What is the usual time for a car insurance claim to be settled?

This is one of those questions that truly reflects the often complex nature of insurance: how white or black are not usually common options but plenty of grey: so as you would have concluded by now, there isn’t a very specific answer or rule of thumb. Let’s explain why in more detail.

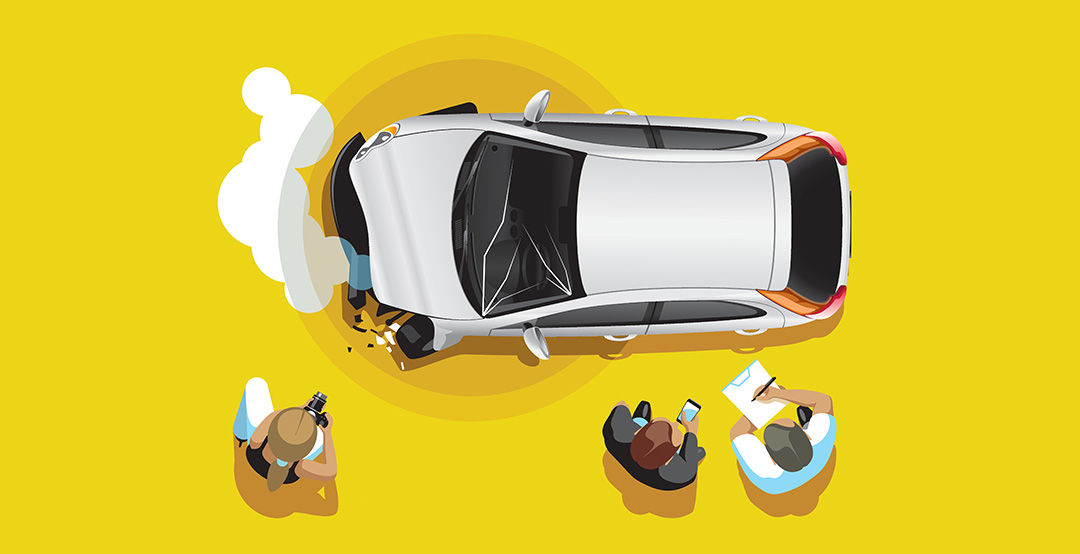

Not all claims are handled the same

Claims are inherently different in nature, and hence different claims will definitely differ in the way an insurance provider processes them, and thus in the time it will take to settle it. Most insurance providers seek to settle all claims within 30 days of filing: that means from filing to paying your agreed claim amount However, some claims will need only 3 business days to be processed. So how is the period it takes for a claim to be settled affected?

The more complex a claim is, the more time it needs to be settled

Some claims are naturally simple in their nature, so claim processing time can be comparatively short. For example, hitting a pillar whilst parking your vehicle and causing a dented rear bumper. As “own damage” with no other party involved, a claim under a Comprehensive policy would be considered relatively quickly.

It is when things get more complicated that the duration is extended. Imagine a scenario where a person is sadly killed by a traffic accident and the car is damaged beyond economical repair. This claim will take a longer time to process and will go into different phases before a settlement for the blood money in respect of the fatality and the car value is decided and offered.

The more complex a claim gets, or the higher its value, the longer the insurance provider might need to evaluate its authenticity and conclude if there’s any attempted fraud or not. If you have any claims specific situation you need help tackling, our insurance advisors at InsuranceMarket.ae will be more than happy to assist you! And don’t forget, all incidents whether they result in a claim or not should be reported to your insurance company. Don’t delay, call us today on our toll free number 800 ALFRED!

Are you looking to upgrade your car? YallaMotor provides prices, specifications, and features of all new cars in the market.