Financial planning is a crucial aspect of managing your finances, especially regarding loans. Dubai Islamic Bank (DIB) offers a Personal Loan Calculator to aid this process significantly. This tool is designed to help potential borrowers understand their loan options better and plan their finances accordingly. Let’s dive into how this calculator works and how it can benefit you.

What is the Dubai Islamic Bank Loan Calculator?

The Dubai Islamic Bank Loan Calculator is an online tool that allows you to estimate your monthly payments for a personal loan. It’s designed to provide you with a clear understanding of your financial commitments before you decide to take a loan. This calculator considers the loan amount, interest rate, and tenure to give you an estimated Equated Monthly Installment (EMI).

How Does the Personal Loan Calculator from Dubai Islamic Bank Work?

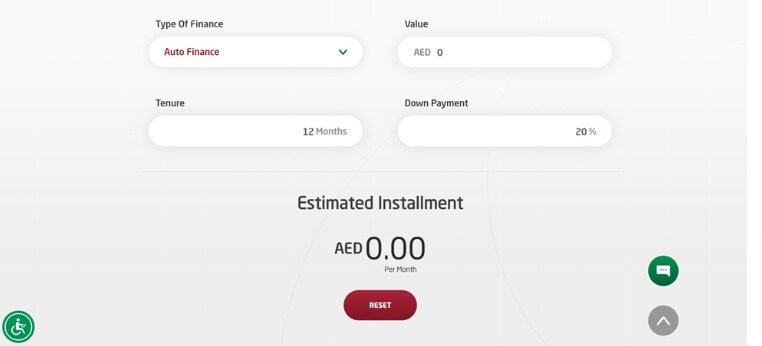

To use the DIB Personal Loan Calculator, you need to input three key pieces of information:

- Loan amount: The total amount of money you wish to borrow.

- Interest rate: The rate at which interest will be charged on your loan.

- Loan tenure: The duration over which you intend to repay the loan.

Once you input these details, the calculator uses a mathematical formula to estimate your monthly EMI. This EMI includes the principal amount and the interest, giving you a comprehensive view of your monthly financial obligation.

Factors Influencing the Computation of Personal Loan EMI

Several factors can influence the computation of your loan EMI. Understanding these factors can help you make more informed decisions about your loan:

- Loan amount: The money you borrow, known as the principal, directly impacts your monthly payment (EMI). More borrowed, higher the EMI.

- Interest rate: A crucial factor. Higher rates mean higher EMIs. Shopping around for the lowest interest rate can reduce your payment burden.

- Loan tenure: The repayment period affects your EMI. Longer tenure equals lower EMI but more interest paid over time. Shorter tenure increases EMI but decreases total interest.

- Interest type: Loans come with fixed or variable rates. Fixed rates keep EMIs constant, while variable rates can change your EMI as interest rates fluctuate.

- Processing fee: Charged by lenders at loan issuance. It can be upfront or added to your loan, affecting your EMI.

- Prepayment and foreclosure: Paying off your loan early may incur penalties. Knowing these terms helps in planning early repayment without surprises.

- Credit score: A credit score affects your loan’s interest rate and eligibility. A better score can secure a lower rate, making EMIs more affordable.

- Repayment frequency: Options may include monthly, bi-monthly, or quarterly payments. Your choice can influence how your EMI is calculated.

- Loan type: Secured (with collateral) and unsecured loans have different rates and terms, impacting your EMI.

- Discounts and offers: Look out for lender promotions that can lower your EMI. Always factor these into your decision.

- Insurance premium: Some loans require insurance, which can be part of your EMI or an additional cost.

- Late payment fees: Missing payments can lead to extra charges and affect the total cost of your loan. Always strive to pay on time.

Benefits of Using the Dubai Islamic Bank Personal Loan Calculator

- Budgeting: Knowing your EMI in advance allows you to budget your monthly expenses more effectively.

- Loan comparison: This tool allows you to compare different loan offers, helping you choose the one that best suits your financial situation.

- Financial planning: Understanding your EMI helps in better financial planning, ensuring that you don’t borrow more than you can afford to repay.

Final Thoughts

The Dubai Islamic Bank Personal Loan Calculator is more than just a tool; it’s your financial planning partner. It helps you make informed borrowing decisions, ensuring that your loan supports your financial goals rather than hindering them. Remember, the key to successful borrowing is not just getting a loan but getting a loan that fits your budget and financial plans.

Using the DIB Personal Loan Calculator, you’re taking a big step towards responsible borrowing and financial stability. So go ahead, try it, and see how it can help you achieve your financial dreams, whether it’s buying that smartphone, renovating your home, or planning a dream vacation.