In today’s financial landscape, choosing the right savings account can be akin to looking for a diamond in the rough. With countless options available, it’s vital to select a bank that not only secures your money but also helps it grow. HSBC Savings Account stands out as a beacon for those seeking reliability, flexibility, and many benefits. Let’s dive into HSBC Savings Accounts, exploring their features, benefits, and how you can start your journey with them.

What are the Features and Benefits of HSBC Savings Account?

HSBC Savings Account is specifically developed to meet the needs and preferences of its customers, offering many features that cater to a wide range of financial needs and goals. Here are some of the standout features and benefits:

- No fees for certain transactions: You won’t be charged for withdrawing cash or checking your balance at non-HSBC UAE Switch ATMs.

- Multiple currency options: Depending on your needs, you can choose an account in AED, USD, EUR, GBP, or RMB.

- Easy cheque deposits: Deposit cheques at 32 locations across the UAE without a card and PIN.

- International access: Your Visa debit card is accepted at over 25 million outlets worldwide and over 1 million ATMs, making global travel or purchases hassle-free.

- Free transactions: Enjoy six free over-the-counter transactions every month in AED.

- 24/7 banking: Manage your money anytime with online banking, phone banking, mobile banking, and SMS alerts.

- Cash deposit machines: Access 91 cash deposit machines in the UAE for instant credit to your account.

- Easy money transfer: Send money within the UAE or internationally in multiple currencies.

It’s important to note that these features are current but could change. HSBC promises to inform its customers about any changes that might affect them. Whether saving for a rainy day, managing daily expenses, or planning for the future, an HSBC Savings Account offers a reliable and convenient solution. Visit HSBC’s Savings Account page for updates.

HSBC Savings Account Annual Fixed Interest Rates

- Currency: AED, Fixed Interest Rate: 0.05%

- Currency: USD, Fixed Interest Rate: 0.10%

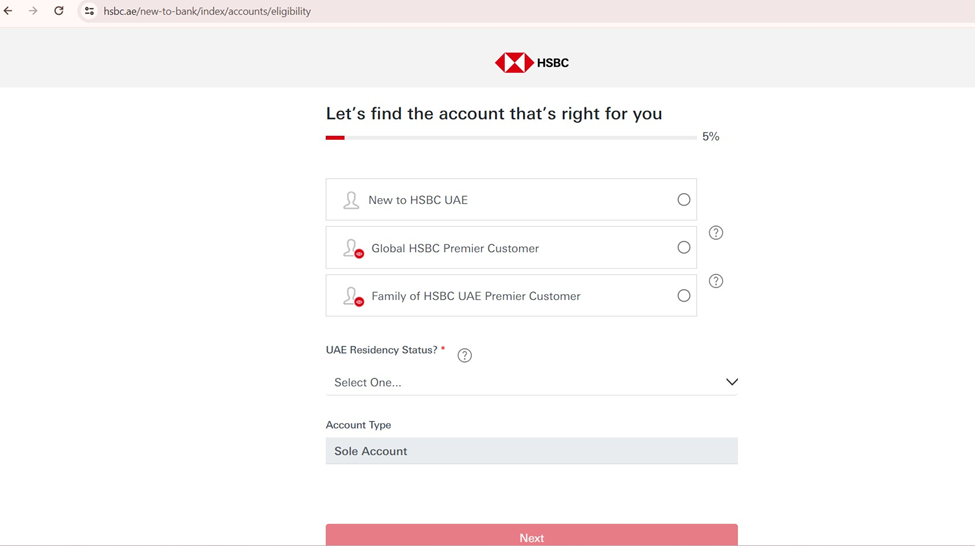

Eligibility Requirements to Open an HSBC Savings Account

Easily show your qualifications through their online platform and swiftly secure preliminary approval. This streamlined process allows you to verify your eligibility with minimal effort, ensuring a quick and efficient preliminary assessment. By leveraging their user-friendly interface, you can receive instant confirmation of your eligibility status, paving the way for a smooth approval process. Their system is designed to provide a hassle-free experience, enabling you to move forward confidently. Gain peace of mind knowing that you can obtain approval in principle rapidly, marking the first step towards achieving your goals.

Documents Needed to Open an HSBC Savings Account

Opening an account is straightforward, but you’ll need to have the following documents ready:

For a Sole Account:

- Original passport: Everyone needs this, no exceptions.

- Valid residence visa: You’ll need a residence visa, too, if you’re not from a GCC country.

- Emirates ID: Emirates ID is a must-have for all applicants.

- Proof of residence in the UAE: This could be a utility bill, a rental agreement, a title deed, or an employment letter—anything that shows you live in the UAE.

- Labour card/work ID: A labour card or work ID is required specifically for women, their fathers or husband sponsors.

- Trade licence: If you’re self-employed, you must show this.

- Income transfer letter: If your income is being transferred to this bank, you’ll need a letter from your employer confirming this.

For a Joint Account:

Both you and the other person (or people) you’re opening the account with will need to visit the bank in person with the same documents listed for a sole account.

By bringing the right documents, you’re taking a big step toward managing your finances in the UAE. Remember, it’s always a good idea to call the bank ahead of your visit to make sure you have everything you need and to ask any questions you might have. This will ensure a smooth and successful bank account opening experience.

Process to Open an HSBC Savings Account in the UAE

Opening an HSBC Savings Account is a simple process:

- Start by downloading the app: The first step is to download the HSBC UAE app. It’s the simplest method of opening a new account and offers a fast and easy application journey.

- Gather your documents: Before proceeding, ensure you have all the required documents ready for submission.

- Fill out the application: Open the app and follow the step-by-step instructions to complete your application form.

- Wait for verification: After you submit your application, HSBC will review and verify your documents and the information you provided. Your new account will be opened without a hitch if everything checks out.

Steps to Close an HSBC Savings Account in the UAE

Should you ever need to close your account, the process is just as straightforward:

- Clear any outstanding: Ensure all checks have cleared and there are no pending transactions.

- Contact HSBC: Contact HSBC through their customer service channels to initiate the closure.

- Follow Instructions: HSBC will guide you through the process, which may involve filling out a form online or visiting a branch in person.

- Confirmation: Once all steps are completed, you’ll receive confirmation that your account has been closed.

Conclusion

HSBC Savings Accounts offer a blend of security, convenience, and growth potential, making them an excellent choice for anyone looking to maximize their savings. Whether you’re a long-time resident of the UAE or just passing through, HSBC provides a financial companion that meets your needs and exceeds expectations. With easy access to your funds, competitive interest rates, and a secure platform, your financial goals are just an account opening away. Start your journey with HSBC today and watch your savings soar to new heights.