When considering a personal loan, it’s important to understand how it will affect your finances. Abu Dhabi Commercial Bank has a calculator that will help you calculate your monthly payments and total loan costs. This guide will explain how to use the ADCB Personal Loan Calculator, its benefits, and its features so you can make smart financial choices.

What is the ADCB Personal Loan Calculator?

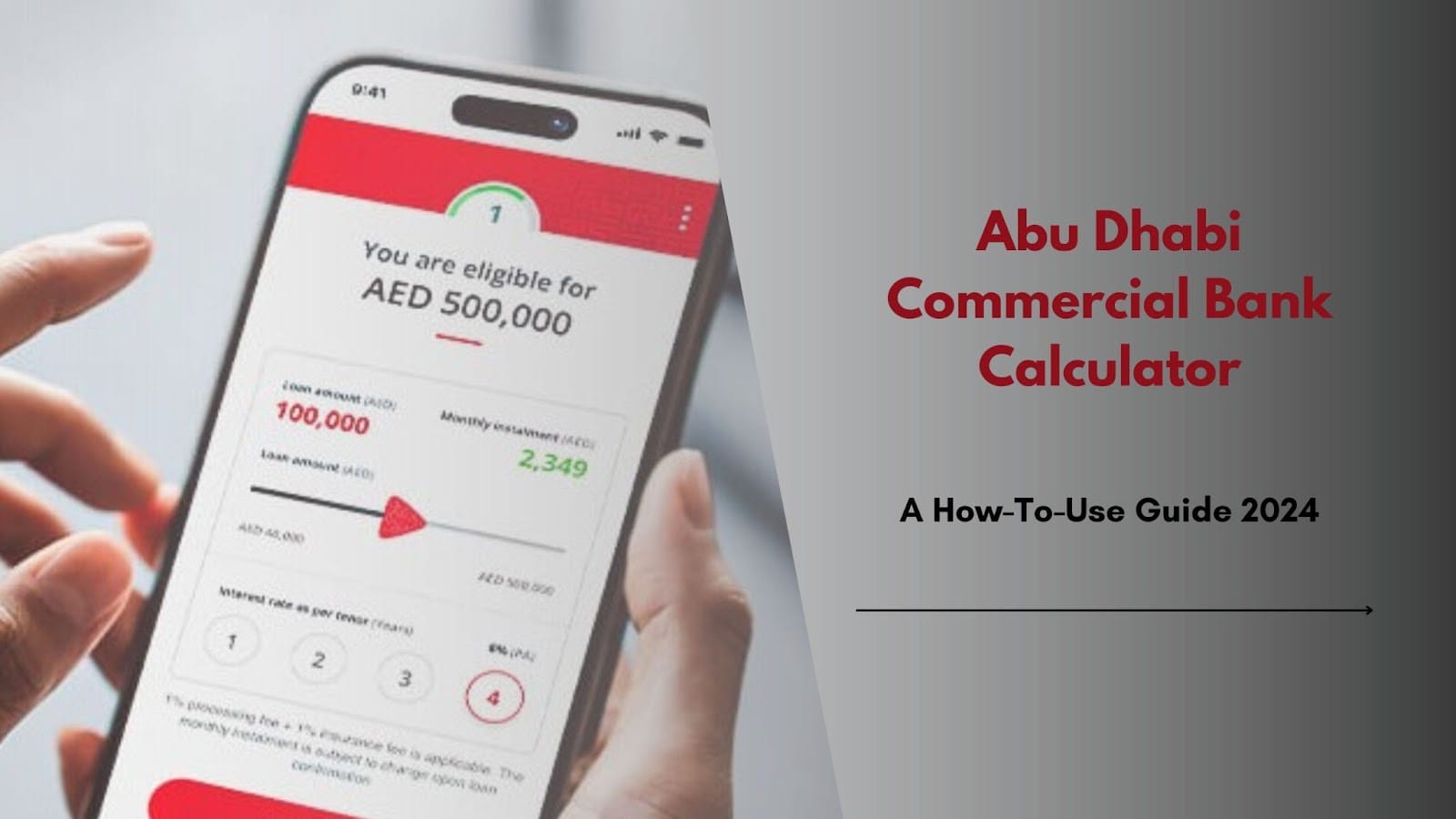

The ADCB Personal Loan Calculator is an online tool that helps you figure out the monthly payments, total interest, and overall personal loan cost. You can quickly understand your financial commitments by entering key details about the loan.

Benefits of Using the ADCB Personal Loan Calculator

- Convenience: You can use it online anytime and anywhere.

- Accuracy: It gives precise estimates based on your input, aiding in realistic financial planning.

- Time-Saving: It quickly shows loan repayment schedules without visiting a bank.

- Informed Decisions: It helps you compare different loan options to choose the best one.

Key Features of the ADCB Personal Loan Calculator

- Loan Amount Input: Enter the amount you want to borrow.

- Interest Rate: Input the interest rate for accurate calculations.

- Loan Tenure: Choose the loan duration to see its effect on monthly payments.

- Detailed Breakdown: It shows a complete breakdown of monthly payments, total interest, and overall loan cost.

How to Use ADCB Bank Personal Loan Calculator?

1. Access the Calculator: Go to the ADCB official website and find the Personal Loan Calculator page by clicking on any of the loans shown on the screen.

2. Enter Loan Amount: Type in the amount you want to borrow, like AED 5,000

3. Select Interest Rate: Enter the interest rate. ADCB’s rates are available on its website or through customer service.

4. Choose Loan Tenure: Choose from 12 to 48 months to repay the loan.

5. View Results: The right side shows the result, which shows the payments, total interest, and overall loan cost.

Tips for Using the ADCB Personal Loan Calculator Effectively:

- Compare Different Scenarios: Try different loan amounts, interest rates, and repayment tenure to see how they affect your payments.

- Stay Updated: Interest rates and loan terms can change. Make sure you have the latest information for accurate results.

- Consult with ADCB: For personalised advice, contact ADCB’s customer service or visit a branch.

Final Takeaway:

The ADCB Personal Loan Calculator is a great tool for anyone considering a personal loan. It gives accurate and detailed estimates, helping you make smart financial choices. Whether dealing with debt, making a big purchase, or covering unexpected costs, this calculator can help you find the right loan for your needs. Additionally, considering Life Insurance alongside your loan can further protect your financial well-being.

This guide will help you use the calculator effectively and make the best financial decisions for your situation. Always check the latest updates and terms directly with ADCB for accurate information.

Are you thinking of applying for a personal loan at the ADCB? Well, check out our comprehensive guide about the application process, eligibility, features, requirements, and other information you need before applying.

Also, before applying for a loan, you must know how to open a bank account with the ADCB. Visit this link to learn more.

Frequently Asked Questions (FAQs)

Q. Is the ADCB Personal Loan Calculator free to use?

Yes, it is free, and anyone can use it.

Q. How accurate are the results provided by the calculator?

The calculator gives accurate estimates based on the information you enter. However, loan terms might differ depending on your situation and the bank’s rules.