Life throws curveballs sometimes – that leaky roof, the surprise medical bill, or the vacation deal that’s too good to miss. But don’t worry, a personal loan can help you swing with the punches. This quick and easy guide will show you exactly how to apply for a personal loan with Deem Finance.

Whether you’re a loan pro or a complete newbie, we’ll break down everything you need to know to get your Deem Finance personal loan application on track.

About Deem Finance

United Arab Emirates (UAE) residents looking for innovative financial solutions should look no further than Deem Finance. Regulated by the Central Bank of UAE and backed by the Gargash Group conglomerate, Deem offers a comprehensive suite of products.

Whether you’re an individual or a company, Deem can be your financial partner. They cater to individuals with unsecured loans and credit cards featuring their popular cash-back and loyalty programs. Businesses can also benefit from Deem’s corporate deposit solutions.

Deem Finanace Personal Loan

Achieving your goals shouldn’t be a financial burden. Their personal loan offers flexible repayment options that fit your budget, with terms ranging from 1 to 4 years.

Plus, you have the freedom to choose your preferred bank account for repayments – they don’t require a salary transfer. For added peace of mind, Deem Credit Life Plus (learn more by contacting Deem customer care at 600-525550) protects your loan in case of unforeseen circumstances. Breathe easily and control your financial future with our convenient and secure personal loan solution.

How to Apply for a Deem Finance Personal Loan:

Here’s a step-by-step guide to get you started with your Deem finance personal loan application:

- Start Application: Click here to be directed to the Deem website’s application page.

- Enter Personal Details: Fill in your full name on the next screen.

- Provide Contact Information: Enter your mobile number in the designated field.

- Communication Preferences (Optional): Choose whether you want to receive updates and notifications on WhatsApp.

- Continue: Click the “CONTINUE” button to proceed with the application process.

Be prepared to provide additional information such as your email address, employment details, and desired loan amount. You may also be asked to upload documents like your Emirates ID, passport, and proof of income (bank statements or salary slips). Deem will review your application and inform you of their decision.

Minimum Salary Requirement

Meeting the minimum salary requirement is a great first step! If you have a monthly salary of AED 5,000 or more, then you’re a few boxes away from availing a personal loan.

To determine your eligibility for a Deem Finance Personal Loan, they also consider a few other factors along with your monthly income.

Required Documents

- Valid Emirates ID

- Passport

- Proof of income (Bank statements or pay slips/salary certificate)

- Additional documents may be requested (they will inform you if needed)

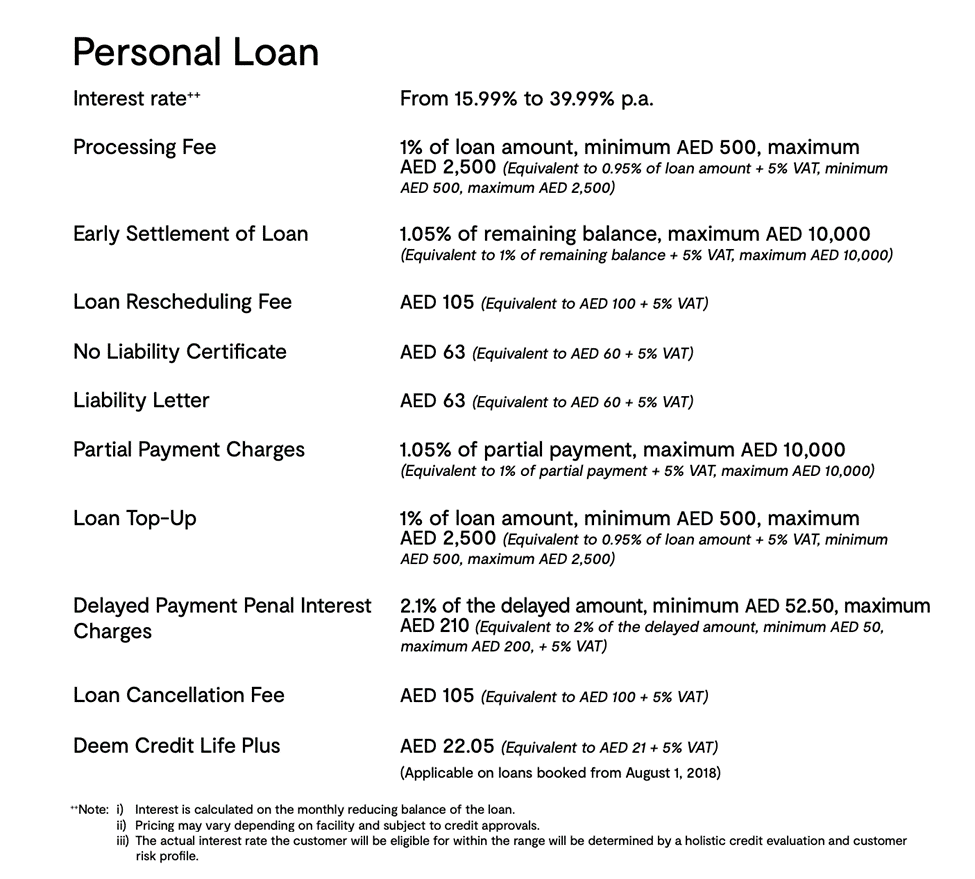

Deem Finance Personal Loan Interest Rates

Deem Finance offers competitive interest rates ranging from 15.99% to 34.99% per year. Your personalised rate will be determined based on your unique profile and loan term.

Here’s a quick summary of their fees and charges.

FAQs

Which bank is Deem Finance under?

Deem Finance is not directly under a specific bank. It’s a financial services provider regulated by the Central Bank of UAE and operates as part of a larger UAE conglomerate, the Gargash Group. This means Deem offers its own financial products like personal loans, but it functions independently within the Gargash Group.

Does Deem Finance check credit score?

Deem lists “good credit score” as a basic requirement for their credit cards. It’s reasonable to assume they would also consider creditworthiness for personal loans.

What is the age limit for Deem Finance?

To apply for a Deem personal loan or credit card, you must be between 21 and 65 years old.

What is an Easy Payment Plan (EPP)?

An Easy Payment Plan (EPP) is a convenient way to spread out your payments over time. It allows you to break down larger purchases (over AED 250) or even your existing credit card balance into smaller, fixed monthly instalments.

Where can you use a personal loan?

You can use a Deem personal loan to consolidate debt, finance home improvements, or cover unexpected expenses. Remember, these loans aren’t ideal for everything, so avoid using them for investments or if there are better loan options available, like student loans for education.