In today’s digital world, banking is changing, and it’s becoming easier and more convenient than ever before. First Abu Dhabi Bank (FAB) is a popular bank in the United Arab Emirates (UAE) that is known for its modern and user-friendly banking services. One of their offerings, the FAB iSave Account, is designed to help people manage their money easily and efficiently.

If you’re living in the UAE and want to learn about banking or start saving your money, the FAB iSave Account might be a good option for you. It has many great benefits, like earning interest on your savings and being able to bank online.

In this guide, we’ll break down the process of opening an FAB iSave Account step-by-step. We’ll make sure you have all the information you need and understand what you have to do. Read more below.

FAB iSave Account

The FAB iSave Account is a special account that helps you save money. With this account, you can earn a really good interest rate of 5.25% per year on any new money you deposit. That means if you put some of your savings into this account, the bank will give you extra money on top of what you already have. I

By opening this account, you’ll have access to one of the best savings rates in the UAE, which means your money will grow faster than other savings accounts. If you already have an account with FAB (First Abu Dhabi Bank), you can easily open an iSave Account using the FAB Mobile app or Online Banking. This means you don’t have to go to the bank in person; you can do it conveniently from your phone or computer.

Let’s know more about the details below.

Step by step process to open a FAB iSave Account

To apply for the FAB iSave Account, follow these step-by-step instructions:

- Step 1. Visit the FAB (First Abu Dhabi Bank) website or access the FAB Mobile app.

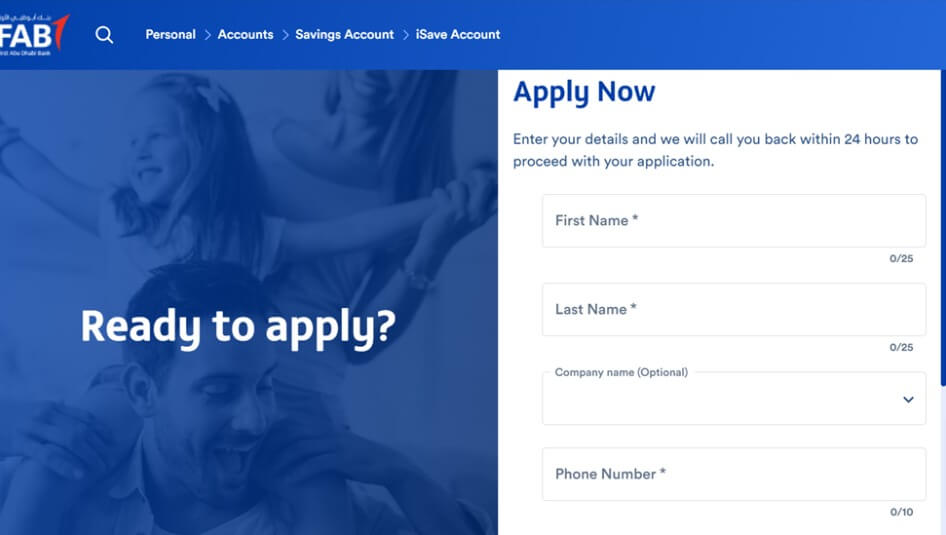

- Step 2. Look for the “Apply Now” button or link. Click on it to initiate the application process.

- Step 3. You will be directed to a form where you need to enter your personal details. Fill in the required information accurately and completely.

- Step 4. Enter your First Name and Last Name in the respective fields.

- Step 5. If applicable, provide your Company Name (optional).

- Step 6. Enter your Phone Number and Email address.

- Step 7. Select your Emirate from the provided options.

- Step 8. Specify your monthly Salary.

- Step 9. Choose your Nationality from the available choices.

- Step 10. Verify that all the information you have entered is correct and complete. Then click on the “Apply Now” button to submit your application.

After submitting your application, you can expect a callback from FAB within 24 hours. During this call, a representative from FAB will guide you through the remaining steps and proceed with your application. Be prepared to provide any additional information or documentation that may be required during the phone call. This may include proof of identification, proof of address, or other relevant documents.

FAB iSave Account Features

The FAB iSave Account comes with several features that make it a convenient and attractive option for saving money. Here are the expanded explanations of each feature:

5.25% Per Year on New Funds Deposited from 01 May 2023 to 31 March 2024

When you deposit new money into your iSave Account between May 1, 2023, and March 31, 2024, you will earn an interest rate of 5.25% per year on that money. This means that the bank will pay you a bonus amount equal to 5.25% of the money you deposit each year.

So, if you save 1,000 AED, for example, you will earn an extra 52.50 AED each year just for keeping your money in the iSave Account.

Instant Account Opening through the FAB Mobile app or Online Banking

You can open an iSave Account right away using either the FAB Mobile app or Online Banking. This means you don’t have to wait in long lines at the bank or fill out a lot of paperwork. With just a few clicks on your phone or computer, you can have your iSave Account up and running in no time.

Available in AED

The iSave Account is available in AED, which stands for the United Arab Emirates Dirham. This is the currency used in the UAE. So, you can deposit and withdraw money in AED when using your iSave Account.

No Minimum Balance Requirement

Unlike some other bank accounts that require you to keep a certain amount of money in your account at all times, the iSave Account doesn’t have a minimum balance requirement. This means you can open an account and start saving any amount of money, even if it’s a small amount. You have the flexibility to deposit as much or as little as you want.

No Restrictions on the Number of Withdrawals

With the iSave Account, you can make as many withdrawals as you need without any restrictions. This means you have easy access to your money whenever you need it. You don’t have to worry about being charged extra fees or facing penalties for withdrawing your funds. It’s a flexible account that allows you to save and withdraw money as per your requirements.

Conditions to Remember when Applying FAB iSAVE

- The special interest rate of 5.25% per year applies only to money deposited into your iSave Account between May 1, 2023, and March 31, 2024. Money in your account before May 1, 2023, will not earn this higher interest rate.

- A rate of 4% per year is valid on new funds for individual customers from 1 July 2022 until 30 April 2023:

- For the period from July 1, 2022, to April 30, 2023, a different interest rate of 4% per year applies to any new money that you deposit into your iSave Account. This is slightly lower than the 5.25% interest rate mentioned earlier.

- The overall balance at the customer level as of 30 April 2023 is considered the base balance for a 5.25% per year interest rate:

- To determine the interest rate of 5.25% per year, the bank considers the total balance you have in your account as of April 30, 2023, as the base balance. It means they use the amount of money you have in your account on that date to calculate the interest you’ll earn on new funds deposited from May 1, 2023, to March 31, 2024.

- A differential interest amount over the prevailing interest rate is applied within 45 days from the campaign’s extension end date (31 March 2024) for the campaign extension months (January, February, and March):

- If the campaign for the special interest rate is extended beyond the original end date of March 31, 2024, the bank will calculate and apply a differential interest amount on the extension months: January, February, and March. This means you may receive an additional interest over the regular interest rate during these months.

Eligibility for Interests

To determine whether you are eligible for the special interest rates offered by the iSave Account, the bank calculates the average balance you maintain in your account each month.

This means they look at the total amount of money you have in your account at the end of each month, add them up, and then divide by the number of months to get the average.

Eligibility for iSave Account

The iSave Account is available only to individual customers. This means that it is not offered to businesses, organisations, or other types of accounts. It is specifically designed for individuals who want to save and earn interest on their personal funds.

You must also be a resident of the United Arab Emirates (UAE) and have a valid Emirates ID. This requirement ensures that the account is available to individuals who are legal residents of the UAE and can provide the necessary identification.

These conditions provide important details about the eligibility, timeframes, and interest rates associated with the FAB iSave Account. It’s essential to understand these conditions to make informed decisions about opening and managing the account.

FAB Mobile App

Individuals can also open an iSave Account and access a wide range of banking services instantly with the FAB mobile bank. Gone are the days of cumbersome paperwork and lengthy processes; the FAB Mobile app offers a seamless and hassle-free banking experience.

Opening an account and obtaining a credit card is very convenient. Users can complete the account opening process with just their Emirates ID within minutes. By eliminating the need to visit a physical branch, the FAB Mobile app allows individuals to start banking on their terms.

With a few taps on the mobile device, users can easily track their account balance, send money to friends and family, and even earn rewards. The app’s user-friendly interface ensures that banking transactions are quick, efficient, and accessible anytime.

Conclusion

In conclusion, opening a FAB iSave Account in the UAE is a straightforward and convenient process that offers numerous benefits to individuals looking to manage their finances effectively. By following the step-by-step guide outlined in this blog, you can easily navigate the account opening procedure.

The FAB iSave Account provides a host of features such as competitive interest rates, a user-friendly mobile banking app, and the ability to track and control your expenses. Additionally, the account offers seamless integration with other FAB services, ensuring a comprehensive banking experience.

With its emphasis on digital convenience, security, and personalized financial management solutions, FAB iSave Account is an excellent option for anyone seeking to optimize their banking experience in the UAE. So, take the first step towards financial empowerment and open your FAB iSave Account today!