In today’s fast-paced world, choosing the right credit card can make a big difference. Are you looking for rewards that fuel your lifestyle? Perhaps you crave the convenience of contactless payments or the peace of mind of travel insurance.

The Commercial Bank of Dubai (CBD) offers a variety of credit cards designed to cater to different spending habits and preferences. This article will guide you to unlocking the best CBD credit card for you. We’ll explore each card’s top benefits, from cashback rewards and airport lounge access to exclusive discounts and travel perks.

Additionally, we’ll walk you through the simple application process so you can start enjoying the benefits of a CBD credit card in no time.

CBD Visa Platinum Credit Card

Do everyday purchases feel more like a chore than a treat? Are annual fees draining your wallet before you even start swiping? If you crave a credit card that simplifies your life and rewards your spending, look no further than the CBD Visa Platinum Credit Card.

This card offers a breath of fresh air – no annual fees to weigh you down, coupled with a range of benefits designed to make every purchase more rewarding.

Features & Benefits

Here’s a breakdown of the exciting features and benefits that come with this card:

- Zero Hassle, Zero Fees: Unlike many other cards, the CBD Visa Platinum Credit Card boasts no annual fees, leaving more room in your budget for the things you love.

- Earn Rewarding Points: Every swipe earns you valuable CBD Rewards Points. With a generous rate of up to 1.5 points per AED spent, your everyday purchases translate into real rewards.

- Travel Benefits: Craving a night out at the cinema? Enjoy 50% off two tickets every month at Novo Cinemas! Just make sure your monthly spending hits AED 2,000 to unlock this perk.

- Travel Like a Pro: The world awaits! Indulge in stress-free travel with exclusive discounts on booking platforms:

- Booking.com: Save up to 8% on your next accommodation booking

- Agoda.com: Explore the globe with up to 12% off on over 985,000 hotels and vacation rentals.

Here’s more:

- Xperience App with 2-for-1 deals (download ENTERTAINER app).

- Credit Shield protects your balance for a monthly fee (details here).

- Exclusive dining, lifestyle, and entertainment offers on the CBD App.

- Transfer balances from other banks with lower interest rates (flexible repayment plans available).

- Limited Time Offers (until March 31, 2024):

- 0% interest on Balance Transfers for 6 or 12 months.

- 0% interest on Cash on Call for 6 or 12 months.

Required Documents:

If you are a salaried individual, please provide the following documents:

- National ID or valid passport, residence visa, and Emirates ID.

- Salary Certificate.

If you are self-employed, please provide the following documents:

- National ID or valid passport, residence visa, and Emirates ID.

- Valid trade license.

Eligibility Criteria:

To be eligible, you must meet the following criteria:

- If you are a UAE National, you must be between 21 and 65 years old (at the card expiry date).

- If you are a UAE resident, you must be between 21 and 63 years old (at the card issuance date).

Additional criteria for salaried individuals:

- You must be a confirmed employee.

- You must have a minimum salary of AED 5,000.

CBD Visa Infinite Credit Card

Experience a world of luxury with the CBD Visa Infinite Credit Card. Earn an AED 2,000 cashback welcome offer, indulge in complimentary airport lounges and travel insurance, and reimagine your every day with the CBD Visa Infinite Credit Card.

Features & Benefits

- Earn AED 2,000 cashback welcome offer (spend AED 12,000 in 30 days)

- No annual fee (free for the first year, free for following years if you spend AED 100,000 annually)

- Earn up to 3 CBD Rewards Points per AED spent

- Complimentary golf (4 rounds/month at Trump International Golf Club with AED 7,500 spent)

- 50% discount on 4 cinema tickets/month (VOX, Reel, Novo)

- 20% discount on F&B at Reel Cinemas (min. AED 20 spend)

- Complimentary Valet Parking (3 times/month at Dubai Airport, Al Maktoum Airport, etc., with AED 5,000 spent)

- Travel benefits:

- Complimentary airport lounge access worldwide (up to 12 visits/year)

- Multi-trip Travel Insurance

- Travel discounts

- Travel Insurance (up to USD 1 million coverage for 90 days)

- Travel discounts:

- 8% off Booking.com stays

- 12% off Agoda.com stays

- Discounts at Emaar attractions (KidZania, Dig It, E-Kart Zabeel, Dubai Aquarium, Dubai Ice Rink, VR Park Dubai)

- More benefits:

- Xperience App with 2-for-1 deals (download ENTERTAINER app)

- Credit Shield (protects outstanding balance for a monthly fee; details here)

- Purchase Protection (doubles manufacturer warranty repair period, up to 1 year, details here)

- Extended Warranty (protects against theft or damage; details here)

- Balance Transfer (lower interest rates, flexible repayment plans, processing fee may apply)

- Cash on Call (access up to 90% of the limit, repay in instalments, processing fee may apply)

Required Documents:

If you are a salaried individual, please provide the following documents:

- National ID or valid passport, residence visa, and Emirates ID.

- Salary Certificate.

If you are self-employed, please provide the following documents:

- National ID or valid passport, residence visa, and Emirates ID.

- Valid trade license.

Eligibility Criteria:

To be eligible, you must meet the following criteria:

- If you are a UAE National, you must be between 21 and 65 years old (at the card expiry date).

- If you are a UAE resident, you must be between 21 and 63 years old (at the card issuance date).

Additional criteria for salaried individuals:

- You must be a confirmed employee.

- You must have a minimum salary of AED 15,000.

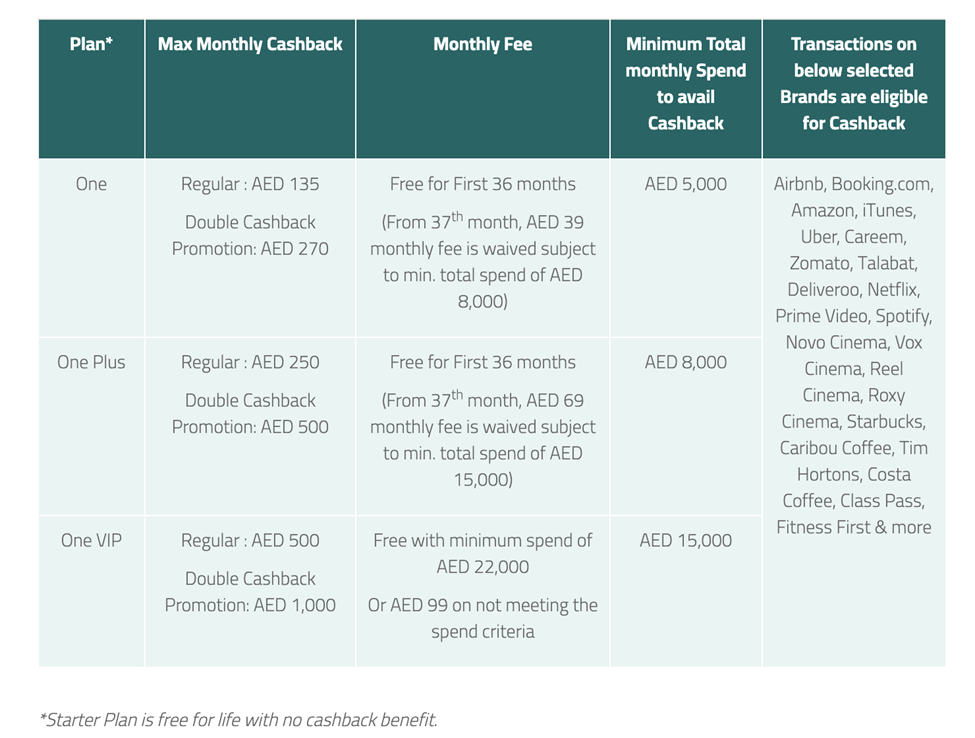

CBD One Credit Card

Earn double cashback on everyday purchases like food deliveries, travel, fitness, coffee, and more. Plus, with CBD One, you can enjoy a personalised plan and choose one that fits your spending habits to maximise your cashback.

Features & Benefits

- Double Cashback (up to AED 1,000) for the first 60 days on listed brands (with selected CBD One Card plan)

- Regular Monthly Cashback (up to AED 500) from 3rd month onwards

- 50% off Movies at Vox & Reel Cinemas

- Complimentary Valet Parking at Malls & Airports (Dubai & Abu Dhabi)

- 4 Free Golf Rounds/Month at Trump International Golf Club

- Up to 8 Free Airport Lounge Visits

- 0% Easy Payment Plan Option

- Balance Transfer Option

- Quick Cash Access

Super Saver Credit Card

CBD One Fees and Plans

Super Saver Credit Card

This card offers a free first year, making it a great way to try it out without any upfront cost. Plus, you can earn up to 10% cashback on everyday purchases in four key categories: bills (think phone and utility bills), education (including schools, colleges, and universities), supermarkets (groceries), and transportation (including fuel).

There’s even a cap of AED 150 per category, ensuring you get a decent chunk of cashback back for your essential spending.

Features & Benefits

- Entertainment: 50% off movie tickets at VOX & Reel cinemas

- Convenience: Complimentary valet parking at over 30 locations

- Travel Perks:

- Access to over 1,000 airport lounges worldwide

- Multi-trip travel insurance (up to USD 500,000 coverage)

- Financial Flexibility:

- 0% Easy Payment Plan (competitive rates)

- Balance Transfer (competitive rates)

- Quick Cash access

Annual Fee

- Free for the first year. AED 400 is applicable from the second year onwards

- No annual fees on supplementary cards

Eligibility criteria

- Minimum 21 years. Maximum 63 years

- Salary: AED 5,000.

CBD Yes Rewards Credit Card

This card offers a delightful welcome bonus of 20,000 Yes Rewards, equivalent to AED 200, to jumpstart your savings. On top of that, you can earn cashback on all your purchases. Here’s the breakdown:

You’ll get a generous cashback boost of up to 15% for every dirham spent at ENOC and EPPCO stations. Aside from that, all your other purchases, no matter where you shop, will earn you up to 1% cashback.

Benefits

- Entertainment: Enjoy 50% off movie tickets at Novo, Reel, and VOX cinemas.

- Convenience: Relax with complimentary valet parking at over 30 locations across the UAE.

- Travel Perks:

- Unwind in style with access to over 1,000 airport lounges worldwide.

- Travel with peace of mind thanks to multi-trip travel insurance covering up to USD 500,000.

Annual Fee

- Free for the first year. Free for subsequent years subject to an annual spend over AED 12,000 (AED 199 annual fee)

- No annual fees on supplementary cards

Eligibility criteria

- Minimum 21 years. Maximum 63 years.

- Minimum salary: AED 5,000.

CBD Smiles Visa Signature Card

Craving travel rewards? The CBD Smiles Visa Signature Credit Card lets you start smiling right away! Earn a whopping 100,000 bonus Smiles points simply by spending AED 2,000 within 30 days of getting your card.

That’s a head start on your dream vacation! Plus, you can conveniently apply in minutes using your Emirates ID through the CBD Mobile Banking App.

Features & Benefits

- Earn 300,000+ Smiles points (worth over AED 4,000) within 90 days of card issuance.

- Get 100,000 bonus points upfront by spending AED 2,000 within 30 days.

- Enjoy your first year free with waived annual fees.

- Access exclusive “Buy 1 Get 1” deals with a free Smiles ‘Unlimited’ subscription.

- Receive a Yallacompare discount voucher worth AED 100.

- Earn up to 10 Smiles points per dirham spent at Etisalat, Smiles app, and elGrocer.

- Collect points internationally (up to 3 Smiles points) and domestically (up to 2 Smiles points).

- Redeem points instantly through the Smiles UAE app for:

- Etisalat bill payments

- Dining and shopping vouchers

- Travel experiences

- And much more!

- Enjoy 50% off movie tickets at Novo, Reel, and VOX cinemas.

- Relax with complimentary valet parking at 30+ locations across the UAE.

- Access over 1,000 airport lounges worldwide (complimentary).

- Travel with peace of mind with multi-trip travel insurance (up to USD 500,000 coverage). (See more lifestyle benefits)

- Take advantage of competitive rates on 0% Easy Payment Plans, Balance Transfers, and Quick Cash access.

Annual Fee

- Free for first year. Option to waive from second year onwards

- No annual fees on supplementary cards

Eligibility criteria

- Minimum 21 years. Maximum 63 years

- AED 12,000.

Conclusion

The Commercial Bank of Dubai (CBD) offers a variety of credit cards to suit different spending habits and lifestyles. Whether you’re looking for cashback rewards, travel perks, or exclusive discounts, there’s a CBD credit card that can help you maximise your spending.

Before applying, be sure to consider your spending habits and compare the benefits of each card to find the one that best suits your needs. Don’t forget to factor in any annual fees or minimum spending requirements. With a little research, you can find the perfect Commercial Bank of Dubai credit card to help you make the most of your money.