In an era where digital innovation is king, how we manage, spend, and receive money has significantly transformed. At the forefront of this financial revolution is Noqodi, a platform that simplifies digital payments for individuals and businesses. This blog post delves into how Noqodi is changing the game in digital payments, making financial transactions smoother, faster, and more secure.

Understanding Noqodi

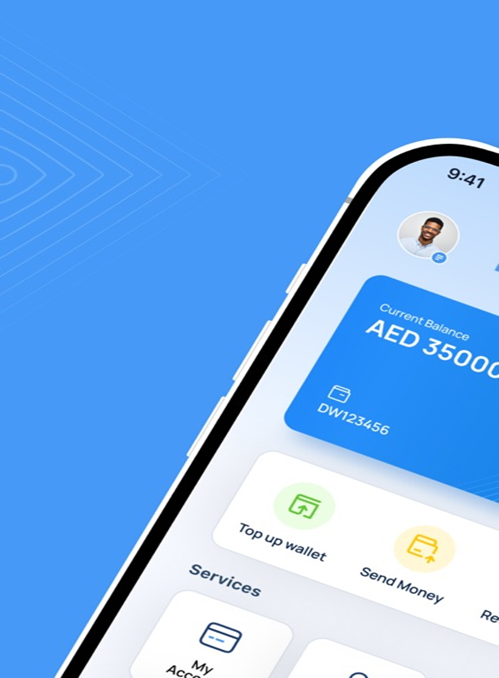

Noqodi is not just another digital payment platform; it’s a comprehensive ecosystem designed to cater to its users’ diverse financial needs. Whether you’re an individual looking to manage your personal finances or a business aiming to streamline your payment processes, Noqodi offers tailored solutions that make digital transactions effortless.

Features and Benefits of Noqodi

Personal Account

Filling up your wallet

Imagine your Noqodi wallet as a treasure chest you can fill up anytime. Here’s how you can do it without any hassle:

- Online banking: It’s like sending a letter directly from your bank to your Noqodi wallet. Just transfer the funds, and voila, they appear in your wallet!

- Partner banks: Visit your bank, use a Cash Deposit Machine (CDM), or just transfer from your bank account to add Money. It’s as easy as buying a coffee.

- Exchange houses and kiosks: Drop by any partner location, hand over the cash, and it will be added to your wallet, like coins in a piggy bank.

- Bank CDMs: Deposit cash directly at the cash deposit machines at partner banks. Think of it as feeding your wallet with Money.

Sending money

Social messaging & SMS: Whether you’re using WhatsApp, Facebook Messenger, or a simple text message, you can send Money to friends and family instantly. With just a few taps, your money will fly to them.

Receiving money

QR code or payment link: Generate a unique code or a link, share it through messages or email, and receive Money securely. It’s like having a secret door only your friends can open with the right key.

Payments

- Scan to pay: Use your Noqodi mobile app at partner merchants, scan, and pay.

- Simplify online payments: Save your card details securely in your Noqodi account for quick online payments. It’s like having a fast pass to the front of the line.

Keeping track

Powerful reporting: Get summaries or detailed reports of your transactions. It’s like having a diary of all your adventures, showing where you’ve spent and received Money.

Security

Their secure payment gateway fully complies with PCI-DSS standards, including regular compliance assessments to ensure the highest level of security. Additionally, they implement tokenisation as an extra layer of security to protect sensitive information.

Business Account

Making online payments a breeze for merchants

Think of your business as a bustling marketplace. Imagine making the checkout process as easy as pie for your customers. Here’s how Noqodi makes that happen:

Customisable checkout page: This isn’t just any page; it’s where your customers can easily pay you, choosing from various payment methods. It’s like having your cash register that accepts everything from magic beans to gold coins!

Xpress payments

Xpress Payments is designed for businesses that are always on the move and need to make payments quickly and securely. Here’s what it does:

One-click payments to registered Billers: Imagine having a magic button that instantly takes care of your bills. That’s what this is. You can pay for services with just one click, making managing bills as easy as flipping a switch.

- Instant payments for essential services: Need to pay for GDRFA Visa services (like tourist visa, residence visa and more), Land Department fees, Zajel, or other government services? It’s like sending a text message, and bam! Your payment is made. Quick, easy, and no fuss.

Your business account also enjoys all the magic tricks of the personal account. This means you get the best of both worlds, with features like topping up your wallet, sending and receiving money effortlessly, making secure transactions, and keeping an eye on your finances with powerful reporting tools.

By bringing these features into your business, managing your finances becomes less about the stress of handling Money and more about the joy of growing your business.

Getting Started with Noqodi

Starting your journey with Noqodi is easy and can simplify managing money for individuals or improve business payment processes. Here’s a friendly guide to get you going:

- Explore the website: Begin by visiting the Noqodi website. Take your time to browse and learn about the different services available.

- Sign up: Decide if you need personal or business services. Then, sign up to create your account. It’s a straightforward step to joining the Noqodi community.

- Customise your experience: Make Noqodi work by adjusting its features to fit your financial needs and preferences. This way, you get the most out of what Noqodi offers, tailored just for you.

Remember, Noqodi is here to help you with your financial management, whether you’re just starting or looking to streamline existing processes.

FAQs

Do you have questions about Noqodi’s services, including Profile Management, Top Up Wallet, Sending Money, Receiving Money, Withdrawing Funds, or using the Biller feature? Here are the compiled most frequently asked questions to help you easily navigate the platform. Whether you’re looking to manage your profile, transact, or get assistance with our billing services, find all the answers you need to make your experience seamless. For detailed information and support, you can send an email to [email protected].

Conclusion

Choosing Noqodi means embracing a future where financial transactions are no longer a chore but a seamless part of our digital lives. With its user-friendly interface, comprehensive solutions, and unwavering commitment to security and innovation, Noqodi is revolutionising digital payments. Join the revolution today and discover the simplicity and efficiency of managing your finances with Noqodi. Check out the best digital banks or top e-wallets in the UAE to help you learn more about safe and fast digital payment.