In the financial landscape of the UAE, prepaid cards have emerged as a beacon of convenience and flexibility, catering to a wide array of needs from budget management to secure online transactions. As we step into 2024, the array of options available has grown, each offering unique benefits tailored to the diverse populace. This guide delves into the best prepaid cards in the UAE, highlighting their key features and how to effortlessly check their balances.

Introduction

Prepaid cards in the UAE have revolutionized the way we approach financial transactions. Unlike traditional credit cards, prepaid cards allow you to load money in advance, offering a controlled spending mechanism without the worry of accruing debt. They’re perfect for budgeting, travel, and gifting, providing a secure and convenient payment method accessible to all, regardless of banking history.

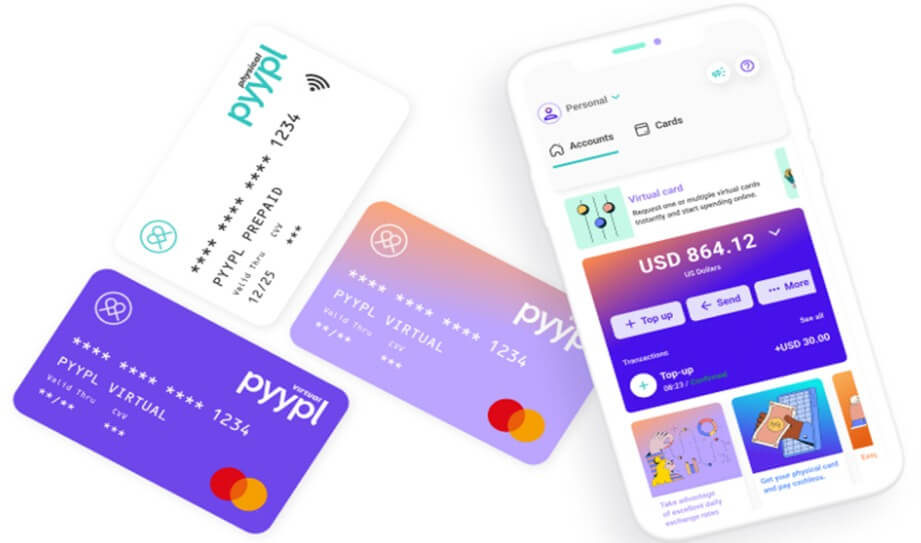

Pyypl Prepaid Digital Card

The Pyypl (pronounced as “people”) Prepaid Digital Card stands out for its digital-first approach, offering a seamless setup process through a mobile app. Ideal for online shopping and international transactions, it ensures you control your spending.

Features and Benefits

Easy Setup and Access

- No paperwork required: Get started in seconds with a fully digital signup process. There’s no need for a minimum salary, minimum balance, registration fees, or even a bank account to access Pyypl’s services.

- Quick registration: Download the Pyypl app, sign up in a few easy steps, verify your identity with an ID or passport, top up your account using various options, and start spending.

Fast and Convenient Money Transfers

- Super fast transfers: Send, request, and receive money from other Pyypl users instantly, without delays, making it perfect for immediate financial needs.

- International payments: Use your Pyypl card at over 50 million outlets worldwide that accept Visa. Whether it’s paying bills, buying subscriptions, or shopping, Pyypl has you covered.

Versatile Top-Up Options

- Effortless top-ups: Top up your Pyypl account using a debit card, bank account, mobile money, or bill payment terminals, depending on your location. This flexibility ensures you can always keep your card loaded and ready to use.

Secure Spending

- Secure payments: Shop with confidence knowing you can freeze and unfreeze your card as needed, providing an extra layer of security against unauthorized use.

- Friendly reports: Keep an eye on your spending with detailed transaction histories and generate reports to track where your money goes, helping you manage your finances better.

How to check Pyypl Card Balance

- Download the Pyypl App: For Android users: Visit the Google Play Store, search for the Pyypl app, and download it. For iOS users: Go to the Apple App Store, find the Pyypl app, and download it.

- Open the Pyypl App: Locate the Pyypl app on your smartphone or tablet and open it.

- Log in: Enter your login credentials (usually your phone number and a PIN or password) to access your account. If you haven’t registered yet, follow the app’s registration process, which typically involves verifying your phone number and creating a password.

- Navigate to the dashboard: Once logged in, you’ll be directed to the main dashboard or home screen of the app. This page generally displays your account overview.

- Check your balance: Your available balance is usually prominently displayed on the dashboard or home screen. If not, look for a section labeled “Account”, “Balance”, or something similar. You may need to tap on your card details or a specific account to view your balance.

- Additional details (optional): If you want more detailed information about your transactions or balance, look for options like “Transactions”, “History”, or “Statements”. Here, you can view detailed transaction records, including deposits, withdrawals, and fees.

Pyypl Prepaid Physical Card

For those who enjoy the feel of a card in their hand, the Pyypl Prepaid Physical Card is a great choice. Just like its digital counterpart, this physical card offers many benefits.

Benefits and Features

- Worldwide use: You can use it at any physical Point Of Sale (POS) terminal around the globe.

- Convenience: It combines the digital benefits with the ease of a traditional card.

How to check its balance

Access your balance through the Pyypl mobile app, where real-time updates keep you informed. The steps to check the balance are the same as those mentioned above.

FAB Ratibi Prepaid Card

The FAB Ratibi Prepaid Card is tailored for salary disbursement, making it a popular choice among employers and employees. It simplifies payroll management while offering employees easy access to their funds.

Benefits and Features

For Everyone:

- Stay notified: Receive free SMS alerts each time your salary is deposited.

- Universal access: Use your card at any ATM, in stores, or for online shopping worldwide on VISA/MasterCard networks.

- 24/7 support: Their call center is always open to assist you.

- Personalize your security: Choose your own PIN at any of their ATMs.

- Compliance: Fully adheres to the UAE’s Wages Protection System (WPS) guidelines.

You’re Protected:

- Accident insurance: Free personal accident insurance offering up to 5 times your monthly salary (max AED 25,000) for severe accidents.

- Hospital cash: AED 50 daily for hospital stays due to accidents, up to AED 1,500.

- Repatriation coverage: Covers the cost of repatriation of mortal remains up to AED 5,000.

Safe and Easy:

- Carry less cash: Reduces the need to carry cash.

- No bank account needed: Get paid directly onto your Ratibi card.

- Fast salary access: Your salary is credited instantly.

For Employers:

- Stress-free payments: A hassle-free solution for salary disbursement.

- Online management: Real-time card management through online banking.

- Flexible solutions: Various services to meet corporate salary processing needs.

- Secure transfers: Safe salary transfers from corporate accounts to Ratibi cards.

How to check FAB Ratibi Prepaid Card Balance

Checking the balance of your FAB Ratibi Prepaid Card is straightforward. Please check it here for the complete steps.

RAKBANK Prepaid Card

The RAKBANK Prepaid Card offers a convenient and secure way to manage your daily transactions without the need for a traditional bank account.

Benefits and Features

Easy and free reload

- Instant Access: Reload your card for free and get instant access to your funds. This feature is particularly useful for managing your budget and ensuring you always have access to your money when you need it.

Enhanced security

- PIN protection: Your transactions are secured with a PIN, adding an extra layer of security to your card.

- Card blocking: In case your card is lost or stolen, you have the ability to block it, protecting your funds from unauthorized access.

Digital Convenience

- Mobile app: Manage your finances on the go with a dedicated mobile app. This app allows you to keep track of your expenses, view transactions, and stay in control of your spending.

- Digital card: Get your RAKBANK Prepaid Card on your phone, making it even more convenient to use without the need for a physical card.

Financial Benefits

- Peer-to-Peer transfers: Easily transfer money to friends and family with SocialPay, a feature that simplifies peer-to-peer transactions.

- Discounts and special offers: Enjoy exclusive discounts and special offers that come with using the RAKBANK Prepaid Card.

- Utility bill payments: Simplify your bill payments with easy utility bill payment options.

- 0% easy payment plan: Benefit from a 0% Easy Payment Plan, allowing you to make larger purchases and pay them off in installments without interest.

- Savings on travel tickets: Save up to 7% on your travel tickets, making it a great option for frequent travelers.

How to Check Balance RAKBank Prepaid Card Balance

- RAKBANK Prepaid App: Download and use the RAKBANK Prepaid App from your device’s app store. This app allows you to check your card balance and view your transaction history among other features.

- Online banking: If you have access to RAKBANK’s online banking platform, you can log in there to view your prepaid card balance and transactions.

- Customer service: Call RAKBANK’s customer service at 04-2130000 from your registered mobile number. Once connected, you can request your prepaid card balance among other account details.

- SMS alerts: Some banks offer SMS alert services for transactions and balance updates. Check if RAKBANK provides such a service for prepaid cardholders.

Al Fardan Exchange TravelEZ Plus Classic Card

The Al Fardan Exchange TravelEZ Plus Classic Card is designed with travelers and staycationers in mind, offering a range of privileges and rewards to enhance your spending experience. Here’s a beginner-friendly, comprehensive overview of its benefits and features:

Benefits and Features

- Reloadable: The card can be topped up, making it a convenient option for managing your travel budget.

- Personalized: Tailored to meet the needs of individuals looking for a safer alternative to carrying cash.

- Worldwide acceptance: Use it for shopping online, at Point of Sale (POS) terminals in the UAE, and almost anywhere Visa is accepted globally.

- Smart & secure: A secure way to manage your funds, the card can also be used to withdraw cash from ATMs worldwide.

- Rewards: The card comes bundled with a wide range of offers, providing added value to your purchases.

How to Check Balance Al Fardan Exchange TravelEZ Plus Classic Card

Option 1: Online Account Centre

- Access your account online:

- Begin by visiting the Al Fardan Exchange Account Centre website.

- Log in:

- Enter your username and password to log into your account. If you haven’t registered yet, look for an option to create an account and follow the prompts.

- Navigate to balance:

- Once logged in, look for the section or tab that says “Balance” or “Account Balance.” This section will allow you to view the balance of each Currency Wallet you have.

Option 2: Visit an Al Fardan Exchange Location

- Find a nearby location:

- Use the Al Fardan Exchange website or Google Maps to find the nearest Al Fardan Exchange branch.

- Visit the branch:

- Go to the branch during its operating hours. It’s a good idea to carry identification with you.

- Request balance check:

- At the branch, ask a staff member to check the balance of your TravelEZ Plus Classic Card. They may need your card and possibly an ID to assist you.

Option 3: Call Customer Services

- Find the customer service number:

- Look at the back of your TravelEZ Plus Classic Card or visit the Al Fardan Exchange website to find the customer service phone number. To help you better, here’s their customer care number: 600522265.

- Make the call:

- Dial the number and follow the voice prompts to reach a representative or the balance inquiry option.

- Provide necessary information:

- Be ready to provide your card details and any other required verification information to the customer service representative.

Option 4: ATM Balance Inquiry

- Locate an ATM:

- Find an ATM that accepts your TravelEZ Plus Classic Card. Remember, while you can check your balance at most ATMs, some may charge a fee.

- Insert your card:

- Insert your TravelEZ Plus Classic Card into the ATM and enter your PIN when prompted.

- Select balance inquiry:

- Choose the option to inquire about your balance. The ATM will display the combined available balance of all your Currency Wallets in the local currency of the ATM.

- Be Aware of Fees:

- Note that some ATMs may charge a fee for balance inquiries, which will be deducted from your available balance. Additionally, some ATM operators may charge their own separate fee.

Conclusion

Prepaid cards in the UAE offer a versatile range of options to suit various needs, from digital-savvy users to international travelers. By choosing the right card for your requirements and keeping track of your balance, you can enjoy these cards’ convenience and security. Whether you’re managing your daily expenses, shopping online, or exploring the world, there’s a prepaid card in the UAE designed for you.