Managing your business finances is a task that demands utmost care, precision, and efficiency. Whether you’re making domestic or international payments, collecting payments, or keeping an eye on your cash flow, it can be a hassle.

But what if there was a way to make this tedious process more straightforward, safer, and efficient? Enter ADCB ProCash, the ultimate corporate banking solution by Abu Dhabi Commercial Bank (ADCB).

What is ADCB?

Before diving into the specifics of ADCB ProCash, let’s briefly cover what ADCB stands for. Abu Dhabi Commercial Bank, or ADCB, is the third-largest bank in the UAE in terms of assets.

Established in 1985, ADCB provides various financial services, from personal and corporate banking to wealth management and Islamic banking solutions. With a strong local presence and numerous international branches, ADCB is a publicly listed company traded on the Abu Dhabi Securities Exchange.

ADCB ProCash: An Overview

ADCB ProCash is a corporate Internet banking platform designed to simplify your business finances. From account management to payments and collections, it offers a complete package of services geared towards business efficiency.

Key Features

- Detailed and Customized Account Statement: Know exactly where your money is going.

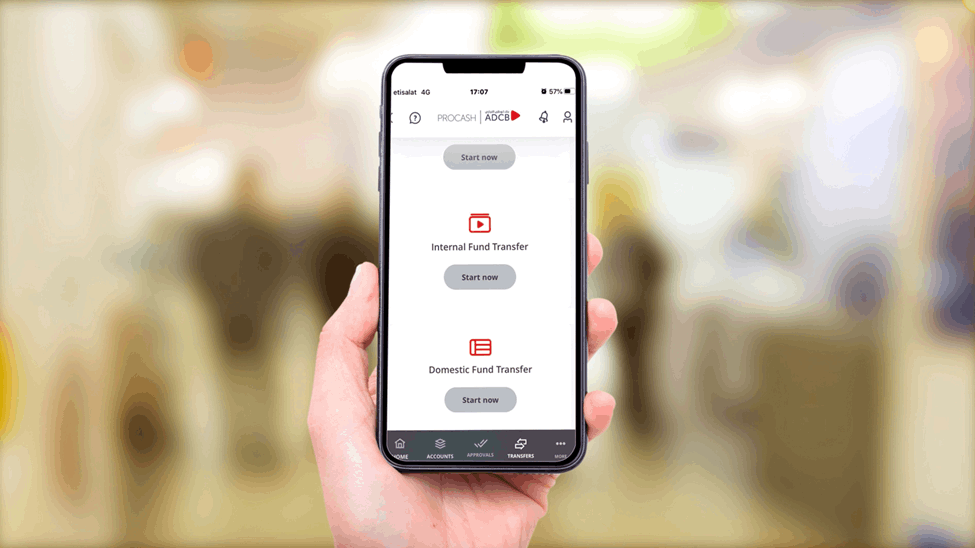

- Support for Domestic and International Payments: Make salary disbursements and other payments with ease.

- Collection Processing: Manage direct debits and cheque clearings.

- Customised Reporting: Generate reports in MT 940, MT 942, and MT 950 formats.

- Single Sign-On: Access both ProCash and ADCB’s trade application, ProTrade, with a single login.

- Additional Security Layers: An extra layer of approval for transactions enhances security.

- Self-Service Cheque Printing: Print cheques directly from the ProCash platform.

- Mobile App: Manage your business on the go with the ADCB ProCash Mobile App.

Key Benefits

- Efficiency: Automates numerous manual tasks, freeing you up for other essential duties.

- Convenience: Access your business account from anywhere with internet access.

- Security: Benefit from state-of-the-art security measures.

- Flexibility: Customize the platform according to your business needs.

How to Register in ADCB Procash?

To register for ADCB ProCash, you can:

- Contact your Relationship Manager.

- Call the ADCB Commercial Banking Contact Centre at 800 SME 800 (800 763 800, toll-free within UAE) or +971 4 427 3951 (from outside UAE).

- Visit any ADCB Branch.

Once you have contacted ADCB, they will provide you with the necessary information and documentation to complete the registration process.

Here are the steps involved in registering for ADCB ProCash:

- Provide ADCB with your business details, such as your company name, trade license number, and contact information.

- Submit your application form.

- Once your application has been approved, you will be provided with a ProCash user ID and password.

- You will also need to download the ADCB Mobile Token app.

Once you have completed these steps, you will be able to log in to ADCB ProCash and start using the platform to manage your business finances.

For any technical assistance, you can reach out to the ProCash Helpdesk at [email protected]

Tips When Registering for the ADCB Procash

Here are some additional tips for registering for ADCB ProCash:

- Make sure to have all of the necessary information and documentation ready before you start the registration process.

- If you have any questions, please do not hesitate to contact your Relationship Manager or the ADCB Commercial Banking Contact Centre.

- Once you have registered for ADCB ProCash, be sure to change your password regularly and keep your security information up to date.

FAQs

What is the user ID for my ADCB account?

A user ID refers to the 6-20 digit identification number provided by the Bank to the Account Holder for accessing ADCB Personal Int.

What are the system requirements for using ADCB ProCash?

To use ADCB ProCash, you will need a computer with an internet connection and a web browser. You will also need to download the ADCB Mobile Token app.

What is the fee for international transfers with ADCB?

When conducting an international transaction through ADCB Internet Banking or the ADCB banking app, you will incur the following charges per transaction: A service fee of Dhs 21 and an exchange rate margin ranging from 0.2% to 5%.

Who can use ADCB ProCash?

ADCB ProCash is available to all ADCB commercial banking customers.

What types of payments can I make with ADCB ProCash?

You can make a variety of payments with ADCB ProCash, including domestic and international payments, salaries, and direct debits.

What is the additional approval layer in ADCB ProCash?

The additional approval layer in ADCB ProCash allows you to add an additional layer of security to transactions received via host-to-host. This can help to protect your business from fraud.

How do I reset my ADCB ProCash password?

To reset your ADCB ProCash password, click on the “Forgot Password?” link on the login page. You will be prompted to enter your user ID and email address. Once you have entered your details, click the “Submit” button to receive a password reset email.

Final Thoughts

In today’s fast-paced world, ADCB ProCash serves as an efficient, secure, and convenient tool for all your business financial needs. So, if you’re considering an upgrade to your business banking solutions, ADCB ProCash is a reliable option that deserves your attention.

Say goodbye to manual labor and hello to streamlined business finance management. Register today and take your business to the next level.