For many people working in Dubai, buying a brand new car is not a financially sound decision. You not only have to pay a hefty price for the new car but also have to pay for expensive comprehensive insurance with high yearly premium. In fact, if you want to save money on your yearly insurance premium, the best option is to buy a second-hand car.

But before you buy a second-hand car, here are some basics that you need to learn about the car insurance in Dubai.

Buying a Second-Hand Car

In Dubai or any other city in UAE, you cannot register or insure a used car unless you have a UAE issued driving license or own a residence permit. Any international driving license is not valid to buy a second-hand or even new car as it is only valid for driving a rental car.

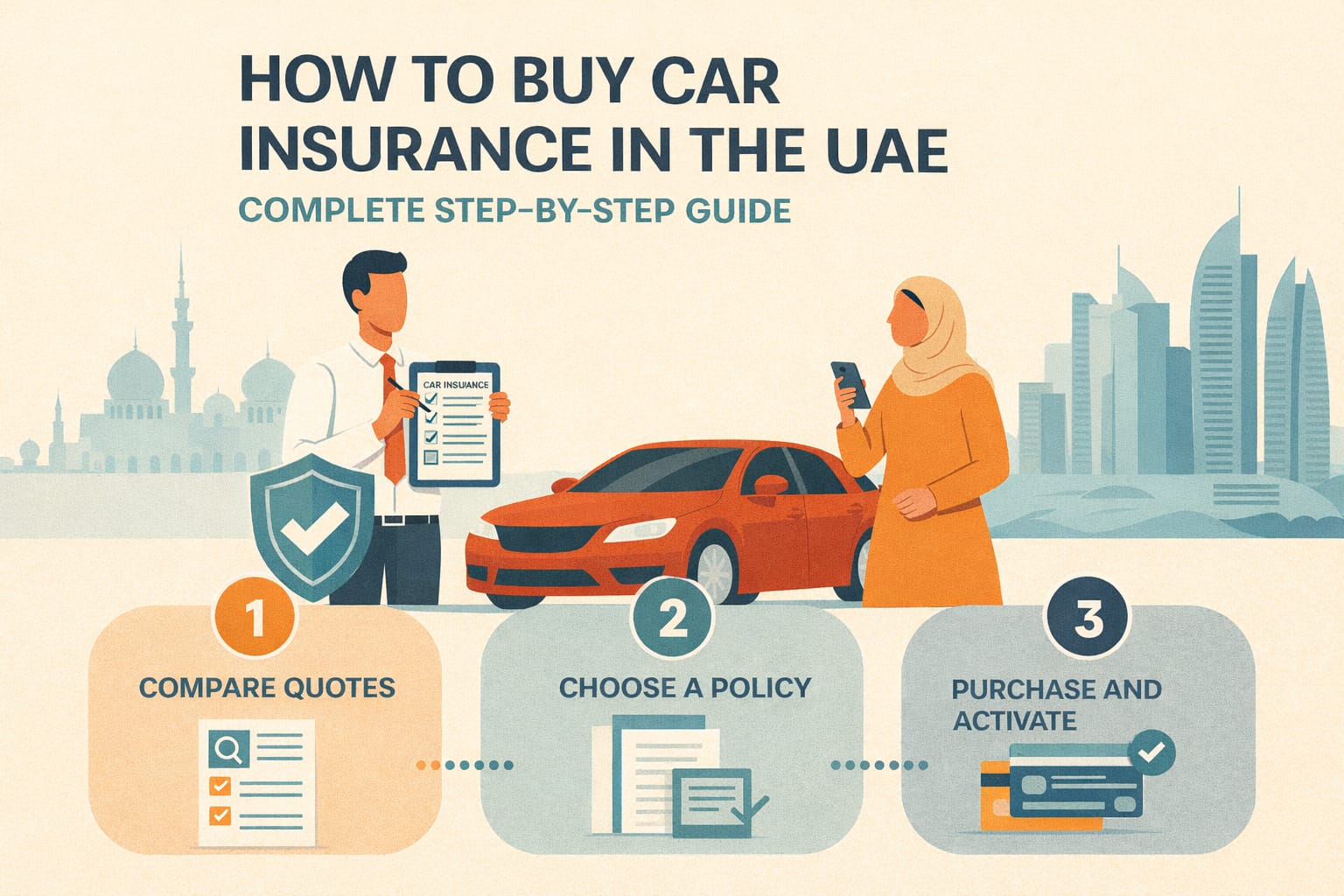

Online Insurance is Easy

Most of the insurance providers offer online insurance with absolutely no need to visit an office. There are also comparison websites that can help you compare and read about the insurance policies, premium costs and required documents for each insurer. So if you are trying to find an insurance provider, keep in mind that you can do it from the comfort of your couch.

For online registration, you usually have to fill an online form and upload the scanned copies of the required documents.

Other Important Tips

Buying second-hand car can save you money but it is also a riskier option as used cars tend to develop more problems if compared to new cars. If your car is very old and you think that repair costs are affordable, then third party insurance is a good option to save money, but if you are buying a luxury car that is just couple of years old, a better option is to buy a comprehensive insurance plan as repair costs are high for these cars.

When buying insurance, also learn about the additional benefits offered against your money. For example, if the insurer offers roadside assistance? What about the off-road insurance if you plan to drive in a desert? If you travel between different Middle East countries, is your insurance valid for GCC states? Does your insurance policy include emergency fuel delivery or windscreen damage protection?

You can learn about all this by comparing different insurance providers and learning about the policies offered by each in detail. While you can surely save money on insurance by buying a second car, a lot also depend on your efforts in finding a most suitable car insurance plan for your second-hand car.