We all know how credit cards have become an essential part of our lives, so why not make the most out of them, right? Whether you’re a seasoned pro or a newbie in the cashback game, this blog is your go-to source for discovering the most rewarding credit cards available in the UAE.

With the financial world constantly evolving, credit card providers are always upping their game to offer exciting features and rewards that cater to our diverse needs. That’s where cashback credit cards come in. They make spending even more fun by giving you back a percentage of what you spend as cold, hard cash.

Whether you’re a jet-setter, a shopaholic, or just someone who loves a good deal, our top 10 cashback credit cards in the UAE cover a wide range of options to suit every taste. We get it; everyone’s got their own financial needs and preferences, which is why our list has something for everyone. Let’s dig in!

What is Cashback in a Credit Card?

A cashback credit card is a type of credit card that offers a cashback reward program to cardholders. With a cashback credit card, you earn a certain percentage of your purchases back as cash rewards. These rewards are typically credited to your credit card account or can be redeemed in various ways, such as statement credits, direct deposits, or even physical checks.

Understanding Cashback Rewards

Cashback in credit cards is essentially a way for credit card issuers to incentivise card usage and reward customers for their spending. Instead of earning points or miles that can be redeemed for specific goods or services, cashback rewards provide more flexibility as they can be used towards any expenses or even deposited directly into your bank account.

Variety of Cashback Rates and Categories

The cashback percentage varies depending on the credit card and the spending category. Some cards offer a flat-rate cashback on all purchases, while others provide higher cashback rates for specific categories such as dining, groceries, or travel. Additionally, cashback credit cards often have certain spending thresholds or caps, meaning that you may earn cashback up to a certain amount or within specific categories.

Maximising Savings and Flexibility

Cashback rewards can be a great way to offset your credit card expenses and save money. By using a cashback credit card for your everyday purchases, you can earn a percentage of your spending back, effectively reducing the overall cost of your transactions.

It’s important to note that cashback rewards are typically taxable, so you may need to report them as income on your tax return, depending on your jurisdiction.

Factors to Consider when Choosing a Cashback Credit Card

When choosing a cashback credit card, there are several important factors to consider. These factors will help you determine which card is the best fit for your spending habits and financial goals. Here are some key considerations:

- Cashback Rates: Look for a card that offers competitive cashback rates. Some cards provide a flat cashback rate on all purchases, while others offer higher rates for specific spending categories. Consider your typical spending patterns and choose a card that rewards you for the categories you spend the most in.

- Spending Categories: Check if the cashback credit card aligns with your spending habits. Some cards offer higher cashback rates for categories like dining, groceries, or travel. If you frequently spend in these categories, a card that prioritises them can help you maximise your cashback earnings.

- Annual Fees: Consider whether the card has an annual fee and whether the benefits and cashback rewards justify the cost. Some cards may have higher cashback rates but come with annual fees, while others may offer lower rates but have no annual fees. Do the math and determine if the rewards outweigh the cost.

- Redemption Options: Look into the redemption options for the cashback rewards. Some cards allow you to redeem cashback as statement credits, direct deposits to your bank account, or even physical checks. Choose a card with redemption options that are convenient and valuable to you.

- Caps and Limitations: Check if the card has any limitations or caps on cashback earnings. Some cards may have maximum cashback limits per year or spending thresholds to earn higher rates. Be aware of these limitations to ensure they don’t hinder your ability to earn rewards.

- Additional Perks: Consider any additional perks or benefits offered by the card. This could include things like travel insurance, purchase protection, airport lounge access, or concierge services. If these perks align with your lifestyle and provide value beyond cashback rewards, they can enhance your overall credit card experience.

- Interest Rates and Fees: While the focus is on cashback rewards, don’t overlook the interest rates and fees associated with the card. If you plan to carry a balance, high interest rates can negate the value of cashback rewards. Additionally, be aware of late payment fees and other charges that may impact your overall financial health.

- Credit Card Issuer: Consider the reputation and reliability of the credit card issuer. Opt for a well-established and trustworthy institution that provides good customer service and has a solid track record.

10 Best Cashback Credit Cards in UAE

FAB Cashback Credit Card

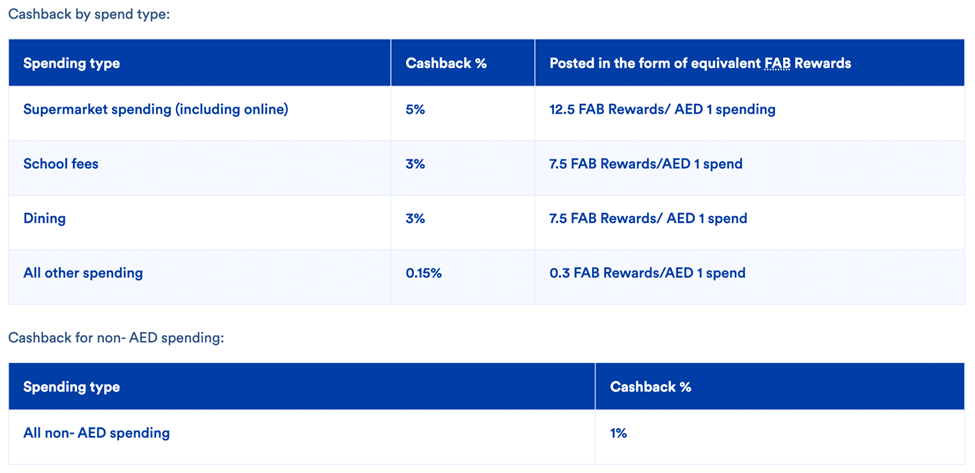

Meet the FAB Cashback Credit Card – your go-to for some serious cashback perks! Score a cool 5% cashback on your supermarket hauls (yes, even online shopping) and 3% cashback on school fees and dining. The best part? No need to stress about hitting a minimum spend!

Just keep in mind if you go for the minimum payment each month, you might end up shelling out more in interest and taking forever to clear that balance. The card requires a minimum monthly salary of AED 5,000, and there’s an annual fee of AED 315.

But hey, the benefits are worth it – top-tier cashback rates on your everyday spending! Your cashback is calculated monthly and can be snagged by the statement date whenever you feel like treating yourself.

Additional Benefits of FAB Cashback Credit Card

- Movie Tickets

- Up to two cinema tickets per month

- AED 15 each on weekdays, AED 20 each on weekends

- Valid at Reel Cinemas, Royal Cinema, and Oscar Cinema

- 20% discount on food and drinks

- Talabat Discounts

- Up to 20% off grocery or food orders twice a month

- Use Mastercard with promo code “MASTERCARD” on Talabat app

- Priceless Offers

- Special offers on dining, fitness, beauty, hotels, and attractions with Mastercard

- Credit Shield

- Outstanding balance paid off in case of inability to meet credit card payments

- Wallet Shield

- Covers fraudulent transactions on lost or stolen credit cards, cash, or identification papers

- Apply by texting “WS” to 2121

- Airport Lounge Access

- Free, unlimited access to over ten airport lounges in UAE, KSA, Jordan, Kuwait, and Egypt

- Hotel Bookings

- Up to 10% cashback on Booking.com with millions of properties worldwide

- IHG Hotels & Resorts

- 15% discount on hotel rooms across Europe, Maldives, India, Middle East, and Africa with Mastercard

- Careem Rides

- 20% off on up to three rides per month with promo code “MASTERCARD”

- Avis Car Rental

- 20% off on car rental

- Complimentary upgrade with every rental

- Reserve at MastercardMEA (avisworld.com) using eligible Mastercard

Note: To access the service, eligible cardholders need to call 04-8524856 and make a booking at least 2 working days in advance of their travel or desired drop-off/pick-up date. The service desk operates 6 days a week, from Monday to Saturday, between 9 am and 7 pm.

How to Apply for FAB Cashback Credit Card?

Apply using FAB mobile app

- Step 1. Download the App: Head to your app gallery, Google playstore, and App store and download the FAB Mobile App on your smartphone.

- Step 2. Create Your FAB Account: Open the app and follow the easy steps to create your FAB account. Enjoy the convenience of a seamless process with zero paperwork.

- Step 3. Emirates ID Verification: Complete the account setup using just your Emirates ID for verification. This streamlined process ensures a hassle-free application.

- Step 4. Explore FAB Rewards: Once your account is set up, explore the FAB Rewards section within the app. Discover various options using your earned rewards, including game time, shopping vouchers, and bill payments.

- Step 5. Apply for FAB Cashback Credit Card: Navigate to the credit card section on the app. Select the FAB Cashback Credit Card and proceed with the application.

- Step 6. Fill in the Required Details: Enter the necessary details as prompted, ensuring accuracy. Provide the required information for a smooth application process.

- Step 7. Review Cashback Benefits: Take a moment to review the exclusive cashback benefits offered by the FAB Cashback Credit Card. Understand the perks, including discounts on movie tickets, Talabat orders, and more.

- Step 8. Submit Your Application: Once all details are filled in, submit your credit card application through the app Enjoy the convenience of an instant application process with no need for physical paperwork. Monitor the status of your credit card application within the app.

- Step 9. Activate Your FAB Cashback Credit Card: Once approved, follow the instructions to activate your FAB Cashback Credit Card. Get ready to enjoy the incredible benefits, including cashback on everyday spending.

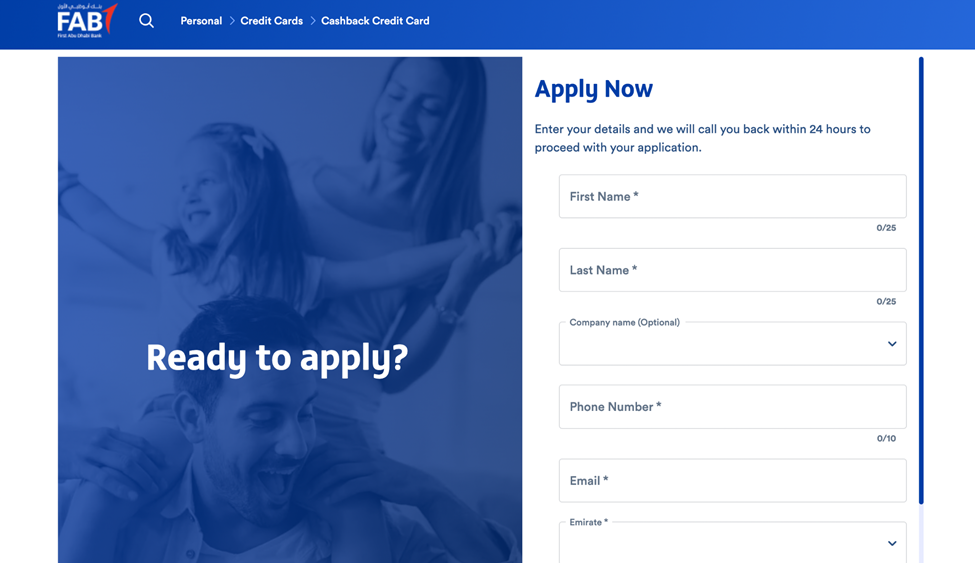

Apply for FAB cashback credit card using homepage

- Step 1. Visit this page: Scroll to the bottom as it leads you to the form as seen in the image above.

- Step 2.Enter your personal details in the provided fields.

- First Name

- Last Name

- Company Name (Optional)

- Phone Number

- Emirate

- Nationality

- Step 3. Provide Financial Information: Disclose your monthly salary to facilitate the application process.

- Step 4. Submit Your Application: Once all details are accurately filled in, submit your application.

- Step 5. Confirmation and Callback: Expect a confirmation message acknowledging your application. A representative will call you back within 24 hours to proceed with your application.

There you have it! Start using your FAB Cashback Credit Card for grocery shopping, dining, and more to take advantage of the fantastic cashback rates.

ADIB Cashback Visa Platinum Card

Discover the cool perks that come with the ADIB Cashback Visa Platinum Card – it’s not your average card! Score an instant 1% Cashback on whatever you’re splurging on, no matter where or when. Take note that the minimum monthly salary requirement is AED 10,000.

Need some extra cash? You can withdraw 100% of your finance limit hassle-free. Plus, enjoy a sweet grace period of up to 55 days to settle your balance – no stress!

But wait, there’s more! Share the love with four free supplementary cards for your fam, so everyone gets in on the Cashback action. Hit the road with confidence thanks to free roadside assistance, covering everything from tows and jump starts to fuel delivery – just call 600-542010 when you need a hand.

And that’s not all – your ADIB Cashback Visa Platinum Card isn’t just about finances; it’s your VIP pass to airport lounges worldwide through Veloce Lounge.

ADIB cashback credit card features

- ADIB Online Banking: Visit simple.adib.ae to view your Card statement and conduct transactions.

- 24×7 Chat Banking: Access your account securely through WhatsApp at +971600543216 anytime.

- E-statements: Choose an eco-friendly option and receive your statements via email.

- SMS Alerts: Stay informed with Card information and transaction alerts.

- Ways To Pay: Multiple convenient options are available for ADIB Covered Card payments.

Click here for a detailed list of payment options.

- ADIB Mobile Banking App: Bank on the go with the ADIB Mobile Banking App. Download from the iTunes App Store, Google Play Store, or the HUAWEI AppGallery.

Required documents for ADIB cashback credit card

- Original and copy of valid passport

- Original and copy of valid Emirates ID

- Bank account statement (last 3 months)

- Salary certificate from current employer (not more than 30 days old)

Fees and Charges for ADIB cashback credit card

- Covered Card Annual Fee 1000

- 5th Supplementary Card Annual Fee 1000

- Monthly Profit Rate (W/ Salary Transfer) 2.99%

- Annualised Profit Rate (W/ Salary Transfer) 36.38%

- Monthly Profit Rate (W/O Salary Transfer) 3.09%

- Annualised Profit Rate (W/O Salary Transfer) 37.60%

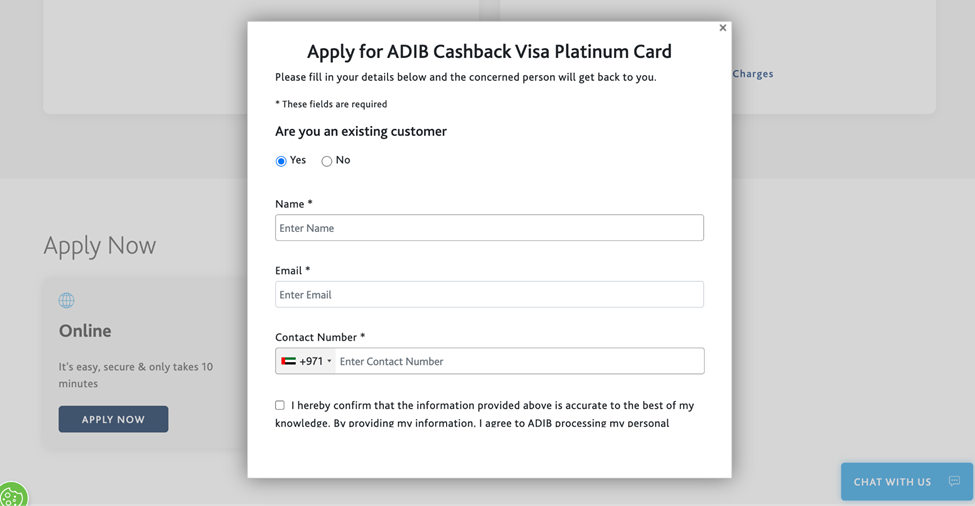

How to Apply for ADIB cashback credit card

Online Application:

- Step 1. Visit the Application Page: Go to the ADIB Cashback Visa Platinum Card application page.

- Step 2.Complete Personal Information:

- Fill in your name in the provided field.

- Provide a valid email address.

- Enter your contact number, including the country code.

- Step 3. Existing Customer Check: Indicate whether you are an existing ADIB customer by selecting “Yes” or “No.”

- Step 4. Confirmation of Information: Confirm the accuracy of the provided information.

- Step 5. Agree to Terms and Privacy Policy: Confirm that the information is accurate to the best of your knowledge. Agree to ADIB processing your personal information per the privacy policy on ADIB.ae.

- Step 6. Confirm that you are 18 years or older to receive marketing materials.

- Step 7. Submit Application: Click on the “Submit” or “Apply Now” button to send your application.

- Step 8. Wait for Contact: Wait for the concerned person to reply. Expect a response regarding the status of your application.

Emirates Islamic Cashback Plus Credit Card

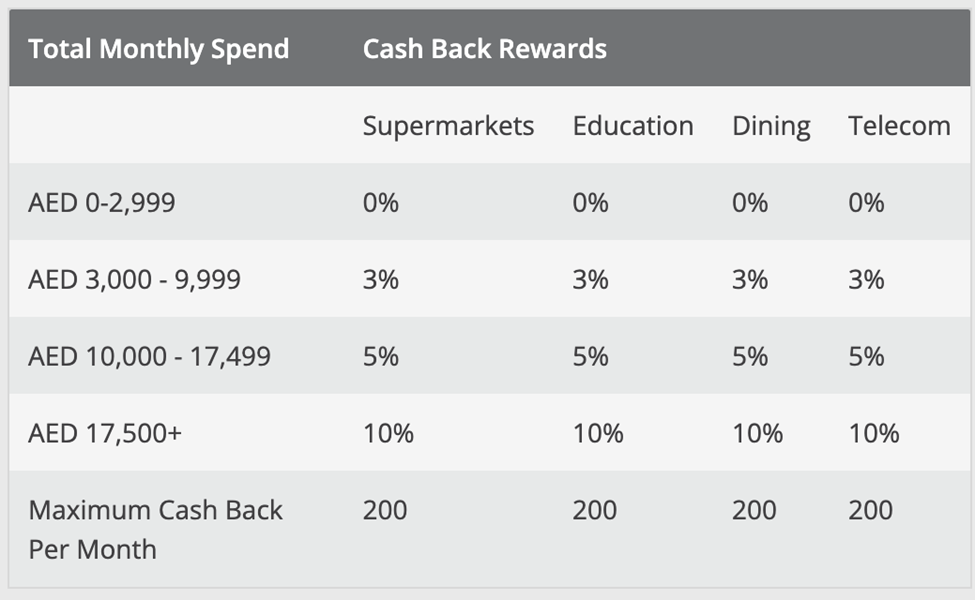

Say hello to the Emirates Islamic Cashback Plus Credit Card – your passport to cool perks without any Annual Membership Fee*. Imagine getting up to 10% cash back on your everyday essentials like groceries, education, dining, and even telecom expenses. It’s like saving while you spend on the things that matter!

But hold up, there’s more to this card than just cashback. Picture this: unlimited access to over 1000+ airport lounges worldwide – that’s right, no more waiting around at the airport. Plus, score two rounds of free golf every month because why not? And just to make life a bit easier, enjoy one free valet parking service per month.

Whether you’re shopping, learning, dining, or just staying connected, this card’s got you covered with some serious savings.

Additional benefits of Emirates Islamic cashback plus credit card

- RTA Benefits: Auto top-up facility on Salik for hassle-free travel through online or mobile banking channels gets updated after 48 hours.

- Complimentary Reel Cinemas Movie Tickets: Enjoy up to 2 “Buy 1 Get 1” complimentary movie tickets monthly with a minimum retail spend of AED 3,000.

- Complimentary Airport Lounge Access: Unlimited access to over 1000 airport lounges worldwide for you and supplementary cardholders.

- Complimentary Golf: Two rounds of complimentary golf per month at select golf clubs with a minimum monthly spend of AED 5,000.

- 20% Off on Emaar Entertainment Attractions: Enjoy a 20% discount on various Emaar Entertainment attractions.

- Extended Warranty: Double the original manufacturer’s warranty automatically up to one year.

- Meet & Greet Bronze Service: Up to 2 complimentary Marhaba Meet & Greet services yearly with a minimum monthly spend of AED 3,000.

- Purchase Protection: Additional peace of mind with protection against theft or damage for your purchases.

- Cash on Call Facility: Avail Cash on Call facility of up to 80% of your available credit limit.

- Luxury Hotel Collection: Enjoy exclusive privileges at over 900 prestigious hotels worldwide.

- Multi-trip travel Insurance: Automatic coverage for travel accidents and travel inconvenience insurance on trips up to 90 days.

- Easy Payment Plan: Shop with ease using the 0% Easy Payment Plan with partner outlets for various tenures.

- No Annual Membership Fee for Cashback Plus: Avail Cashback Plus with no Annual Membership Fee until 31 December 2023.

- Complimentary Valet Parking: Enjoy 1 complimentary valet parking service monthly at select locations in the UAE.

- Complimentary Access to Dubai Ladies Club & Sharjah Ladies Club: Avail complimentary access to these clubs with a minimum monthly spend of AED 3,000.

How to earn cashback on Emirates Islamic cashback plus credit card?

Click here to calculate how much cashback you can earn with the Emirates Islamic Cashback Plus Card.

Things to Remember:

- Daily profit calculation at a rate of 3.49% per month for cash withdrawals or partial payments.

- Late payment incurs an AED 225 charge (Obligated Amount to Charity).

- Cash withdrawal incurs a fee of 3% of the amount or AED 99 (whichever is higher) in addition to the billed Profit amount.

- AED 249 will be charged if the credit card balance exceeds the set credit limit.

- Up to 2.34% fee for transactions in currencies other than UAE Dirham.

- Mastercard or Visa determines the exchange rate within a range of wholesale market rates.

- Enrolled for complimentary Card Takaful cover at a premium of 0.99% per month for the outstanding amount (first two statements only).

- Non-payment may block credit cards, affecting credit rating and future finance eligibility.

- All fees exclude 5% Value Added Tax (VAT), where applicable.

How to apply for Emirates Islamic cashback plus credit card:

- Step 1. Access the Form: Visit the registration form here.

- Step 2. Complete Personal Information: Fill in your first name, last name, mobile number, and email address in the respective fields.

- Step 3. Location Information: If you are based in Abu Dhabi, provide the necessary details, such as your company name and monthly income in AED.

- Step 4. Agree to Terms and Conditions: Review the Terms and Conditions provided. Tick the checkbox to confirm your agreement.

- Step 5. Submit the Form: Once all required fields are completed and the Terms and Conditions are agreed upon, submit the form.

- Step 6. Confirmation: Receive a confirmation message indicating that your interest has been registered successfully.

- Step 7. Wait for Contact: Expect a team member to contact you personally to discuss further details.

Mashreq Cashback Credit Card

Mashreq Cashback Credit Card, is a game-changer in the world of credit rewards. This card offers unlimited cashback of up to 5% on every spend, making it a valuable companion for your transactions. Your monthly income should be a minimum of AED 5,000.

The best part is that it comes with a “Free for Life” feature, ensuring no annual fees to worry about. As a welcome gesture, new cardholders can enjoy a generous AED 1,000 Welcome Bonus when they spend AED 9,500 or more within the first 2 months after card issuance. For existing customers, an AED 100 Welcome Bonus is offered on spending AED 5,000 or more during the same period. Your retail interest rate is 46.20% per annum, which will appear on your monthly statement.

Dive into a world of rewarding categories with 5% cashback on international and local dining spending, 2% cashback on other international transactions, and up to 1% on local spending. The card also introduces a bonus shopping feature, enhancing your overall cashback experience.

Additionally, earn 0.33% cashback on specific categories like government payments, utilities, education, charity, fuel, rental, and telecom spends. It’s important to note that cashback is not applicable on bill payments made via Mashreq Online and Mashreq Mobile.

Take note that certain transactions are not eligible for cashback, including balance transfers, local cash advances, credit card cheques, finance charges, fees imposed by the bank, transactions reversed by merchants, and utility bill payments made through the bank’s payment channels such as the call centre, online banking, ATM, mobile banking, branches, or any other designated bank channel.

Additional benefits of Mashreq cashback credit card:

- Enjoy 20% cashback for the first 6 months at popular platforms like Zomato, Netflix, and more.

- Maximum cashback is capped at AED 50 per merchant per month. (Terms and Conditions apply)

- Avail exclusive cashback card benefits tailored for Emirati families.

- Join the DragonFly & Dine Programme for dining discounts. Download the Dine & Fly mobile app, register, and start enjoying exclusive benefits.

- Unlock Visa Mena Offers powered by Entertainer, featuring 2-1 deals on food, entertainment, and shopping. Access 5,000 travel discounts through the Visa Offers MENA app, available on Google and iOS App Store.

- Annual fees are waived for both the Primary and Supplementary Cards.

- Enjoy an interest-free period with a competitive rate of 3.85% per month.

- Maintain financial flexibility with a minimum monthly payment requirement set at 5% of your monthly statement balance.

- Safeguard your financial well-being with Pay Protect Insurance, covering 0.99% of your monthly statement balance, plus 5% VAT.

Eligibility for Mashreq cashback credit card

- Monthly income of AED 5,000.

- The program is open to cardholders whose cards are not blocked and are in good standing.

- Cashback earned by supplementary cardholders will be credited to the primary cardholder’s account.

- Participation in the program is automatic for all eligible cardholders.

How to Apply for Mashreq cashback credit card?

- Step 1. Initiate Authentication: Begin the application process by selecting the “Authenticate” option, which can be found on this application page.

- Step 2. Authenticate via SMS: Enter your mobile number, including the country code. Provide your email address. A 6-digit code will be sent to the provided mobile number via SMS, and you have to enter an Authentication Code.

- Step 3. Personal Details: Provide your personal details, including your full name, date of birth, and any other required information.

- Step 4. Employment Details: Enter relevant employment details such as your occupation, employer information, and income details.

- Step 5. Address Details: Fill in your current address details, including your residential address and any additional required information.

- Step 6. Confirmation: Review the information provided for accuracy and completeness. Confirm your consent to proceed with the application process.

- Step 7. Application Completion: Complete the application process, ensuring all steps are accurately filled.

Simply Life Cashback Credit Card

The Simply Life Credit Card offers a range of day-to-day benefits to enhance your lifestyle. With a cashback feature starting from spends as low as AED 1000, cardholders can enjoy 1% cash back on all purchases. The cashback eligibility is simple – make monthly purchases of at least AED 1,000, with a maximum monthly cashback of AED 1,000.

The card is designed to be user-friendly, with no annual fees, making it a cost-effective choice. Cardholders making monthly purchases worth AED 1,500 or more receive two free movie tickets. The redemption process is hassle-free – simply purchase two tickets anywhere in the UAE for any show, and the cashback for the tickets (up to AED 70) will be credited.

It’s worth noting that movie tickets purchased at various outlets, including Cinema ticket counters, Cinema Kiosks, Cinema Websites, and Cinema Mobile Apps, qualify for movie cashback, excluding purchases at cinema food counters.

Additional Features/Benefits of Simply Life cashback credit card

- Complimentary access to Marhaba Lounges at Dubai International Airport Terminals 1 and 3 and the Terminal in DWC – Al Maktoum International Airport. Cardholders must present the Simplylife MasterCard and a flight boarding pass at the lounge entry.

- Enjoy free entry to the Diamond Lounge at the VIP terminal of Abu Dhabi International Airport. Presentation of the Simplylife MasterCard and a flight boarding pass are required for lounge access.

- Transfer your outstanding balance from another bank’s credit card to your Simplylife Credit Card.

- Benefit from remarkably low-interest rates.

- Split everyday purchase transactions into easy instalments of 6, 9, 12, 18, or 24 months at low interest rates.

- Obtain cash against your credit limit with a quick transfer to your account within 3 working days.

- Enjoy a low-interest rate and flexible repayment options over 6, 9, 12, 18, or 24 months.

- Enhance safety with the Card Control feature on the ADCB Mobile Banking App.

- Set daily or monthly spending limits. Temporarily block the card.

- Secure your credit card’s outstanding balance with an insurance plan against emergencies.

Documents required for Simply Life cashback credit card :

- Accomplished Application Form

- Passport copy (with residence visa for Expatriates and page 60 for UAE Nationals, both valid for 30 days at the time of approval of the card).

- Copy of the Labor Card or a Government-issued photo ID card to be self-attested by the customer.

- Emirates ID card or copy of EIDA application from.

- Current Salary certificate or latest pay slip.

- 3 months bank statement.

Fees of Simply Life cashback credit card:

- Finance charges

- (Retail purchase) 3.25% per month

- (Cash advance) 3.50% per month

- (Balance Transfer/Credit Card Loan/Installment Plans) Up to 2.25% per month

- Cash advance fee- 3.15% or AED 105 (whichever is higher)

- Over-limit fee- AED 288.75

- Late payment fee- AED 241.50 (if minimum payment due is not paid by Payment Due Date)

- Card replacement fee- AED 78.75

- Duplicate statement fee- AED 26.25

- Credit shield fee (Optional)- 1.0395% (Of outstanding at billing cycle)

HSBC Cashback Credit Card

Discover the HSBC Cashback Credit Card, designed to bring you cashback rewards throughout the year. This card lets you earn up to 5% cashback on your daily expenditures, including a variety of enticing lifestyle, dining, and travel rewards. To apply, a minimum monthly income of AED 10,000 is required.

Enjoy a fixed APR of 44.28% for both cash withdrawals and purchases, and for the first year, relish a fee waiver. Following the initial year, an annual fee of AED 313.95 (including VAT) applies. As a special offer, receive AED 400 cashback when you spend AED 5,000 within the initial 60 days.

With benefits such as cashback on spending, an annual fee waiver, up to 56 interest-free days on purchases, and a complimentary 12-month Careem Plus subscription, the HSBC Cashback Credit Card is tailored for those who appreciate the perks of intelligent spending. Apply now and unlock the advantages of this rewarding credit card.

Additional Benefits of HSBC cashback credit card:

- Earn up to 5% cashback on everyday spending.

- Earn 5% (up to AED 200) on fuel and 2% (up to AED 200) on groceries and education per statement cycle when you spend at least AED 3,000 a month.

- Earn 0.5% on all other spends and when you spend less than AED 3,000 a month.

- Access over 10,000 Buy 1 Get 1 Free offers on food deliveries, dining, spa days, and getaways.

- Get discounts at over 400 restaurants across the UAE when you pay with your credit card.

- Enjoy Buy 1 Get 1 Free movie tickets every month, plus 20% off food and drink at cinemas across the UAE.

- Access over 200 offers across dining, retail, and accommodation across MENA with the Timeout and Golf Access Programme.

- Enjoy up to 10% cashback when you book your next holiday on your credit card at Booking.com.

- Save at over 200 airport restaurants worldwide with DragonPass Dine & Travel.

- Get 12 complimentary visits for you and additional cardholders to over 1,000 lounges a year when you make at least 1 international purchase worth USD 1 with your HSBC Visa card 15 days before you travel.

- Get deals on shopping, travel, dining, and more worldwide with Home & Away.

- Complimentary cover of up to USD 500,000 for you and your family on all trips up to 90 days.

- Automatic extended warranty on purchases made in full with your card, doubling the original manufacturer’s warranty for up to 1 year.

- Visa Concierge takes care of the details, from restaurant bookings to travel plans and more.

- Covered for fraudulent transactions on your card up to USD 2,500 a claim and up to USD 4,000 a year.

Eligibility requirement for HSBC cashback credit card :

- No HSBC bank account required

- Minimum monthly income of AED 10,000

- Age between 21 and 65

- Residency in the UAE

Requirements:

- Proof of Identification

- Passport

- Emirates ID

- Residence visa (for non-GCC nationals)

- Proof of UAE Residency (Choose one)

- Tenancy agreement or EJARI

- Title deeds (for homeowners)

- Utility bill (not older than 2 months)

- Proof of Income:

- Last 2 bank statements from the account where your salary is deposited, or 2 salary credits into your HSBC account

- Salary certificate from your employer issued within the last month

If applying for an additional card, you will also need to provide passport and Emirates ID information for the additional cardholder. Upon approval, a security cheque equivalent to 120% of your credit facility will be required.

How to Apply for HSBC cashback credit card ?

- For New HSBC Customers:

- Check Eligibility Online: Visit the HSBC website and check your eligibility for the Cashback Credit Card. Complete the online eligibility check, and receive an approval in principle within 5 minutes.

- Application Approval: Once your application is approved, your Cashback Credit Card could be delivered to you within 24 hours.

- Apply Now: Proceed to the online application by clicking on the “Apply now” button.

- For Existing HSBC Customers:

- Request a Callback: If you’re already an HSBC customer, you can request a callback by clicking on the “Get a callback” option. Fill in the required details, and an HSBC representative will contact you during working hours (Monday to Friday, 09:00 to 16:30).

- Callback Confirmation: Await a callback from HSBC within the specified working hours. If you make a request outside these times, expect a response on the next working day.

- Contacting HSBC:

- Alternatively, you can call HSBC directly to initiate the application process.Call +9714 3216834, and the HSBC team will assist you in the application process.

- Lines Open 24/7: The HSBC helpline is available 24/7 for your convenience.

Calls may be recorded to enhance the service quality.

Note: The provided contact information is for both local and international callers.

Citi Bank Cashback Credit Card

The Citi Cash Back Credit Card is your key to enhanced spending and substantial savings. With a focus on cash back rewards, this card offers a tiered system to make your transactions more rewarding. Gain an impressive 3% cash back on non-AED spend, ensuring added value for your international transactions. Additionally, enjoy a 2% cash back on grocery and supermarket purchases, as well as a 1% cash back on all other expenditures, making every aspect of your spending journey more lucrative.

Beyond its cash back features, the Citi Cash Back Card brings convenience to your financial management with its Easy Installment Plan, allowing you to convert significant purchases into manageable payments. Furthermore, the card provides instant access to cash loans with just a click.

As part of Citi’s ongoing promotions, the card opens doors to local discounts and exclusive offers on dining, online shopping, and entertainment. This ensures that every transaction with your Citi Cash Back Card not only brings financial benefits but also adds to the joy of creating memorable moments with your loved ones.

Additional Benefits of Citi Bank cashback credit card :

- No Annual Fee: Enjoy the first year without any annual fee, and from the second year onward, the annual fee is waived if you reach a minimum spend of AED 9,000.

- Clear, Simple & Easy: No minimum spend requirement, no retail purchases excluded, and no caps, all within your monthly credit limit.

- Unlimited Global Airport Lounge Access: Benefit from unlimited access to over 1,100 airport lounges worldwide through the MasterCard Travel Pass app.

- Airport Transfers: Receive 2 complimentary airport rides per year, each valued at up to AED 110, using the code “MAUAE2” on the Careem app.

- In Good Company: Explore a world of exclusive benefits and offers with the Citi Cash Back Card. Access Mastercard’s premium privileges, spanning lifestyle, travel, and more, to elevate each experience

Eligibility and Requirements:

- Age: Must be 21 years old or above.

- Minimum Monthly Income: AED 8,000.

- Required Documents:

- Valid Emirates ID

- Passport

- Valid UAE Visa Copy

Important Information:

Both the Salary Account IBAN number and Passport number are essential during the application process.

How to Apply:

- Step 1. Visit Citibank UAE Website: Navigate to the Citibank UAE official website and locate the Citi Cash Back Card section. Click on “Apply Now” to initiate the application process.

- Step 2. Complete Application Form: Fill in the application form with accurate details, including your full name, contact information, and the required income details. Ensure all information provided is correct.

- Step 3. Document Upload (if necessary): If the application requires supporting documents, such as ID or income proof, upload them securely as per the provided guidelines.

- Step 4. Consent Declaration: Sign the consent declaration affirming that the information provided is accurate and complete.

- Step 5. Review Application: Carefully review the entire application to ensure accuracy and completeness. Correct any errors if identified.

- Step 6. Submit Application: Submit the application online. Your application will be processed, and you will receive confirmation of submission.

- Callback Request (Optional): Alternatively, if you prefer assistance, you can submit a callback request. A Citibank representative will contact you to provide guidance on the application process.

RAKBANK Titanium Credit Card

With up to 5% cashback at supermarkets, worldwide dining savings, and even up to 50% cashback at cinemas, the Titanium Card ensures a wealth of benefits. Enjoy a standard 2% cashback on all your spending globally, making it a permanent feature of this card. The cashback system offers maximum value, with tiered rates based on your monthly domestic and international spend.

The maximum monthly cashback cap is set at AED 1,500. Offering flexibility, you can request cashback anytime, credited directly to your account or deducted from the outstanding amount. The process is hassle-free – no paperwork is needed. However, keep in mind that the minimum redemption amount is AED 500, and the cashback excludes specific transactions like balance transfers, local cash advances, and utility bill payments made through the bank’s channels.

Your monthly statement reflects the cashback earned during the current period, maintaining the convenience and simplicity of the Titanium Credit Card’s rewarding system.

Additional Benefits:

- Up to 10% cash back on hotels with booking.com

- 15% off and more at IHG hotels

- 20% on car rental and upgrades on Avis

- 10 % off at Rentalcars.com

- Access to over 10 airport lounges worldwide

Eligibility:

- Minimum monthly salary of AED 8,000

Note: The Titanium Credit Card offers no annual fee and a monthly financing charge of 3.65%. For more detailed information about fees and charges, please consult the Service and Price Guide provided.

How to Apply:

- RAKBANK Mobile App- Download the RAKBANK App and apply instantly by following the prompts and inputting all the necessary information.

Scan this QR code to download from Google Play Store

Scan this QR code to download from Apple Store

CBD Super Saver Credit Card

CBD’s Super Saver credit card goes beyond the basics, offering some cool perks and financial flexibility. Need to switch your balance? No problem – transfer it to CBD and enjoy the lowest interest rate in town. Running low on cash? Use the cash-on-call feature and get up to 90% of your credit card limit in your account, payable in easy monthly chunks over 3 to 36 months. And for those big purchases, CBD’s got your back with an easy installment plan at a sweet 0% interest rate.

Say bye-bye to the annual fee in your first year – it’s on the house! If you’re already part of the CBD crew, the annual fee kicks in from year one, but don’t worry – it’s all laid out for you. Plus, your family gets free-for-life supplementary cards for anyone 15 and up.

Cashback, anyone? Earn up to 10% on everyday spending like bills, education, groceries, and transport. To sweeten the deal, there are lifestyle perks galore – free golf rounds, complimentary valet parking, and a cool 50% off cinema tickets. Entertainment? Sorted! Download the ENTERTAINER app and dive into 2-for-1 deals. Movie buff? Enjoy a 20% discount on F&B at Reel Cinemas.

And for those ‘just in case’ moments, there’s Credit Shield – protect yourself and your family by insuring your credit card outstanding balance. It’s a small 1% monthly fee, but the peace of mind is worth it.

Additional Benefits:

- Discounts at Emaar Attractions

- 20% off regular admission tickets at KidZania®, E-Kart Zabeel, Dubai Aquarium, and Underwater Zoo Penguin Cove and Nursery experience.

- 20% off The Storm Coaster at Dubai Hills Mall.

- 20% off Dubai Ice Rink general admission tickets.

- 20% off at Zabeel Sports District (excluding badminton games).

- Bonus credits at Play DXB when purchasing credits with CBD Credit Card.

- Visa Benefits:

- Airport Lounge Access:

- 8 complimentary visits per calendar year at over 1,000 Airport Lounges worldwide via Lounge Key for Primary and Supplementary cardholders.

- 1st visit is complimentary; subsequent visits require a minimum international spend of USD 1 using the CBD Super Saver Credit Card.

- Exceeding the maximum complimentary visits incurs a USD 32 charge.

- Multi-trip Travel Insurance:

- Applicable to the cardholder and family for up to 90 days from the date of travel, with coverage up to USD 500,000.

- Purchase Protection:

- Doubles the repair period offered by the original manufacturer’s warranty, up to 1 year.

- Extended Warranty:

- Protects against theft or accidental damage

- Convenience:

- CBD Helpline (600-575556) available from 09:00 AM to 05:00 PM.

- Security:

- CBD credit cards feature Chip & Pin for secure transactions, ensuring safe purchases, bill payments, and cash withdrawals.

Required Documents

- If you’re a salaried individual, please submit:

- National ID or valid passport, residence visa and Emirates ID.

- Salary Certificate.

- If you’re self-employed:

- National ID or valid passport, residence visa and Emirates ID.

- Valid trade licence.

Eligibility Criteria

- UAE Nationals: Must be between 21 and 65 years old at the card’s expiry date.

- UAE Residents: Must be between 21 and 63 years old at the card’s issuance date.

- Salaried Individuals: Must be confirmed employees with a minimum salary of AED 5,000.

How to Apply

- Step1. Download CBD App:

- Visit your device’s app store (Google Play for Android or the App Store for iOS).

- Search for “CBD App” and download the official app provided by Commercial Bank of Dubai.

- Step 2. Install and Open:

- Once the app is downloaded, install it on your device.

- Open the CBD App by tapping on its icon.

- Step 3. Application Initiation:

- Look for the “Apply Now” or similar option within the app’s interface.

- Click on the relevant link to initiate the credit card application process.

- Step 4. Provide Information:

- Fill in the required details accurately as prompted by the application form.

- This typically includes personal information, contact details, and any other necessary details as per the application requirements.

- Step 5. Upload Documents:

- If prompted, upload any necessary documents directly through the app.

- Ensure that the documents provided are clear and meet the specified requirements.

- Step 6. Submit Application:

- Review the information entered to ensure accuracy.

- Once satisfied, submit the application through the app.

- Step 7. Confirmation:

- Await confirmation of your application status.

- You may receive updates through the app, email, or SMS regarding the progress of your application.

- Step 8. Application Status Check:

- Monitor your application status within the CBD App.

- You may receive further instructions or notifications through the app.

Abu Dhabi Commercial Bank ADCB 365 Cashback Credit Card

Here’s the lowdown on how to score those awesome cashback perks with the ADCB 365 Cashback Credit Card. Just toss in a minimum of AED 5,000 each month, and you’re good to go – but keep in mind, they cap it at AED 1,000. If you splash out AED 5,000 in the first 45 days, you pocket a welcome bonus of AED 365. This cool bonus transforms into cashback magic within 90 days of getting your paws on the card, as long as you hit that spending target.

Now, rolling into year two, there’s a little thing to note – an annual fee of AED 383.25 (including VAT) shows up for the primary credit card. But here’s where it gets exciting – movies and snacks! Flash your ADCB 365 Cashback Credit Card at VOX Cinemas for some epic extras. Immerse yourself in the latest movies, from IMAX to the classic Standard, and grab a rad buy-one-get-one-free deal.

And for a blockbuster snack upgrade, whip out your ADCB card – the one that snags you a Buy 1 Get 1 free movie ticket – and indulge in a supersized combo of popcorn and a soft drink at VOX Cinemas‘ candy bar. Beyond the cinema buzz, this card lets you globe-trot and save. Save up to 12% on over 985,000 hotels and vacation spots worldwide with Agoda.

Additional Benefits:

- Mobile and Digital Wallets: Smooth and tailored payment options designed to fit your lifestyle.

- Credit Shield: Get complimentary life cover for an extra layer of security.

- Card Control: Take the reins and have complete control over all your card transactions.

- School Fee Payments: Convert those school fees into a stress-free 0% Interest Payment Plan.

- FlexiPay: Conveniently settle balances with easy monthly payments.

- Balance Transfer: Shift outstanding balances from other bank credit cards with a breeze.

- Credit Card Loan: Enjoy a zero-interest rate and repay effortlessly with instalments spread over up to 12 months.

- Instalments Payment Plans: Explore more at offers.adcb.com or a detailed list of participating partners.

How to Apply?

- Apply Online

- Visit the online application portal here.

- Fill in the required personal details.

- Request Callback

- If you are an existing ADCB customer, select “Yes.” Otherwise, select “No.

- Enter your Customer ID and other necessary details. You can check the portal here.

- Contact Centre

- Call the 24-hour contact centre at 600 50 2030.

- Speak with a customer service representative to inquire about the ADCB Cashback Credit Card.

- Express your interest in applying for the card.

- Provide any required information as guided by the representative.

- Apply through SMS

- Open the messaging app on your mobile phone.

- Type ‘365’ as the message and send it to 2626

- Send the SMS to 2626 from your registered mobile number.

- Visit them personally

- If you prefer face-to-face assistance, locate the nearest ADCB branch.

- Inform the staff that you are interested in applying for the ADCB Cashback Credit Card.

- The ADCB staff will guide you through the application process.

FAQs

Is Cashback Worth it Credit Card?

Yes, cashback credit cards can be worth it for many individuals. These cards offer a percentage of your spending back to you, providing a direct monetary benefit. However, the value depends on your spending habits and the specific terms of the card. If you use the card responsibly and the rewards align with your lifestyle, a cashback credit card can be a valuable financial tool.

Can I use an international credit card in Dubai?

Many establishments in Dubai accept major international credit cards, including those issued in India. However, it’s always a good idea to inform your bank of your travel plans to ensure that your card will work seamlessly and to inquire about any potential foreign transaction fees.

What are the downsides of using a cashback card?

While cashback rewards offer flexibility, certain redemption options, such as reserving first-class flights and upscale hotels, may provide higher value compared to cash-back rewards. Another potential drawback is the presence of foreign transaction fees, which are more commonly associated with cash-back cards than travel rewards cards.

Is cashback more advantageous than interest?

For individuals who consistently settle their monthly balances and anticipate frequent credit card usage, a cashback credit card can be a suitable choice. However, if you typically maintain a balance, the accrued interest charges and fees might outweigh the savings gained from the cashback.