In today’s fast-paced world, where everything is going digital, the United Arab Emirates (UAE) is no exception. The Central Bank of the UAE is now actively promoting the transition to a cashless society. With the increasing prevalence of smartphones, digital wallets and mobile wallets have gained significant popularity in the UAE. These wallets offer a convenient way to make payments, whether it’s for shopping, bill payments, or sending money to friends and family. In this article, we’ll explore the top 10 E-Wallets in the UAE that are revolutionizing the way people handle their finances.

Payit E-Wallet UAE

Payit is an all-in-one eWallet that allows users to make various payments and transfers online without needing a bank account or paying registration fees. It offers services like sending money, international mobile top-ups, bill payments, and shopping, providing a convenient and cashless experience in the UAE.

Benefits and Features of Payit E-Wallet :

- All-in-One eWallet: Payit allows you to send money, top up internationally, pay bills, and shop online without a bank account or registration fees.

- No Minimum Balance: You can use Payit without worrying about maintaining a minimum balance.

- Diverse Payment Options: Pay for various services like education fees, bills (Du, Etisalat, NOL, Mawaqif, Salik), and even withdraw cash from ATMs.

- Split Bills Feature: Easily split bills with friends, making group payments hassle-free.

- Global Money Transfer: Send money securely to over 200 countries and territories.

- Domestic Help Payments: Employers can conveniently pay their domestic help with just a few clicks.

- Wallet-to-Wallet Transfers: Pay friends easily and keep track of your expenses.

- Request Payment: Request money through a simple QR code scan or contact selection.

- ADX Dividends: Receive dividends from the Abu Dhabi Securities Exchange directly on the Payit app.

Offers on Payit E-Wallet:

- DragonPass ‘Dine & Travel’ Airport Dining Program: Access to over 200 airport restaurant offers globally. Expires on 31 Dec 2025.

- Agoda: Save up to 12% at over 985,000+ hotels & vacation rentals worldwide. Expires on 31 Dec 2025.

- Visa Luxury Hotel Collection (VLHC) Offers: Benefits at over 900 properties. Expires on 31 Dec 2025.

- YQ Meet and Assist: Up to 30% off retail rates at over 450 destinations globally. Expires on 31 Dec 2025.

- Extended Warranty: Doubles the repair period offered by the original manufacturer’s warranty for up to 1 year. Expires on 31 Dec 2025.

- Buyers Protection: Complimentary insurance for theft, accidental damage, or non-delivery. Expires on 31 Dec 2025.

- The Entertainer: 2-for-1 offers with the ENTERTAINER mobile app. Expires on 31 Dec 2025.

- Avis: Up to 20% discount with Avis. Expires on 31 Dec 2025.

- Booking.com: Up to 10% cashback when you pay with Visa. Expires on 31 Dec 2025.

- Jumeirah Hotels: Up to 25% discount at Jumeirah Hotels & Resorts. Expires on 31 Dec 2025.

- Medical & Travel Assistance: Access to help for Letsgo Payit Cardholders. Expires on 31 Dec 2025.

- Global Custom Assistance Services (GCAS): Support and customer service for Platinum Cardholders. Expires on 31 Dec 2025.

- Jumeirah Hotels Food and Beverage Offers: Up to 20% off at participating restaurants. Expires on 31 Dec 2025.

- Wild Wadi Waterpark: Up to 25% discount for Letsgo Payit cardholders. Expires on 31 Dec 2025.

- Global and Local Merchant Offers: Exclusive offers across the world. Expires on 31 Dec 2025.

- JOI Gifts: 10% off on JOI Gifts with Payit. Expires on 31 Dec 2025.

- Saramart: 20% off on Saramart. Expires on 31 Dec 2025.

- Hummel: 10% off on Hummel. Expires on 31 Dec 2025.

- Namshi: Up to 20% off on Namshi. Expires on 31 Dec 2025.

- Fragrance: 10% off at Fragrance. Expires on 31 Dec 2025.

- Agent Provocateur: 15% off on Agent Provocateur. Expires on 31 Dec 2025.

- Swarovski: 5% off at Swarovski. Expires on 31 Dec 2025.

- Citruss TV: AED 50 off on Citruss TV. Expires on 31 Dec 2025.

- Basharacare: 5% off at Basharacare. Expires on 31 Dec 2025.

- Ounass: 10% off on Ounass. Expires on 31 Dec 2025.

- Sephora: Flat 5% off at Sephora. Expires on 31 Dec 2025.

- West Elm: 10% OFF at West Elm. Expires on 31 Dec 2025.

- Blends: Free Delivery on Blends. Expires on 31 Dec 2025.

- Tangara: 12% off on Tangara. Expires on 31 Dec 2025.

- Clarks: 20% OFF at Clarks. Expires on 31 Dec 2025.

- Noon: 10% OFF at Noon. Expires on 31 Dec 2025.

- DUBZ: 10% discount on Home check-in and Luggage Services. Expires on 31 Dec 2025.

- Tamanna: 15% OFF at Tamanna. Expires on 31 Dec 2025.

- Aldo Shoes: 15% OFF at Aldo Shoes. Expires on 31 Dec 2025.

- Nice One: AED 50 OFF at Nice One. Expires on 31 Dec 2025.

- Like Card: 1% OFF on Like Card. Expires on 31 Dec 2025.

- My Party Centre: 16% OFF at My Party Centre. Expires on 31 Dec 2025.

- Level Shoes: 10% OFF at Levelshoes. Expires on 31 Dec 2025.

- Ace: 10% OFF at Ace. Expires on 31 Dec 2025.

- Linzi: 15% OFF at Linzi. Expires on 31 Dec 2025.

- Nayomi: 15% OFF at Nayomi. Expires on 31 Dec 2025.

- Pan Emirates: 5% OFF at Pan Emirates. Expires on 31 Dec 2025.

- CURRENTBODY: 69% OFF at Currentbody. Expires on 31 Dec 2025.

- Fordeal: 15% OFF at Fordeal. Expires on 31 Dec 2025.

- My Protein: 10% OFF at My Protein. Expires on 31 Dec 2025.

- GAP: 10% OFF at Gap. Expires on 31 Dec 2025.

- Cocina Restaurant: 20% off on total food and beverage purchases. Expires on 31 Dec 2025.

- Joyalukkas: 10% discount at Joyalukkas. Expires on 1 May 2024.

- Jannah Hotels: 15% off the best available room rate at Jannah Hotels & Resorts. Expires on 31 Dec 2025.

- Umrah Packages for GCC Travelers with Saudia: Up to 40% off. Expires on 31 Dec 2025.

- Sun & Sands Sports: 25% off Sun & Sand Sports purchases. Expires on 27 March 2024.

- Under Armour: 25% off Under Armour purchases. Expires on 29 March 2024.

- Dropkick: 10% off Dropkick purchases. Expires on 27 March 2024.

- Travelwings: Flat AED 400 off holidays and AED 50 off flights. Expires on 30 June 2024.

- Rayna Tours: Exclusive Offers on UAE Tourist Visas. Expires on 31 Dec 2025.

- Rayna Tours: Up to 50% Discount on Local Activities and Attractions. Expires on 31 Dec 2025.

- Rove Hotels: 20% off at Rove Hotels. Expires on 31 Dec 2025.

- Musafir.com: Exclusive travel offers. Expires on 31 Dec 2025.

- Asia Opticals: 40% off all sunglasses and frames. Expires on 31 Dec 2025.

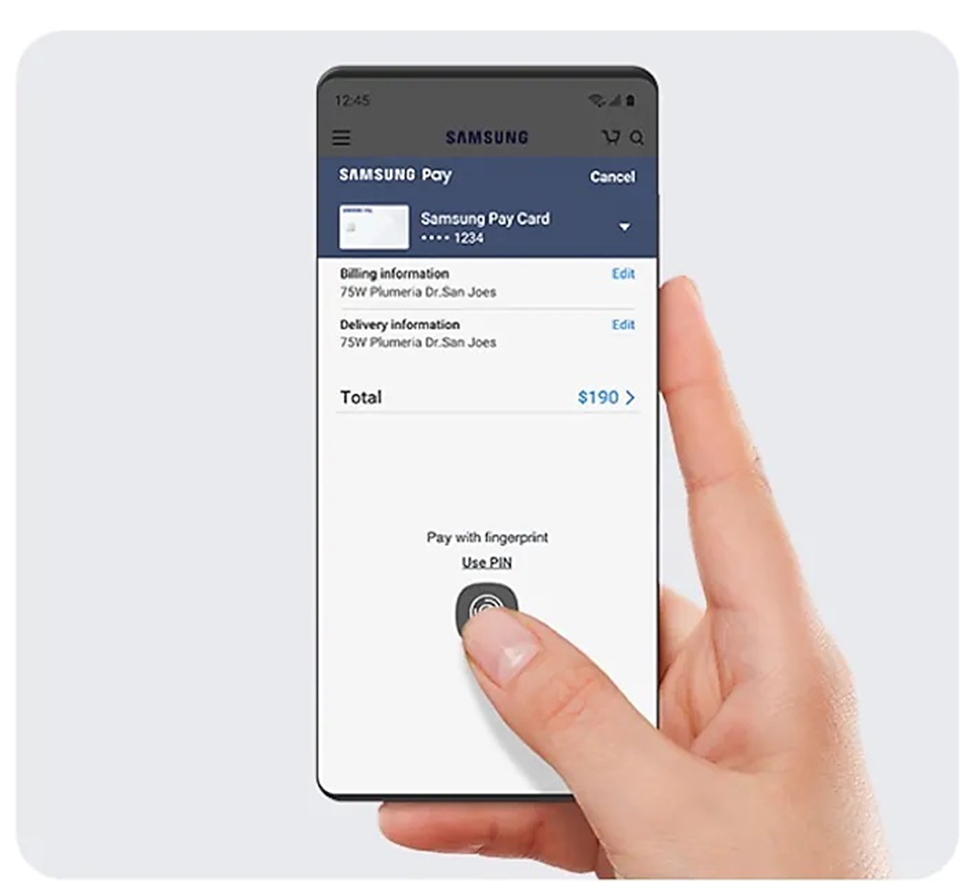

Samsung Pay E-Wallet

Samsung Pay is known for its convenience and versatility. Compatible with various Samsung devices, including smartphones and smartwatches.

Benefits and Features of Samsung Pay E-Wallet:

- Versatile Card Storage: Samsung Pay allows you to store credit, debit, gift, and membership cards on your devices. You can simply take a photo of your card or barcode to add it to your digital wallet.

- Wide Bank and Card Support: The service supports 1,000+ banks and credit unions, including Visa, Mastercard, and American Express cards issued by partner banks.

- Convenient Gift Card Management: You can buy, send, and receive gift cards directly from the app and store new and existing gift cards for easy access.

- Samsung Money by SoFi: When you set up and add money to your Samsung Money by SoFi account, you can enjoy a discount of up to 30% on everything at Samsung.com. Plus, you’ll get free shipping, free returns, and other benefits, helping you make the most of your money.

- Extensive Acceptance: Samsung Pay is accepted at millions of places, working in-store, in-app, and online. It’s compatible with many Samsung devices, making it a widely accepted mobile payment method.

- Fast and Secure Checkouts: You don’t need to enter your credit card number for in-app or online purchases. Authentication can be done via fingerprint, PIN, or iris scan.

- Transit Payments: Samsung Pay can be used for transit systems. It allows for tap-and-go payments, streamlining your commute.

- Cash Back Awards: Earn money back when shopping at favorite merchants through Cash Back Awards in Samsung Pay.

- Advanced Security: Each transaction is secured by your bank’s fraud protection and authenticated by your fingerprint, PIN, or iris scan. Samsung Knox and tokenization provide additional security layers.

- Data Security and Privacy: Samsung Pay uses tokenization for transactions, ensuring your real card number isn’t used from your phone. It also features Samsung Knox technology for constant monitoring and security.

Google Pay E-Wallet

Google Pay is a globally recognized E-Wallet that’s making waves in the UAE. Whether you have an Android or iOS device, you can use Google Pay.

Benefits and Features of Gpay:

- Autofill for Payment Details: Once you save your payment details in Google Pay, they will automatically appear at checkout on Android and Chrome, making your transactions quicker and more convenient.

- Tap to Pay: This feature lets you pay with your phone in stores. Just look for the symbols indicating in-store checkout compatibility and tap your phone to make a payment.

- Buy with Google: You can check out quickly wherever you see the ‘Buy with Google Pay’ button, streamlining your online shopping experience.

- Peer-to-Peer Payments: Google Pay lets you send money easily to anyone with a Google Account using just your phone. This makes transferring money to friends and family simple and fast.

- Built-in Authentication and Encryption: Google Pay offers robust security features, such as authentication, transaction encryption, and fraud protection.

- Control Over Your Transactions: You completely control your transactions, ensuring your money and personal information are safe.

Apple Pay E-Wallet

Image Source

Apple Pay is a convenient and secure payment method that allows you to make purchases using your Apple devices like the iPhone, Apple Watch, Mac, and iPad,. It’s designed to be faster and easier than traditional payment methods, offering a private way to pay without sharing your card details with merchants.

Benefits and Features of Apple Pay E-Wallet:

- Ease of Setup and Use: Apple Pay can be set up in seconds on your iPhone, and you can add your credit or debit card to the Wallet app. This setup allows you to use Apple Pay across your Apple devices efficiently.

- Apple Pay Later: This feature enables you to split your purchase into four equal payments over six weeks without interest, fees, or impact on your credit score. It offers flexibility and convenience for managing finances.

- Apple Cash Integration: Apple Cash works within Apple Pay, allowing you to send and receive money easily. It’s a digital card in your Wallet, usable for various transactions.

- Online and In-App Purchases: You can use Apple Pay for online purchases in Safari and in-app transactions, streamlining the checkout process.

- Enhanced Security: Apple Pay uses a device-specific number and unique transaction code for each purchase, ensuring that your card number is never stored on your device or Apple servers. It also doesn’t share your card numbers with merchants.

- Privacy Protection: Apple Pay doesn’t keep transaction information that can be tied back to you, ensuring your purchases remain private.

- Hygienic and Contactless: It supports contactless payments, reducing the need to touch buttons or terminals and handle cash.

- Apple Pay Security: It’s considered safer than using physical cards. Face ID, Touch ID, or a passcode is required for purchases, adding an extra layer of security.

- Global Use: Apple Pay works in countries and regions supporting contactless payments, though Apple Pay Later is available only in the United States.

- Business Integration: Businesses can easily accept Apple Pay by contacting their provider. There’s also support for developers to integrate Apple Pay into websites and apps.

- Difference Between Apple Cash and Apple Pay: Apple Cash is a digital card in Wallet for sending and receiving money, while Apple Pay enables secure, contactless purchases using various cards added to Wallet, which is only available in the US.

Etisalat E-Wallet

Etisalat now offers a user-friendly and secure service that makes your life easier. With just one easy-to-use app, you can shop, pay utility bills, top up your accounts, and do much more. It’s quick, safe, and convenient. Say goodbye to carrying cash – your phone is all you need, acting as your wallet.

Benefits and Features of Etisalat Wallet:

- Convenience: With Etisalat Wallet, your phone becomes your wallet. This means you can conduct financial transactions anytime and anywhere, right from your smartphone. Obtain the Etisalat Wallet app by downloading it from both the Apple App Store and the Google Play Store.

- Versatility: The wallet allows for various transactions, including:

- Airtime top-ups

- Purchasing goods

- Paying bills

- Paying parking services

- International credit transfers to over 100 countries.

- Getting notified when new bills arrive

- Alert when the prepaid balance is low.

- View your Etisalat Rewards balance.

- Redeem your loyalty points.

- Security: Etisalat Wallet is designed with high security in mind, ensuring your financial transactions are safe. The security is ensured through a PIN, which can be either 4 o 6 digits, and it is further protected by a one-time password (OTP) provided by your bank.

- Ease of Use: The application is user-friendly, making it accessible even for beginners who are not tech-savvy.

Careem PAY

Careem Pay is a secure and versatile payment platform that allows users to top-up their wallet, pay bills, send money locally and internationally, and make everyday payments easily through the Careem app.

Benefits and Features of Careem Pay:

- Wallet Top-Up and Withdrawal: Users can top-up or receive cash into their wallet and withdraw it to their bank account anytime.

- Safety and Security: Careem PAY is designed to protect users’ cards and money, with approval from the UAE central bank.

- Pay Anyone, Any way: The service allows users to pay using saved cards or wallet balances for transactions on the app or at shops accepting Careem PAY.

- International Money Transfer: Users can send money between the UAE and Pakistan, with recipients receiving it in just 15 minutes.

- Efficient Bill Payments: Careem PAY enables users to pay various bills (phone, gas, Salik top-ups) quickly and set up recurring payments.

- Send and Request Money: Money can be sent or requested safely using a phone number.

- Merchant Solutions: Careem PAY also offers solutions to help businesses grow.

- No Additional Charges for Bill Payments: Using Careem PAY to pay bills incurs no extra charges.

- Remittance Payments: Remittance payments are available between the UAE and Pakistan, with plans to include more countries.

- Extensive Services: Careem also offers various other services, including rides, food delivery, grocery shopping, home cleaning, and more. These integrate seamlessly with Careem PAY for easy payments.

Beam Wallet

Beam Wallet is a user-friendly platform that combines online payments, shopping experiences, and marketing, making it easier for users to manage transactions and benefits in retail and commerce.

Benefits and Features of Beam Wallet:

- All-in-One Solution: Beam Wallet brings together paying for things, earning rewards, and marketing (how stores promote their products) in one place.

- Smart Contracts for Better Deals: It uses “smart contracts” to help stores and customers make deals that benefit both. Customers can get better offers, and stores can operate more efficiently.

- Earn Rewards When You Shop: When you use Beam Wallet to pay, you get cash rewards for every purchase. You can use these rewards whenever you want.

- Easy for Stores to Use: Stores can join Beam Wallet without special bank agreements. Beam Wallet takes care of all the complicated parts of handling payments.

- Saving Money in Retail: Beam Wallet helps reduce the huge costs usually involved in processing payments and marketing in the retail industry.

- Direct Rewards for Your Data: Instead of stores spending a lot on ads, they reward you directly for your shopping data. This means you get better deals, and stores understand what you like.

- Benefits for Everyone Involved:

- Stores: Get better at offering what customers want.

- Customers: Get rewards and better shopping experiences.

- People Running the Network: Help make all these transactions happen.

- Token Holders: Benefit from the overall success of Beam Wallet.

- Easy to Access on Your Phone: You can download the Beam Wallet app on your smartphone, making it easy to use.

WePay E-Wallet

Image Source WePay is a payment processing service that enables businesses to easily integrate and monetize payments, offering tailored solutions, end-to-end financial services, and innovative payment technologies.

Benefits and Features of WePay:

- Customized Solutions: WePay works closely with businesses to provide payment solutions that grow and adapt with them over time.

- Complete Payment Services: It offers a wide range of payment services, similar to those you’d expect from a big bank, but with the user-friendliness of tech company software.

- Modern and Flexible: WePay uses the latest technology to offer flexible payment solutions, making it easy for businesses to adapt to new trends and needs.

- Helps Earn More Money: The platform is designed to help businesses make more money from their payment processes.

- A Trusted Payment Partner: WePay is a well-known name in the payment industry, handling many transactions and moving a lot of money every second.

- For All Types of Businesses: Whether you’re just referring customers or handling lots of payments, WePay makes it easy to get started. It offers quick setup, clear pricing, and options for accepting different types of card payments.

- Easy Management Tools: Businesses can easily manage their payments, view reports, handle customer disputes, and more, all from WePay’s Merchant Center.

- Security and Compliance: WePay handles tricky parts, such as security and legal compliance, protecting businesses from fraud and financial losses.

- Fast Payments: Businesses can receive their money quickly, even on the same day, using a Chase bank account.

Klip E-Wallet

Klip is made by Emirates Digital Wallet LLC together with 15 big banks in the UAE. It’s also supported by the UAE Central Bank.

Benefits and Features of Klip E-Wallet:

Safe and Secure: The UAE Central Bank also endorses it, aiming to minimize cash usage and mitigate risks such as fraud. This ensures that it is a secure location for your funds.Good for Workplaces: Klip is not just for individual people but also for companies. Employers can use Klip to pay their employees securely, which builds trust. Employees like it because they can easily manage their money, like paying bills or sending money.

AliPay E-Wallet

AliPay is a digital payment platform that provides accessible digital payments for everyone, focusing on financial inclusion and partnering globally to serve customers at the forefront of digital payments.

Benefits and Features of AliPay E-Wallet:

- Keeping Payments Safe: Alipay ensures that every payment is super safe. They use special technology to protect your money. Plus, you can pay by scanning a QR code, which is easy and keeps you safe from germs.

- Easy to Use: Alipay is all about making your life easier. Whether shopping, paying bills, or doing other things, Alipay helps you do them smoothly and quickly without any hassle.

- For Everyone: Alipay is made for everybody. It doesn’t matter where you are or what you do; Alipay wants to ensure you can use its service. They’re working hard to ensure that everyone can join in and use digital payments.

- Helping Businesses Grow: Alipay can be a big help if you have a business. They offer tools and services that make selling things online easier, reaching more customers, and understanding your business better with helpful data. This means your business can grow faster and reach more people.

Conclusion

The UAE is rapidly moving towards a cashless society, and these top 10 E-Wallets are leading the way. Whether you’re shopping, paying bills, or sending money, these E-Wallets offer convenience, security, and rewards. Embrace the future of finance in the UAE with these innovative digital wallets.