Ratibi is a unique payment system that makes it easier for people earning up to 5,000 AED to get their salaries. If you’re an employer or an employee in this income range, Ratibi is a great choice for you.

It’s simple to use and doesn’t require a regular bank account. Instead, employees get a special card called a Ratibi card. Think of it like a prepaid debit card that your salary gets added to directly. Once the money is on the card, you can do almost anything with a normal bank account. You can take out cash from an ATM, shop at stores, or even pay your bills online.

This system makes paying employees quick and efficient for employers, without dealing with the hassles of paper checks or waiting for bank transfers to go through. For employees, it’s a straightforward way to get money without complications. All in all, Ratibi makes the entire salary payment process smoother for everyone involved. Whether you’re a boss wanting to make payroll easier or an employee looking for a fuss-free way to get paid, Ratibi has got you covered.

Why is Ratibi a Game-changer?

- Safety first: It comes with Free Personal Accident Insurance. In case of unexpected accidents, you’re already covered.

- Always accessible: You get 24/7 access to the largest network of ATMs and CDMs. No more worrying about finding a place to get cash or deposit money.

- No hidden costs: Forget about keeping a minimum balance or paying monthly charges. This card is all about financial freedom.

- Worldwide usability: Whether shopping at a local store or traveling abroad, you can use this card to make payments and withdraw money from a wide range of ATMs worldwide.

The best part? You don’t need a bank account to use this card, which means you save on those pesky banking fees. Get the Ratibi Payroll Prepaid Card and take the first step toward easy, secure, and cost-effective money management.

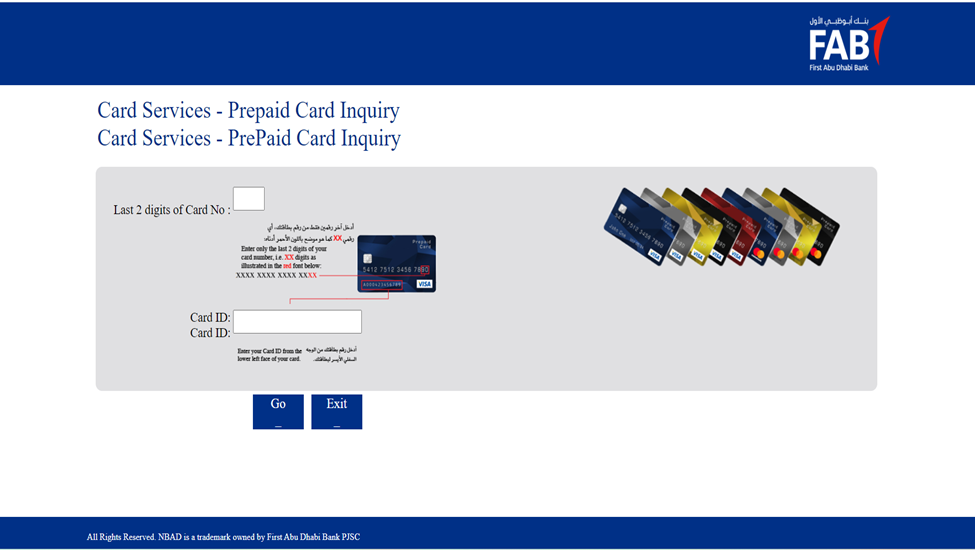

Ratibi Prepaid Card Balance Check

- Navigate to the bank’s official website that issued the Ratibi Prepaid Card and follow this prepaid card balance inquiry link.

- Enter the last two digits of your card number.

- Enter your card ID.

- Click the “Go” button, and the website will show your remaining balance on your Ratibi card.

What are the Benefits of a Ratibi Card?

If you want to manage your salary conveniently and securely, a Ratibi Card could be your go-to solution. Here’s why:

- Free SMS alerts: Every time your salary is credited, you’ll get an SMS. No need to constantly check your account.

- ATM access: You can use this card at any ATM, not just from your bank. That’s flexibility for you!

- In-store and online: This card covers whether you shop at a mall or online.

- Global reach: With VISA/MasterCard compatibility, your Ratibi Card is accepted worldwide. You’re not restricted by geography.

- 24/7 customer support: Got a problem? Just make a call. Customer service is available around the clock to help you out.

- Personalized PIN: You can choose your own ‘PIN’ at any ATM. Your security, your rules.

- UAE WPS guidelines: The card is 100% compliant with the UAE Government’s Wage Protection System (WPS) guidelines.

- No more cash worries: Carrying cash around can be risky. Imagine losing your hard-earned money or getting it stolen! Going cashless eliminates that worry.

- Skip the bank: Need a bank account? No problem! This system works even without one, making it accessible to everyone.

- Get paid easily: Your salary gets credited instantly once it’s payday. No more waiting in long lines or for checks to clear.

- Automated convenience: Everything is automated, so you don’t have to lift a finger. This means fewer mistakes and faster transactions.

- Safe and secure: Rest easy knowing that your money is protected through a secure system.

Insurance Benefits If You Have Ratibi

Let’s discuss a special insurance benefit often linked with cards: “Free Personal Accident Insurance.” Here’s what it includes:

- Death or disability cover: If the cardholder faces an unfortunate accident resulting in death or permanent total disability, they can get financial support. You’ll receive five times your monthly salary or a maximum of AED 25,000. This helps your family cope financially during a tough time.

- Hospital cash benefit: Should you get into an accident and need to stay in the hospital for at least 24 hours, you’ll be eligible for a daily cash benefit. You’ll receive AED 50 per day for up to 30 days. This can help cover minor medical expenses, up to a maximum of AED 1,500.

- Repatriation benefit: In the tragic event of death, the insurance will cover the costs to move the mortal remains back to the home country. The maximum limit for this is AED 5,000.

Remember, insurance like this serves as a safety net. It’s always wise to read the terms and conditions carefully. And also to seek advice or help from a credible insurance company. This is to understand what you’re covered for fully.

Ratibi Wages Protection System

The FAB bank offers a Wages Protection System (WPS) to handle salary payments easily and legally. Here’s why you should consider it:

- Automated service: No manual work needed! We even have a dedicated help desk to assist you.

- One-Step transfer: Make a single bank transfer and pay everyone. No more juggling multiple transactions.

- Safe and convenient: This is a secure way to spend your employees without the risks of handling cash.

- Pay in local currency: Save on costs and simplify payments using the UAE’s local currency.

Ratibi Salary Payment for Non-WPS

Suppose you’re in the UAE and use FAB Bank, good news! They can handle your Non-WPS salary payments in local currency. What does that mean? If your company is separate from the WPS (Wage Protection System), FAB Bank can still help you pay your employees.

How it works is pretty simple. You send them a file with all the salary details in one go. This is called “bulk processing,” and it’s a time-saver. FAB Bank then takes a single debit from your account to pay everyone on your team.

Worried about security? Don’t be. The salary information is highly secure. Only specific people in your company can see these details. So you save time and maintain privacy. It’s a win-win situation.

Policy and Procedures Guide

- Open a corporate account: If you’re an employer, you must have a Corporate Account with the FAB Bank to get Ratibi cards for your employees.

- Be the liaison: You’ll act as the middleman between the bank and your employees. Any communication about the Ratibi cards will go through you.

- Teach card basics: It’s your responsibility to guide your employees on properly using and taking care of their Ratibi cards.

- Handle lost cards: If a card gets confiscated by an ATM, it will be destroyed. You’ll need to apply for a new one on behalf of the employee.

Eligibility

- Corporate bank account: First, your employer must have a business account with the bank. This is a must.

- UAE residency: If you’re an employee, you must live in the UAE. So, make sure your residency status is in order.

- KYC details: You must keep your “Know Your Customer” (KYC) details up-to-date. This includes information like your Emirates ID, address, and financial records.

How to Apply for a Ratibi Card?

- Ratibi Application: First, fill out the Ratibi application form. You must also complete an Excel sheet with your employees’ details to request Ratibi cards.

- iBanking Application: Fill out the iBanking application form to manage the cards online. This will give you easy, web-based access to your account.

- Submission: Finally, submit all your filled-out forms to your nearest bank branch. You can also submit them at community banking branches nearby.

What are the Forms you Must Complete to Get a Ratibi Card?

- Application Form for Ratibi Payroll Card and Salary Transfer via WPS or Non-WPS: Fill this out to get your employees up with Ratibi cards for salary payments.

- Employees’ Details File: Create a file with all your employees’ important details. This helps in accurate salary distribution.

- WPS SIF File Creator: If you’re using WPS (Wage Protection System), you must create a special file to ensure everyone gets paid properly.

- Routing codes: These codes help direct the salaries to the right bank accounts. Make sure you have the correct ones.

- Salary transfer request: Submit this request to move the money from your corporate account to your employees’ Ratibi cards or bank accounts.

- Ratibi – WPS Cancellation Request: There’s a special form if you need to cancel the WPS service for Ratibi.

- iBANKING Corporate Online Banking Application UAE: Finally, set up online banking to manage everything smoothly.

In a nutshell

The Ratibi Prepaid Card is not just another card. It’s a revolution in how salaries are managed and disbursed in the UAE. Whether you are an employer or an employee, adopting Ratibi can be a transformative experience.