Are you looking for a safe and simple way to protect your hard-earned money while earning some profit along the way? If so, a Savings Account in the UAE could be your perfect financial tool. In this guide, we’ll explore a Savings Account, its benefits, why you should consider opening one, and the best banks to open one.

What is a Savings Account in UAE?

A Savings Account is a bank account designed to help you securely save money while earning interest on your deposits. Different banks in the UAE offer varying interest rates, so shopping around for the best deal is important. Most Savings Accounts have added perks like a free debit card and cheque book. Here are some key points to know:

- Savings Accounts are a safe way to store your money.

- Interest rates can vary from bank to bank.

- Some banks offer additional benefits like free debit cards.

Why Should You Get a Savings Account?

Now, let’s delve into why you should consider getting a Savings Account in the UAE:

- Safety and security: A Savings Account provides a haven for your money, protecting it from theft or loss. The bank insures your funds, ensuring you won’t lose them.

- Earn interest: While the interest rates offered by Savings Accounts may not make you wealthy overnight, they provide a steady source of passive income. Over time, your money can grow significantly.

- Emergency fund: Life is unpredictable, and unexpected expenses can sometimes arise. A Savings Account ensures you have readily accessible emergency funds, safeguarding you from financial hardships.

- Disciplined saving: A Savings Account encourages you to save regularly. Unlike cash in hand, which can be easily spent, money in a Savings Account is less accessible, helping you stick to your savings goals.

- Prize draws: Some Savings Accounts in Dubai offer the exciting opportunity to win monthly cash prizes. This can add fun to your savings journey and potentially make it a rewarding experience.

Best Banks to Open a Savings Account

First Abu Dhabi Bank (FAB) Saving Account

iSave Account

Features:

- Earn 5.25% interest yearly on new deposits from 01 May 2023 to 31 March 2024.

- Open instantly via the FAB Mobile app or Online Banking.

- No minimum balance is needed.

- Unlimited withdrawals.

Eligibility

- For individual customers only.

- Must be a UAE resident with a valid Emirates ID.

Documents Needed:

- Account opening form.

- Valid passport, resident visa, and Emirates ID.

- Proof of income.

Elite Savings Account

Features

- Multi-currency with no minimum balance.

- Competitive interest rates.

- Tiered interest for AED accounts.

Eligibility

- Must have either 500,000 AED in Total Relationship Balance, 2,500,000 AED in Mortgage, or 50,000 AED Salary Transfer.

Documents Needed:

- Same as iSave Account.

Personal Call Account

Features

- Earn interest and access funds anytime.

- Available in AED and major currencies.

Eligibility:

- Open to both UAE residents and non-residents.

- Suitable for salaried and non-salaried individuals.

Documents Needed:

- Same as iSave Account.

Personal Savings Account

Features

- Available in Dirham and major currencies.

- Earn interest (based on current rates).

- Minimum monthly balance of AED 3,000 or equivalent.

- Free FAB Mastercard debit card.

- Complimentary airport lounge access.

Eligibility

- Must be 18 years or older.

- Open to UAE nationals, GCC nationals, resident expatriates, and non-residents.

- Suitable for salaried, self-employed, and non-salaried.

Documents Needed

- Same as iSave Account.

How to Apply for a Savings Account at FAB?

- Choose the Type of Savings Account:

- Visit the ADCB website and explore the different types of savings accounts available.

- Gather Required Documents:

- Typically, you would need your Emirates ID, passport, visa (for expatriates), and proof of income.

- Visit a Branch or Apply Online:

- Depending on the bank’s process, you may be able to start your application online and choose your desired type of savings account by clicking “Learn more, then look for the “Apply Now” section, or you might need to visit a branch. Check if ADCB offers an online application process for the specific savings account you’re interested in.

- Complete the Application Form:

- Fill out the application form with all the required personal and financial details. This can usually be done online or at a branch with the assistance of a bank representative. For online applications, you can find the application form at the bottom of each page.

- Submit the Required Documents:

- Provide copies of all the necessary documents along with your application form.

- Wait for Approval:

- After submitting your application, the bank will review it and conduct any necessary background checks. This process may take a few days.

Abu Dhabi Commercial Bank Saving Account

Saving Account at Abu Dhabi Commercial Bank

ADCB Savings Account

Designed for regular savings with an interest rate of 0.10% p.a.

Call Accounts

Interest will not accrue on Call Accounts if the amount is less than AED 15 for accounts in AED or the equivalent of USD 5 for accounts in other currencies.

Savings Account Features and Benefits:

- Open to UAE residents and non-residents.

- Options to hold in AED or USD currencies.

- Earns interest: 0.10% per annum for both AED and USD accounts.

- Interest calculation: Based on the monthly minimum balance, paid every six months.

- Free electronic statements within the statement cycle.

- The debit card option is available for AED Savings accounts only

Call Account Features and Benefits:

- Available to both UAE residents and non-residents.

- It can be held in AED, USD, and other major currencies.

- Interest is calculated daily and paid monthly.

- Provides free electronic statements within the statement cycle.

Eligibility

- Minimum Salary: AED 5,000 per month.

- Residency: Primarily for residents employed in the UAE.

Documents Required

For UAE Residents:

- Your original passport with a UAE residence visa (make sure it’s valid for at least 30 days).

- Your original Emirates ID.

- A salary certificate.

For Non-Residents (excluding Aspire Segment customers):

- Your original passport.

- A copy of your visit visa and entry stamp page or e-gate card.

- Bank statement: A three-month stamped statement from your current bank.

- A recommendation letter from an existing ADCB customer (they should have been with the bank for over a year).

How to Apply for a Savings Account at Abu Dhabi Commercial Bank?

Step 1: You have several options to start your application:

- Online Form: Fill out a basic information form on the ADCB website.

- Contact Centre: Call their 24-hour contact centre at 600 50 2030.

- SMS Application: Send ‘CASA’ to 2626 from your registered mobile number.

- Branch Visit: Visit any ADCB branch. You can find the closest branch on their website.

- Chat: Use the chat option on the ADCB website for assistance.

Step 2: Complete the Application

- If applying online, fill in the form with your name, mobile number, email address, and nationality.

- If applying via other methods, follow the instructions provided by the ADCB representative.

Step 3: Await Confirmation

After submitting your application, wait for a response from ADCB. They might contact you for further information or to confirm the opening of your account.

Emirates Islamic Bank Saving Account

Savings Accounts at Emirates Islamic Bank

- Kunooz Savings Account: Designed for maximising future savings potential.

- E-Savings Account: Offers up to 1.50% p.a. expected profit, exclusively online.

- Investment Savings Account: Suitable for individuals and organisations seeking profit-generating accounts.

- Super Savings Skywards Account: Save and earn Skywards Miles.

- Super Savings Etihad Guest Account: Save and accumulate Etihad Guest Miles.

- Emarati Family Savings Account: Tailored for families, offering separate accounts with shared benefits.

Features and Benefits of Emirates Islamic Savings Accounts

Kunooz Savings Account

Key Features:

- Weekly Cash Prize of AED 10,000.

- Monthly Prize of a Mercedes EQS.

- Quarterly Grand Cash Prize of AED 1 Million.

Benefits:

- Opportunity to win significant cash prizes and luxury cars.

- Free internationally recognized debit card.

E-Savings Account

Key Features:

- Up to 1.50% expected profit rate in AED & USD.

- Online banking convenience.

Benefits:

- No limit on the number of withdrawals.

- Profits are paid out quarterly.

- Shari’a compliant Wakala-based profit-bearing account.

Investment Savings Account

Key Features:

- Available in AED and USD.

- Based on the Islamic structure of Mudaraba.

Benefits:

- Free internationally recognized debit card.

- Profits are paid out quarterly.

Super Savings Skywards Account

Key Features:

- Earn up to 15,000 Skywards Miles per quarter.

- 2,000 bonus Skywards Miles on opening an Islamic banking saving account..

Benefits:

- No minimum balance requirement.

- Free Saving Account with various banking conveniences.

Super Savings Etihad Guest Account

Key Features:

- Earn up to 15,000 Etihad Guest Miles per quarter.

- 2,000 bonus Etihad Guest Miles on opening an Islamic banking saving account.

Benefits:

- Free internationally recognized debit card.

- No minimum balance requirement.

- Access to phone banking and SMS updates.

Emarati Family Savings Account

Key Features:

- Higher expected profit rates are based on pooled family balances.

- Separate individual savings accounts for each family member.

Benefits:

- 100% account privacy.

- 50% discount on processing fees for finances and vouchers up to AED 700 on cards.

- No minimum monthly balance or salary requirement for family members.

Eligibility Criteria

Kunooz Savings Account

Eligibility: Minimum balance of AED 3,000, open to individuals, joint accounts, and minors.

E-Savings Account

Eligibility: Self-opening through online banking, no minimum balance requirement.

Investment Savings Account

Eligibility: Minimum balance of AED 3,000, open to individuals. Open to individuals, joint accounts, minors, and businesses, including sole proprietorships, partnerships, Joint Stock, and Limited Liability companies.

Super Savings Skywards Account

Eligibility: Salary transfer of AED 5,000 or more or maintain a minimum quarterly average balance of AED 5,000.

Super Savings Etihad Guest Account

Eligibility: Salary transfer of AED 5,000 or more or maintain a minimum quarterly average balance of AED 5,000.

Emarati Family Savings Account

Eligibility: The Emarati Family Saving Account is exclusively available for individual UAE National customers. This account requires a minimum of two members and can accommodate up to a maximum of ten members, allowing for the benefits of combined earnings. The primary account holder must be at least 21 years old. While there are no age restrictions for secondary members, accounts held by minors must be overseen by their Legal Guardian. It is mandatory for all account members to be immediate family members, defined as a spouse, siblings, children, and parents, and they must have a first-degree relationship to be linked to the account.

Documents Required

Typically, banks require identification documents (like Emirates ID for residents), proof of address, and possibly income verification. For the Emirati Family Savings Account type, the documents needed are Khulasat-al-Qaid, Marriage certificate, EIDA of each member and Passport of each member.

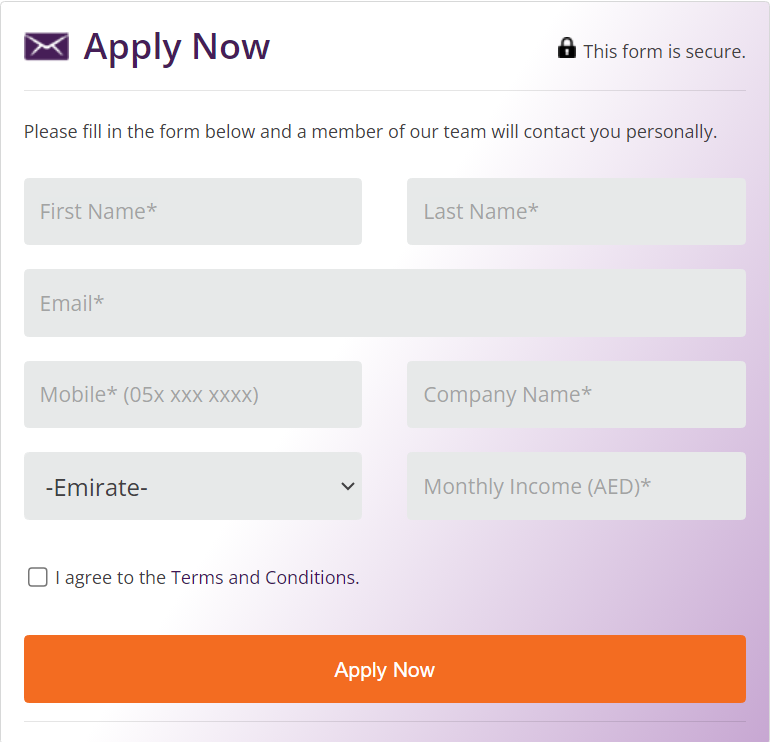

How to Apply for a Savings Account at Emirates Islamic?

- Visit the Kunooz Savings Account Page: Go to the Savings Account page on the Emirates Islamic website.

- Choose Savings Account Type: Choose your desired savings account type based on your need.

- Click Apply Now: You can start your application process online by clicking the “Apply Now” button on the webpage.

- Fill in the Application Form: You must complete the application form with your details. This will include selecting your Emirate (e.g., Abu Dhabi, Dubai, etc.), family name, first name, company name, email, mobile number, monthly salary and agreeing to the terms and conditions.

- Submit Your Application: After filling out the form, submit your application. A representative from the bank will contact you to proceed with the application process.

RAKBANK Savings Account

Types of Savings Accounts at RAKBANK

- Regular Savings Account: Standard savings account with the features mentioned above.

- RAKBANK Emirates Skywards Savings Account: A specialised account for earning Emirates Skywards miles.

- RAKbooster Account: An account offering potentially higher returns.

Features and Benefits of RAKBANK Savings Account

- Competitive Interest Rates: Offers an interest rate of 0.25% p.a.

- No Minimum Balance Requirement: For the first three months, there is no minimum balance requirement.

- Currency Options: Accounts can be held in various currencies, including USD, EUR, GBP, etc.

- Convenient Money Transfers: Facilitated through RAKMoneyTransfer.

- Next-Gen Digital Banking: Access to advanced digital banking services.

- Quick Account Setup: The account opening process is straightforward with RAKBANK App and can be completed in minutes.

- Debit Mastercard: Access to over 1 million ATM locations worldwide, secure chip & PIN technology, and transaction SMS alerts.

- Virtual Debit Card: Instant issuance for convenient online transactions.

- Cardless Cash Withdrawals: Enhanced convenience for cash access.

- Bill Payment Options: Easy and convenient bill payment facilities.

Eligibility

Age: 18 years old and above

Residency: UAE residents & non-residents

Documents Required

- Valid Passport & Visa

- Valid Emirates ID.

- Income proof

How to Apply for a Savings Account at RAKBANK?

- Use the ‘Call Me Back‘ feature on the RAKBANK website to request a callback from a bank representative. You can also apply through the bank’s mobile app and follow the instructions provided.

- Fill in your details like name, email address, mobile number, and salary in the provided form.

- A bank representative will get back to you shortly to assist you.

Conclusion

In conclusion, investing in a Savings Account in the UAE is a wise financial move. It’s not only about growing your wealth but also about ensuring financial security and discipline in saving. With the right account, you can enjoy peace of mind knowing your money is safe and working for you.