Dreaming of luxurious hotel stays and exclusive travel perks? Buckle up, wanderlust warrior, because we’re diving into the world of Marriott Bonvoy credit cards!

Whether you’re a seasoned Marriott loyalist or a travel newbie, these cards offer a treasure trove of benefits to elevate your journeys. From racking up points fast to unlocking VIP treatment and snagging free nights, we’ll lay out the top features of this card and guide you through the application process like a pro.

So, ditch the generic travel card because, in this blog, we’ll answer all your burning questions about the Marriott Bonvoy Credit Cards, so read on.

About Marriott Bonvoy: The World’s Smartest Traveller

Travelling smart has never been easier with Marriott Bonvoy®. As a member, you’ll unlock exclusive benefits, redeem points for free nights, and indulge in unrivalled experiences. Best of all, joining is completely free.

During your stay, take advantage of complimentary Wi-Fi and stay connected with our Mobile Chat feature, enabling you to reach the front desk anytime. Plus, the more nights you stay, the closer you get to unlocking Elite Status and enjoying even more exclusive benefits.

Earn Everywhere

Collecting points has never been more rewarding. Marriott Bonvoy lets you earn points through hotel stays, meetings, events, and our exceptional partnerships. Whether renting a car, booking flights, embarking on tours and activities, or using their affiliated credit cards, every aspect of your travel can contribute to your points balance.

Uniquely Useful Points

With Marriott Bonvoy, your points are uniquely useful. Transform your hard-earned points into unforgettable experiences, whether redeeming them for nights at our luxurious hotels and resorts, booking flights to your dream destinations, or indulging in curated experiences that money can’t buy.

Marriott Bonvoy® World Mastercard® from Emirates NBD

Get a wealth of rewards with Emirates NBD Marriott Bonvoy Credit Card offer. Earn up to 150,000 Bonus Points that can be redeemed for exciting experiences and valuable benefits. To apply, you only need a minimum salary of AED 20,000.

Earn an additional 75,000 bonus points when you make purchases totaling US$10,000 or more on your Credit Card within the first three months of Card membership.

With 150,000 Bonus Points up for grabs, you’ll have the opportunity to elevate your travel, enjoy memorable stays, and indulge in a range of exclusive perks.

To take advantage of this exceptional offer, an annual fee of AED 1,575 applies. This fee opens the door to a world of rewards and benefits that make every moment more rewarding.

Earn Points

Maximise your Marriott Bonvoy Points earnings with this credit card. Here’s how you can earn points on your spending:

- Earn 6 points per US$1 spent at hotels participating in the Marriott Bonvoy program.

- Earn 3 points per US$1 on all international and other purchases.

- Grocery and supermarkets, fast-food restaurants, insurance, and car dealerships earn points at 25% of the domestic spend earning rate, equivalent to 0.75 points per USD.

- Petroleum, transit, government services, utility payments, real estate, education, and telecommunication payments earn points at 10% of the domestic spending earning rate, equivalent to 0.30 points per USD.

- Spends originating in European Union countries earn points at 50% of the international spend earning rate, equivalent to 1.5 points per USD.

- Additionally, you can earn up to 50% more monthly points on retail purchases by enrolling in the Express Points Programme. This program requires a monthly fee of AED 300 and offers you the chance to boost your points earnings.

Benefits

- Free Night Award

- Receive a complimentary Free Night Award every year after your Credit Card account anniversary. Use the award for a one-night stay at a participating hotel, with redemption levels at or under 35,000 Marriott Bonvoy points.

- Automatic Marriott Bonvoy Gold Elite Status: Gain automatic Marriott Bonvoy Gold Elite status, unlocking various benefits. Enjoy 25% more points on hotel stays, Enhanced Room Upgrades, 2 pm Late Checkout, and more.

- Register for Your World Rewards™ to earn twice with Marriott Bonvoy and Emirates Skywards®.

- Earn points on flights, and if you hold Skywards Silver or above status, earn Miles on stays.

- 5 Elite Night Credits

- Each calendar year, receive 5 Elite Night Credits to help you progress towards the next level of Marriott Bonvoy Elite status.

Additional Credit Card Benefits:

- Enjoy up to 30% off at participating restaurants, adding value to your dining experiences.

- Gain unlimited complimentary access to over 1000 airport lounges worldwide, enhancing travel comfort.

- Take advantage of complimentary airport transfers within the UAE.

- Receive free rounds of golf at five prestigious UAE courses, indulging in your passion for the sport.

- Access complimentary concierge service, ensuring personalised assistance and convenience.

Required Documents for Opening Account

- Duly filled Credit Card application

- Original Emirates ID and copy with passport copy

- Latest salary certificate for salaried individuals

- Trade license for non-individuals

- Latest 3-month original bank statements (or mini ATM statements)

- Security cheque

Required Documents for Credit Card Increase

To request a credit card limit increase, please ensure you have the following documents ready:

For Salaried Individuals Banking with ENBD:

- Original passport and a copy of the passport with the visa page.

- Emirates ID and a copy of the Emirates ID.

- Latest salary certificate (issued within the past month).

- Pay slip (if there is a salary variance over 10%).

For Non-Salaried Individuals Banking with ENBD:

- Original passport and a copy of the passport with the visa page.

- Emirates ID and a copy of the Emirates ID.

- Latest salary certificate (issued within the past month).

- Pay slip (if there is a salary variance over 10%).

- The latest three months’ original bank statements.

For Self-Employed Individuals:

- Original passport and a copy of the passport with the visa page.

- Emirates ID and a copy of the Emirates ID.

- Valid trade licence.

- Memorandum of Association (MOA).

- Latest three months’ bank statements for the company (from Emirates NBD or any other bank).

Required Documents for a Supplementary Card

To apply for a supplementary credit card, please ensure you have the following documents available:

- Emirates ID or Passport of the Supplementary Card Applicant: Provide the Emirates ID or passport of the individual applying for the supplementary card. This ensures their identification and eligibility for the card.

- Original Credit Card of the Primary Cardholder: Present the original credit card belonging to the primary cardholder. This is required to verify and link the supplementary card to the primary cardholder’s account.

How to Apply

Through the Mobile App:

- Log in to Mobile Banking: Open your smartphone’s ENBD X Mobile Banking app. Enter your login credentials (username and password) to access your account.

- Access Credit Card Application: Navigate to the main menu once logged in. Look for the “See All Products” option and tap on it. Under the “Add New” section, select “Credit Card.”

- Select Card and Begin Application: Choose the credit card option that suits your needs from the available options. Tap on “Apply now” to initiate the application process.

- Enter Required Details: Fill in the required details accurately in the provided fields. Provide information such as your personal details, contact information, and financial information. Ensure all the information is correct before proceeding.

- Review and Submit Application: Review the details you have entered to verify their accuracy. If everything is correct, tap on the “Submit” button to submit your credit card application.

- Enter Smart Pass PIN: You will be prompted to enter your Smart Pass PIN for security purposes. Enter your Smart Pass PIN in the designated field to complete the application process securely.

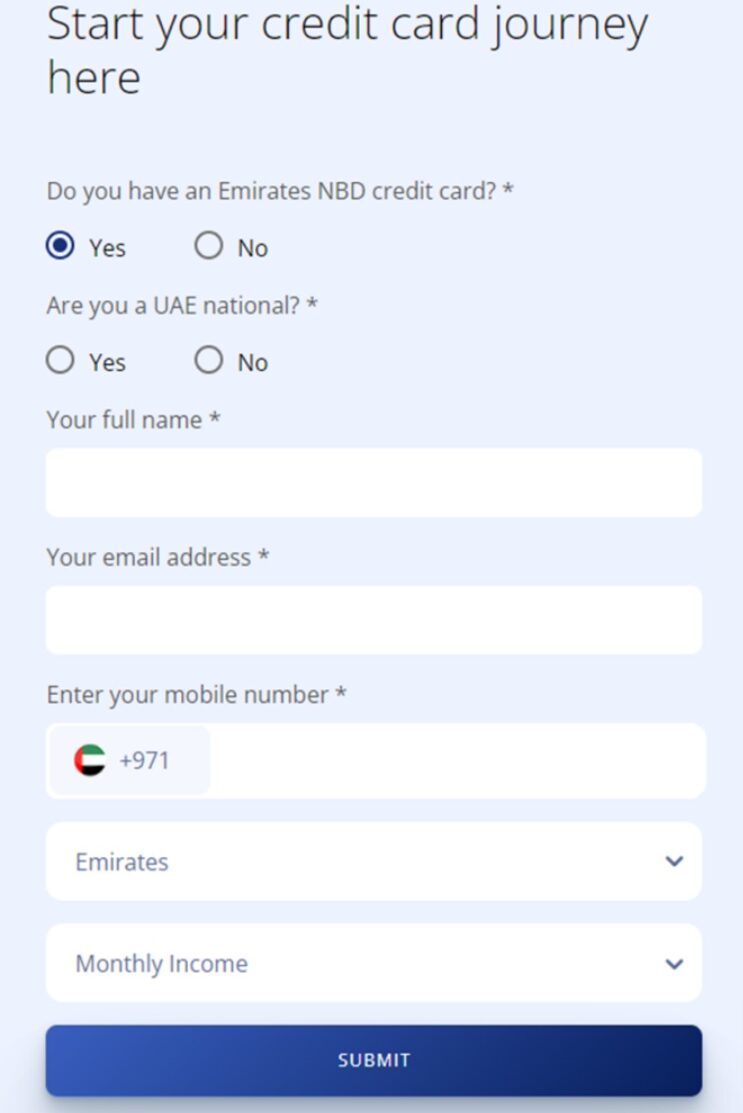

Through the Website:

- Visit the Website: Open your preferred web browser and go to their website. Look for the “Credit Cards” section and click on it. Locate the Marriot NBD credit card and click on the “Apply Now” button to begin the application process.

- Enter Your Details: Follow the instructions provided on the application page. Enter all your details, contact information, and any other required information accurately. Make sure to double-check the information before proceeding to the next step.

- Select Primary Credit Card: Choose the primary credit card option that best suits your preferences and needs. Review each card’s features, benefits, and terms carefully before selecting. Once you have chosen, click on the “Submit” button to proceed.

- Application Process Completion: After submitting your application, their team will review it.

Within two working days, you will receive a call from their representative to complete the application process. During the call, you may be asked to provide additional information or clarification. Their representative will guide you through the remaining steps to finalise your credit card application.

Note: The processing time for most credit card applications is typically 1-3 working days. Once your application is approved, your card will be delivered within 2-4 working days. For international deliveries, please allow 7 to 10 working days. Please be aware that an AED 150 fee and 5% VAT will apply for international delivery services.

Conclusion

In conclusion, the Marriott Credit Card offers a fantastic opportunity for travellers and rewards enthusiasts to earn impressive points and enjoy various benefits. With its generous sign-up bonus, accelerated earning potential, and exclusive perks, this credit card can enhance your travel experiences and provide significant value.

You can access a world of possibilities by applying for the Marriott Bonvoy Credit Card. A major advantage is the ability to earn points on everyday purchases and redeem them for free hotel stays, room upgrades, and other travel-related expenses. Whether you’re a frequent business traveller or someone who enjoys occasional vacations, this credit card allows you to make the most of your trips and save money in the process.