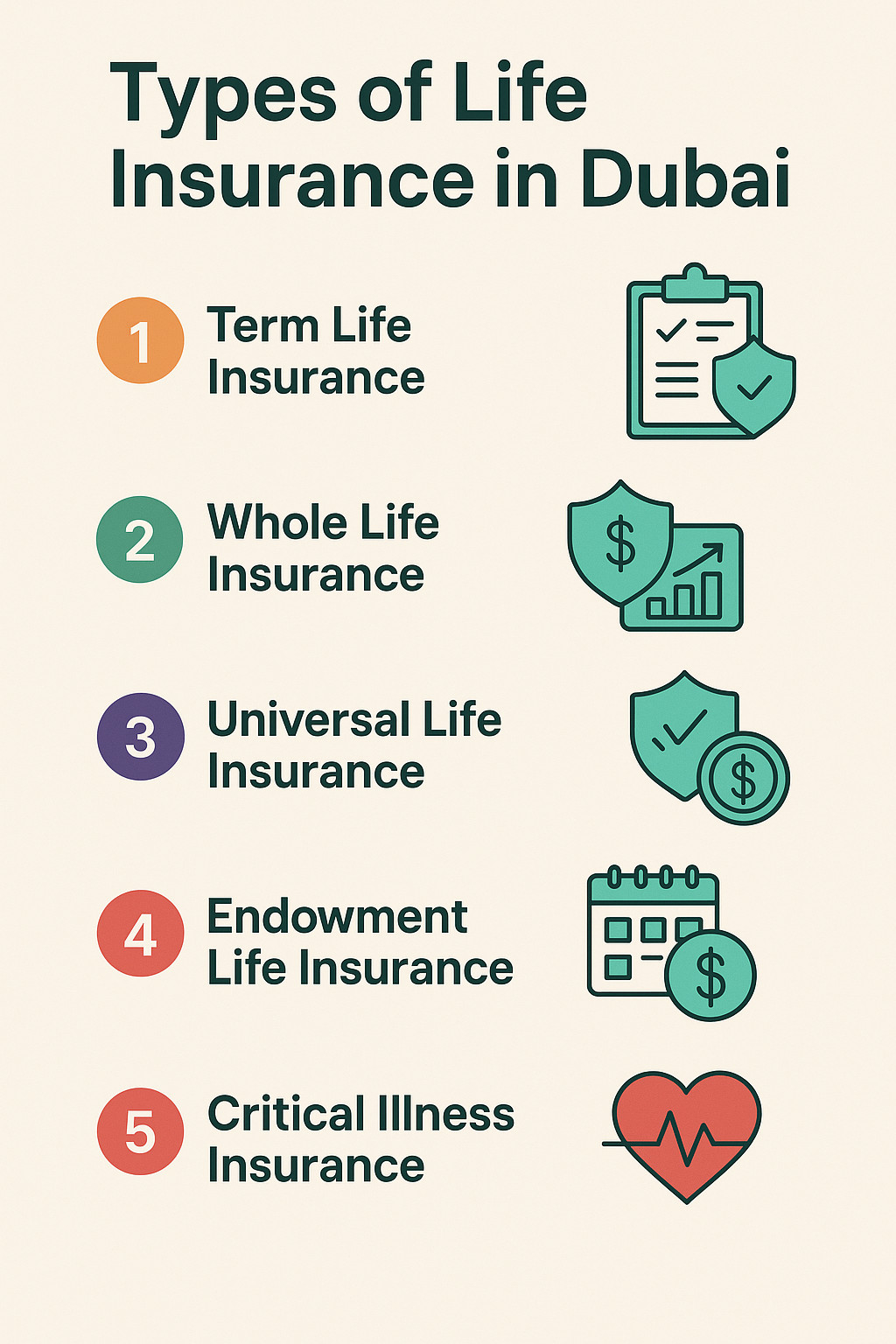

Types of Life Insurance in Dubai

In Dubai, people can choose from five main types of life insurance. These options help protect loved ones and secure their financial future. Each type offers unique features and benefits tailored to different needs and circumstances.

1. Term Life Insurance

Term life insurance covers you for a set time, typically between 5 and 30 years. It provides an easy way to protect your family if you die unexpectedly during the policy term. This insurance is ideal for individuals seeking affordable coverage that terminates on a specific date.

2. Whole Life Insurance

Whole life insurance provides coverage for your entire life. It also has an investment component that builds cash value over time. This insurance protects your beneficiaries and helps you save. So, it’s a useful tool for long-term planning.

3. Universal Life Insurance

Universal life insurance offers permanent coverage and flexible premium payments. It also allows for adjustable death benefits. Policyholders can adjust their premiums and death benefits as their financial needs change. This gives them more control over their policy and ensures continued protection.

4. Endowment Life Insurance

Endowment life insurance pays a lump sum. This happens either when the policyholder dies or at the end of a set term, whichever comes first. This insurance is a great way to save for the future. It helps you reach long-term savings goals or leave money for your loved ones.

5. Critical Illness Insurance

Critical illness insurance covers serious medical emergencies like cancer, heart attack, or stroke. If the policyholder gets diagnosed with a covered illness, they will receive a lump sum. This payment can help cover medical bills and other financial needs during challenging times.

Understanding Term Insurance

Term insurance is a straightforward and cost-effective type of life insurance. It provides coverage for a specified period, known as the term. Unlike whole life insurance, term insurance doesn’t build cash value. Instead, it offers pure protection at a lower premium, making it a sensible choice for many.

One of the key benefits of term insurance in Dubai is its simplicity. Clear terms and conditions help policyholders easily understand their coverage, providing a sense of security and peace of mind for individuals and their loved ones.

Term insurance allows policyholders to select the coverage amount and policy duration, enabling them to tailor the policy to fit their specific needs and circumstances. This flexibility ensures financial security for their loved ones in the event of an unexpected occurrence, giving them a sense of control over their financial planning.

Advantages of Term Insurance in Dubai

In Dubai, term insurance helps expats and residents protect their loved ones. It provides financial security for unexpected events. A key benefit of term insurance is its lower cost compared to other types of life insurance.

Term insurance offers high coverage at a low premium. This makes it a great choice for anyone seeking strong protection without incurring a significant expense. This affordability helps people achieve financial stability for their families. They don’t have to sacrifice quality or benefits.

Another advantage is the flexibility that term insurance offers regarding policy duration. Policyholders can choose terms from 5 to 30 years. This allows them to tailor coverage to their specific needs. It’s particularly helpful during important times, such as paying a mortgage or covering the costs of your kids’ education.

Types of Term Insurance Plans Available

In Dubai, you can find many types of term insurance plans. They meet different needs and preferences.

Level Term Insurance

The most common type is level-term insurance. Here, the death benefit remains constant throughout the policy term.

Convertible Term Insurance

Convertible-term insurance allows you to convert your term policy into a permanent life insurance plan without the need for additional medical exams or underwriting, which is the process of assessing your health and medical history. This option gives flexibility for those who want long-term coverage later.

Decreasing Term Insurance

Decreasing-term insurance is suitable for individuals with financial obligations that decrease over time, such as mortgage loans. The death benefit decreases annually, but the premiums remain unchanged. This matches the decreasing liabilities over time.

Choosing the Right Term Insurance Policy

When selecting a term insurance policy in Dubai, consider your needs and financial objectives. Begin by figuring out how much coverage you need. Consider your income, debts, and future costs. Determine the duration of coverage by considering your financial situation and objectives.

Also, check the exclusions and limits of each policy. Ensure it aligns with your lifestyle and potential risks. Find policies with flexible premium payments and features that suit your needs. Think about getting help from InsuranceMarket.ae advisors. They can guide you in making your decisions.

Factors to Consider Before Buying Term Insurance

When purchasing term insurance in Dubai, there are key factors to consider.

Assess Your Financial Situation

Understanding your current and future financial needs helps you choose the right coverage amount.

Evaluate Your Health and Lifestyle

Age, health, and existing medical conditions can affect premium costs and policy terms.

Choose the Right Term Length

Decide how long you need the term insurance policy. Think about your financial goals and responsibilities.

How to Calculate Term Insurance Coverage

Assess Your Financial Obligations

Consider these factors: debts, mortgage payments, kids’ education costs, and future living expenses.

Check Your Income

Figure out the income your family needs to keep their lifestyle if you’re not around.

Factor In Future Expenses

Consider significant life events, such as college tuition for your children, weddings, or retirement planning.

Common Mistakes to Avoid When Buying Term Insurance

Insufficient Coverage

You must check your financial obligations. This includes debts, future expenses, and income replacement needs.

Not Reviewing Policy Terms

Understand the fine print, including exclusions, limitations, and renewal options.

Delaying Buy

Waiting too long can result in higher premiums due to age or health changes.

Benefits of Term Insurance for Expats in Dubai

Expatriates in Dubai can benefit from term insurance policies designed for them.

- Portability: Coverage can often be maintained if you relocate.

- Cost-effective: Competitive premium rates.

- Convenient: Online platforms like InsuranceMarket.ae simplify the process.

Tips for Getting the Best Term Insurance Deal

- Compare quotes from multiple providers.

- Choose coverage based on your actual needs.

- Work with trusted advisors at InsuranceMarket.ae for expert guidance and support.

Conclusion

In closing this guide on Term Insurance in Dubai, keep this in mind: it’s vital to protect your loved ones and secure your financial future.

Term insurance isn’t just a policy. It’s a promise to protect your family’s well-being when you’re gone. Take the chance to make smart choices about protecting what’s most important. You can build a secure future full of opportunities. Take the right steps and acquire knowledge. InsuranceMarket.ae offers support and expertise to help you.